As global markets navigate the complexities of policy shifts and economic indicators, investors are keenly observing how these factors influence various sectors. In this context, penny stocks—often representing smaller or emerging companies—continue to capture interest due to their unique potential for growth and affordability. While the term may seem dated, it remains relevant as these stocks often offer intriguing opportunities when backed by strong financial fundamentals.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.21 | MYR340.59M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.48 | MYR2.39B | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.15 | £796.86M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.59 | A$69.16M | ★★★★★★ |

| Wellcall Holdings Berhad (KLSE:WELLCAL) | MYR1.55 | MYR771.82M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.83 | HK$526.87M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.885 | MYR293.77M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.895 | £373.95M | ★★★★☆☆ |

| Embark Early Education (ASX:EVO) | A$0.81 | A$148.62M | ★★★★☆☆ |

| Genetec Technology Berhad (KLSE:GENETEC) | MYR0.82 | MYR643.61M | ★★★★★★ |

Click here to see the full list of 5,795 stocks from our Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

YesAsia Holdings (SEHK:2209)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: YesAsia Holdings Limited is an investment holding company involved in the procurement, sale, and trading of Asian fashion and lifestyle products, beauty items, cosmetics, accessories, and entertainment products with a market cap of HK$1.57 billion.

Operations: The company generates revenue primarily from two segments: Entertainment Products, contributing $2.56 million, and Fashion & Lifestyle and Beauty Products, accounting for $270.65 million.

Market Cap: HK$1.57B

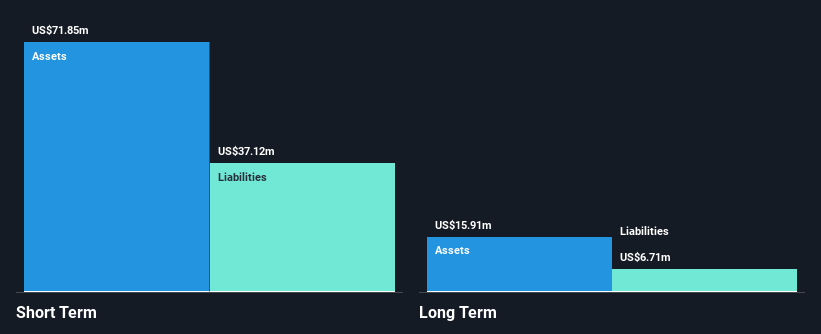

YesAsia Holdings has shown significant financial improvement, reporting a substantial increase in sales to US$163.35 million and net income of US$11.11 million for the first half of 2024. The company is debt-free, with short-term assets exceeding both short and long-term liabilities, indicating strong financial health. Despite recent shareholder dilution, YesAsia's return on equity is high at 39%. The seasoned management team and board bring extensive experience to the company. Earnings are forecasted to grow at a robust rate of nearly 49% annually, highlighting potential for continued growth in profitability.

- Click here to discover the nuances of YesAsia Holdings with our detailed analytical financial health report.

- Explore YesAsia Holdings' analyst forecasts in our growth report.

Abbisko Cayman (SEHK:2256)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Abbisko Cayman Limited is a clinical-stage biopharmaceutical company focused on discovering and developing small molecule oncology therapies in Mainland China, with a market cap of HK$2.89 billion.

Operations: The company generates revenue of CN¥497.27 million from its innovative medicine development segment.

Market Cap: HK$2.89B

Abbisko Cayman, a clinical-stage biopharmaceutical firm, is currently pre-revenue but shows promise with its recent Phase 3 MANEUVER study results. The study demonstrated significant improvements in treating tenosynovial giant cell tumor using pimicotinib, highlighting potential therapeutic advancements. Despite being unprofitable and not expected to achieve profitability soon, Abbisko has managed to reduce losses by 17.5% annually over the past five years and maintains a strong cash position with a runway exceeding three years. The company benefits from an experienced management team and board while remaining debt-free with substantial short-term assets covering liabilities.

- Navigate through the intricacies of Abbisko Cayman with our comprehensive balance sheet health report here.

- Review our growth performance report to gain insights into Abbisko Cayman's future.

Beingmate (SZSE:002570)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Beingmate Co., Ltd. is involved in the research, development, production, and sale of children's and nutritious food products in China with a market cap of CN¥4.72 billion.

Operations: The company's revenue is primarily generated from its operations in China, amounting to CN¥2.70 billion.

Market Cap: CN¥4.72B

Beingmate Co., Ltd. has shown financial improvement with a net income of CN¥71.79 million for the first nine months of 2024, up from CN¥49.41 million the previous year, reflecting enhanced profitability despite a volatile share price recently. The company's cash exceeds its total debt, indicating sound financial health, although short-term liabilities slightly surpass short-term assets. A significant one-off gain of CN¥105.6 million impacted recent results, and while Return on Equity is low at 4.9%, earnings growth has been notable over five years at an annual rate of 20%. The board's average tenure suggests limited experience but no shareholder dilution occurred last year.

- Click here and access our complete financial health analysis report to understand the dynamics of Beingmate.

- Understand Beingmate's track record by examining our performance history report.

Taking Advantage

- Explore the 5,795 names from our Penny Stocks screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Abbisko Cayman, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2256

Abbisko Cayman

Engages in the discovering and developing small molecule oncology therapies in China.

Flawless balance sheet with acceptable track record.