Global markets have been grappling with challenges such as declining consumer confidence, regulatory uncertainties in the tech sector, and ongoing trade tensions. In this context, investors might find opportunities by exploring penny stocks—typically smaller or newer companies that can offer unexpected value. Despite being an older term, penny stocks remain relevant today for those seeking to identify companies with strong financial foundations and potential for growth.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Financial Health Rating |

| Warpaint London (AIM:W7L) | £3.60 | £290.83M | ★★★★★★ |

| Angler Gaming (NGM:ANGL) | SEK3.82 | SEK286.44M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.86 | HK$43.33B | ★★★★★★ |

| NEXG Berhad (KLSE:DSONIC) | MYR0.26 | MYR723.36M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.505 | MYR2.51B | ★★★★★★ |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.41 | SGD9.52B | ★★★★★☆ |

| Sarawak Plantation Berhad (KLSE:SWKPLNT) | MYR2.27 | MYR633.4M | ★★★★★★ |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.68 | A$80.9M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.69 | £419.72M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £2.985 | £296.88M | ★★★★☆☆ |

Click here to see the full list of 5,733 stocks from our Global Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Sa Sa International Holdings (SEHK:178)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sa Sa International Holdings Limited is an investment holding company that operates in the retail and wholesale of cosmetic products across Hong Kong, Macau, Mainland China, Southeast Asia, and internationally with a market cap of HK$1.99 billion.

Operations: The company's revenue is primarily derived from Hong Kong & Macau at HK$3.09 billion, followed by Mainland China with HK$648.19 million and Southeast Asia contributing HK$391.73 million.

Market Cap: HK$1.99B

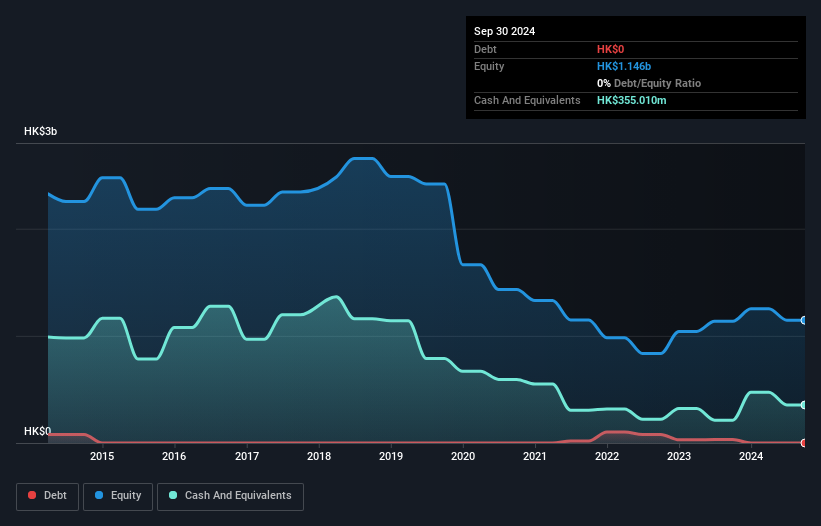

Sa Sa International Holdings, with a market cap of HK$1.99 billion, primarily generates revenue from Hong Kong and Macau. The company reported third-quarter sales of HK$1.06 billion for 2024. Despite being debt-free and having stable weekly volatility, its recent earnings growth has been negative at -49.3%, contrasting with past significant growth over five years at 42.3% annually. Profit margins have decreased to 3.6% from last year's 7.2%. Recent management changes include the appointment of a new CFO, Mr. Chung Ming Kit, who brings extensive financial expertise to the seasoned team and board.

- Unlock comprehensive insights into our analysis of Sa Sa International Holdings stock in this financial health report.

- Explore Sa Sa International Holdings' analyst forecasts in our growth report.

FAR International Holdings Group (SEHK:2516)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: FAR International Holdings Group Company Limited is an investment holding company that offers cross-border e-commerce logistics services in Mainland China, Hong Kong, the United States, the United Kingdom, and other international markets, with a market cap of HK$803.40 million.

