Cathay Pacific Airways' (HKG:293) Shareholders Are Down 45% On Their Shares

While it may not be enough for some shareholders, we think it is good to see the Cathay Pacific Airways Limited (HKG:293) share price up 18% in a single quarter. But that doesn't change the fact that the returns over the last three years have been less than pleasing. In fact, the share price is down 45% in the last three years, falling well short of the market return.

View our latest analysis for Cathay Pacific Airways

Cathay Pacific Airways wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over three years, Cathay Pacific Airways grew revenue at 0.1% per year. Given it's losing money in pursuit of growth, we are not really impressed with that. The stock dropped 13% during that time. Shareholders will probably be hoping growth picks up soon. But the real upside for shareholders will be if the company can start generating profits.

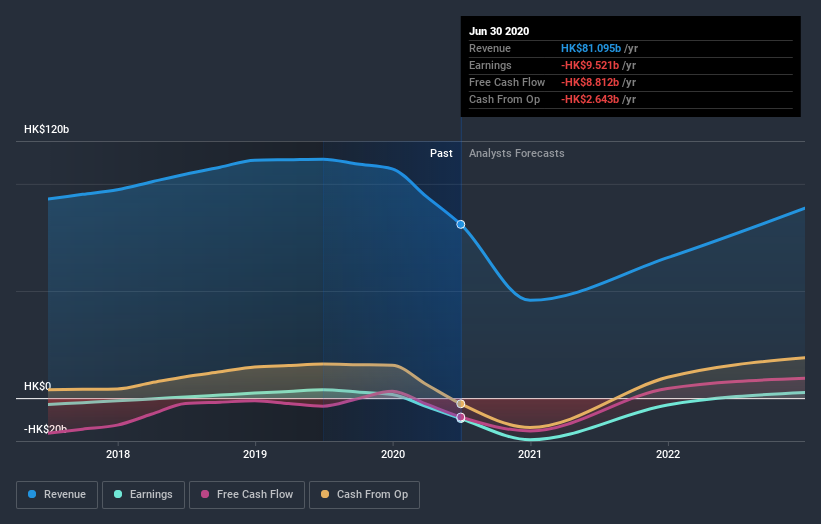

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Cathay Pacific Airways is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. Given we have quite a good number of analyst forecasts, it might be well worth checking out this free chart depicting consensus estimates.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Cathay Pacific Airways' total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Its history of dividend payouts mean that Cathay Pacific Airways' TSR, which was a 34% drop over the last 3 years, was not as bad as the share price return.

A Different Perspective

Investors in Cathay Pacific Airways had a tough year, with a total loss of 22%, against a market gain of about 22%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 5% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Cathay Pacific Airways you should know about.

Of course Cathay Pacific Airways may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

When trading Cathay Pacific Airways or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:293

Cathay Pacific Airways

Offers international passenger and air cargo transportation services.

Undervalued with solid track record and pays a dividend.