- Hong Kong

- /

- Marine and Shipping

- /

- SEHK:2343

Pacific Basin Shipping Limited's (HKG:2343) P/S Is Still On The Mark Following 30% Share Price Bounce

Despite an already strong run, Pacific Basin Shipping Limited (HKG:2343) shares have been powering on, with a gain of 30% in the last thirty days. Notwithstanding the latest gain, the annual share price return of 8.4% isn't as impressive.

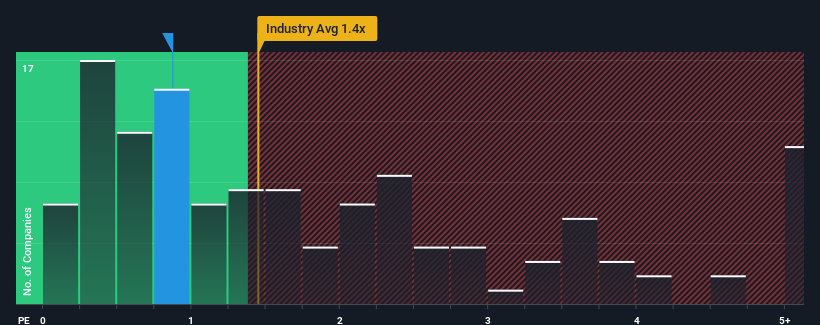

Even after such a large jump in price, there still wouldn't be many who think Pacific Basin Shipping's price-to-sales (or "P/S") ratio of 0.9x is worth a mention when it essentially matches the median P/S in Hong Kong's Shipping industry. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Pacific Basin Shipping

What Does Pacific Basin Shipping's P/S Mean For Shareholders?

Recent times have been more advantageous for Pacific Basin Shipping as its revenue hasn't fallen as much as the rest of the industry. One possibility is that the P/S ratio is moderate because investors think this relatively better revenue performance might be about to evaporate. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. But at the very least, you'd be hoping the company doesn't fall back into the pack if your plan is to pick up some stock while it's not in favour.

Want the full picture on analyst estimates for the company? Then our free report on Pacific Basin Shipping will help you uncover what's on the horizon.How Is Pacific Basin Shipping's Revenue Growth Trending?

In order to justify its P/S ratio, Pacific Basin Shipping would need to produce growth that's similar to the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 30%. Even so, admirably revenue has lifted 56% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 2.9% per year during the coming three years according to the eight analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 2.9% per annum, which is not materially different.

In light of this, it's understandable that Pacific Basin Shipping's P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What Does Pacific Basin Shipping's P/S Mean For Investors?

Pacific Basin Shipping's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

A Pacific Basin Shipping's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Shipping industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

Before you settle on your opinion, we've discovered 2 warning signs for Pacific Basin Shipping that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2343

Pacific Basin Shipping

An investment holding company, engages in the provision of dry bulk shipping services in Hong Kong and internationally.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives