- Hong Kong

- /

- Marine and Shipping

- /

- SEHK:316

New Forecasts: Here's What Analysts Think The Future Holds For Orient Overseas (International) Limited (HKG:316)

Celebrations may be in order for Orient Overseas (International) Limited (HKG:316) shareholders, with the analysts delivering a significant upgrade to their statutory estimates for the company. The analysts greatly increased their revenue estimates, suggesting a stark improvement in business fundamentals. Investors have been pretty optimistic on Orient Overseas (International) too, with the stock up 26% to HK$136 over the past week. It will be interesting to see if today's upgrade is enough to propel the stock even higher.

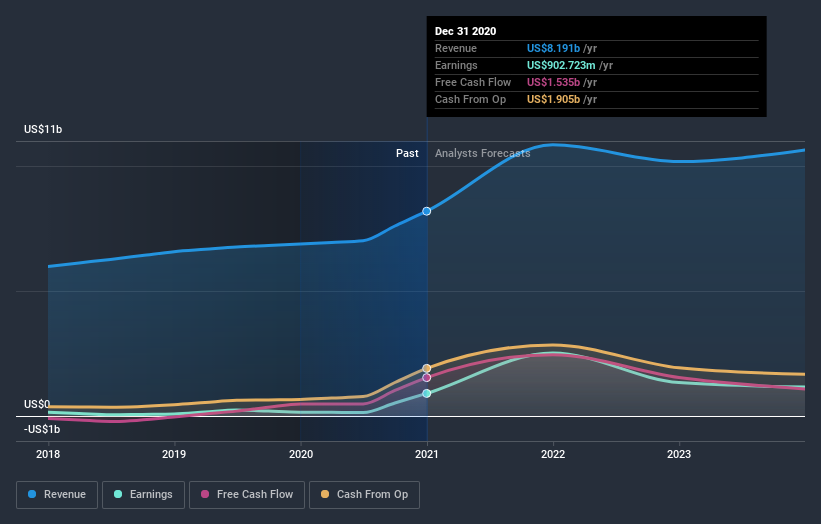

Following the upgrade, the latest consensus from Orient Overseas (International)'s twin analysts is for revenues of US$11b in 2021, which would reflect a sizeable 32% improvement in sales compared to the last 12 months. Statutory earnings per share are presumed to shoot up 176% to US$3.98. Prior to this update, the analysts had been forecasting revenues of US$9.4b and earnings per share (EPS) of US$1.49 in 2021. There has definitely been an improvement in perception recently, with the analysts substantially increasing both their earnings and revenue estimates.

See our latest analysis for Orient Overseas (International)

Of course, another way to look at these forecasts is to place them into context against the industry itself. It's clear from the latest estimates that Orient Overseas (International)'s rate of growth is expected to accelerate meaningfully, with the forecast 32% annualised revenue growth to the end of 2021 noticeably faster than its historical growth of 7.2% p.a. over the past five years. Compare this with other companies in the same industry, which are forecast to grow their revenue 7.5% annually. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect Orient Overseas (International) to grow faster than the wider industry.

The Bottom Line

The most important thing to take away from this upgrade is that analysts upgraded their earnings per share estimates for this year, expecting improving business conditions. They also upgraded their revenue estimates for this year, and sales are expected to grow faster than the wider market. More bullish expectations could be a signal for investors to take a closer look at Orient Overseas (International).

Using these estimates as a starting point, we've run a discounted cash flow calculation (DCF) on Orient Overseas (International) that suggests the company could be somewhat undervalued. You can learn more about our valuation methodology on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

If you’re looking to trade Orient Overseas (International), open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:316

Orient Overseas (International)

An investment holding company, provides container transport and logistics services in Asia, Europe, North and South America, Australia, and Africa.

Flawless balance sheet slight.