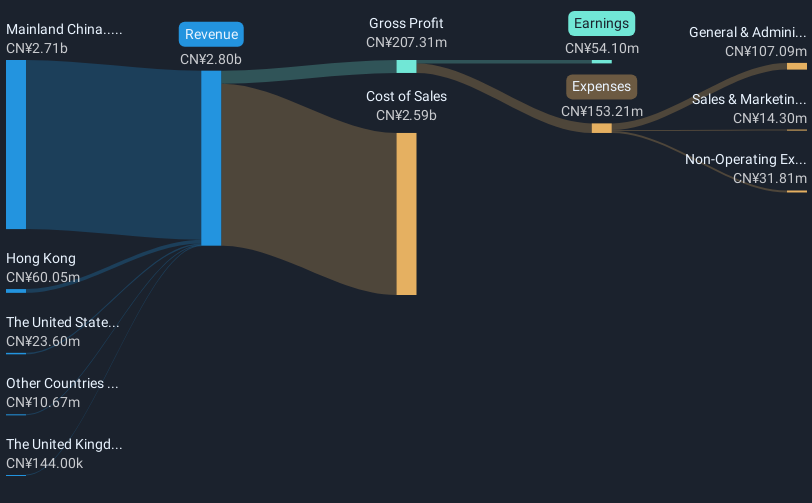

Operations: The company's revenue is primarily derived from its Transportation - Air Freight segment, totaling CN¥2.80 billion.

Market Cap: HK$803.4M

FAR International Holdings Group, with a market cap of HK$803.40 million, derives significant revenue from its Transportation - Air Freight segment totaling CN¥2.80 billion. The company's earnings have rebounded dramatically over the past year with a 131.2% increase, outpacing the logistics industry average of 6.5%, although they had declined by an annual rate of 6.8% over five years prior to this recovery. Despite having more cash than total debt and well-covered interest payments (13.4x EBIT), operating cash flow remains negative, indicating potential liquidity challenges ahead. Recent executive changes include appointing Mr. Wang Tiantian as CEO to enhance strategic leadership amidst ongoing volatility concerns in share price stability and management experience gaps.

- Get an in-depth perspective on FAR International Holdings Group's performance by reading our balance sheet health report here.

- Gain insights into FAR International Holdings Group's historical outcomes by reviewing our past performance report.

Modern Avenue Group (SZSE:002656)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Modern Avenue Group Co., Ltd. operates retail outlets worldwide and has a market cap of CN¥1.74 billion.

Operations: Modern Avenue Group Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥1.74B

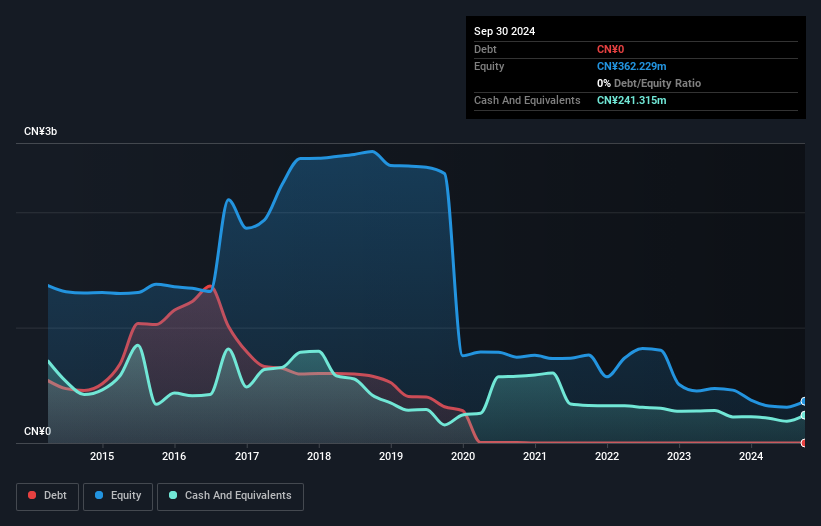

Modern Avenue Group, with a market cap of CN¥1.74 billion, is currently unprofitable but has managed to reduce its losses at a rate of 63% annually over the past five years. While it boasts no debt and sufficient short-term assets (CN¥374.5M) to cover both short-term (CN¥125.1M) and long-term liabilities (CN¥38.6M), its share price remains highly volatile, surpassing 75% of Chinese stocks in weekly volatility. The company maintains a positive free cash flow, providing a cash runway exceeding three years despite not generating significant revenue streams yet, as evidenced by recent shareholder meetings focusing on governance adjustments rather than financial performance updates.

- Click to explore a detailed breakdown of our findings in Modern Avenue Group's financial health report.

- Learn about Modern Avenue Group's historical performance here.

Summing It All Up

- Dive into all 5,733 of the Global Penny Stocks we have identified here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2516

FAR International Holdings Group

An investment holding company, provides cross-border e-commerce logistics services in Mainland China, Hong Kong, the United States, the United Kingdom, Singapore, the United Kingdom and internationally.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives