- Hong Kong

- /

- Transportation

- /

- SEHK:254

National United Resources Holdings Limited (HKG:254) May Have Run Too Fast Too Soon With Recent 26% Price Plummet

National United Resources Holdings Limited (HKG:254) shares have had a horrible month, losing 26% after a relatively good period beforehand. For any long-term shareholders, the last month ends a year to forget by locking in a 68% share price decline.

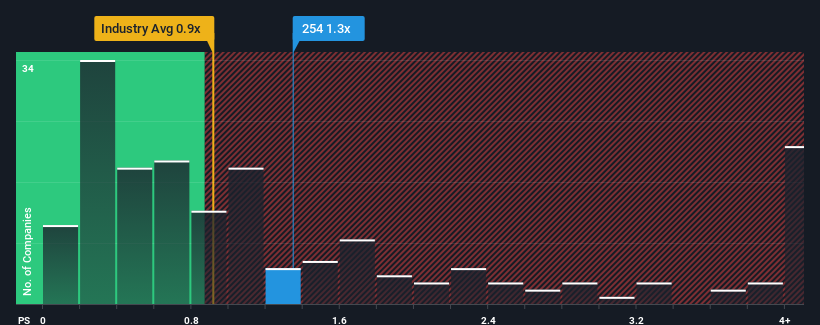

In spite of the heavy fall in price, you could still be forgiven for thinking National United Resources Holdings is a stock not worth researching with a price-to-sales ratios (or "P/S") of 1.3x, considering almost half the companies in Hong Kong's Transportation industry have P/S ratios below 0.6x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for National United Resources Holdings

What Does National United Resources Holdings' P/S Mean For Shareholders?

The revenue growth achieved at National United Resources Holdings over the last year would be more than acceptable for most companies. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on National United Resources Holdings will help you shine a light on its historical performance.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as high as National United Resources Holdings' is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a decent 9.3% gain to the company's revenues. However, this wasn't enough as the latest three year period has seen an unpleasant 42% overall drop in revenue. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

In contrast to the company, the rest of the industry is expected to grow by 6.0% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this in mind, we find it worrying that National United Resources Holdings' P/S exceeds that of its industry peers. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Bottom Line On National United Resources Holdings' P/S

National United Resources Holdings' P/S remain high even after its stock plunged. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that National United Resources Holdings currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. With a revenue decline on investors' minds, the likelihood of a souring sentiment is quite high which could send the P/S back in line with what we'd expect. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

You should always think about risks. Case in point, we've spotted 3 warning signs for National United Resources Holdings you should be aware of, and 1 of them can't be ignored.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if National United Resources Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:254

National United Resources Holdings

An investment holding company, engages in the car rental service business.

Excellent balance sheet low.

Market Insights

Community Narratives