- Hong Kong

- /

- Marine and Shipping

- /

- SEHK:2343

3 Dividend Stocks Offering Yields From 3% To 6.2%

Reviewed by Simply Wall St

In a week marked by volatility and geopolitical tensions, global markets have experienced mixed performances, with the U.S. Federal Reserve holding rates steady amidst ongoing inflation concerns and AI competition fears impacting tech stocks. As investors navigate these uncertain times, dividend stocks can offer a measure of stability through regular income streams; this article explores three such stocks providing yields between 3% and 6.2%, making them potentially attractive options for those seeking consistent returns in fluctuating market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.29% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 4.09% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.55% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.47% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.08% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.43% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.45% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.96% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.66% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.88% | ★★★★★★ |

Click here to see the full list of 1955 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

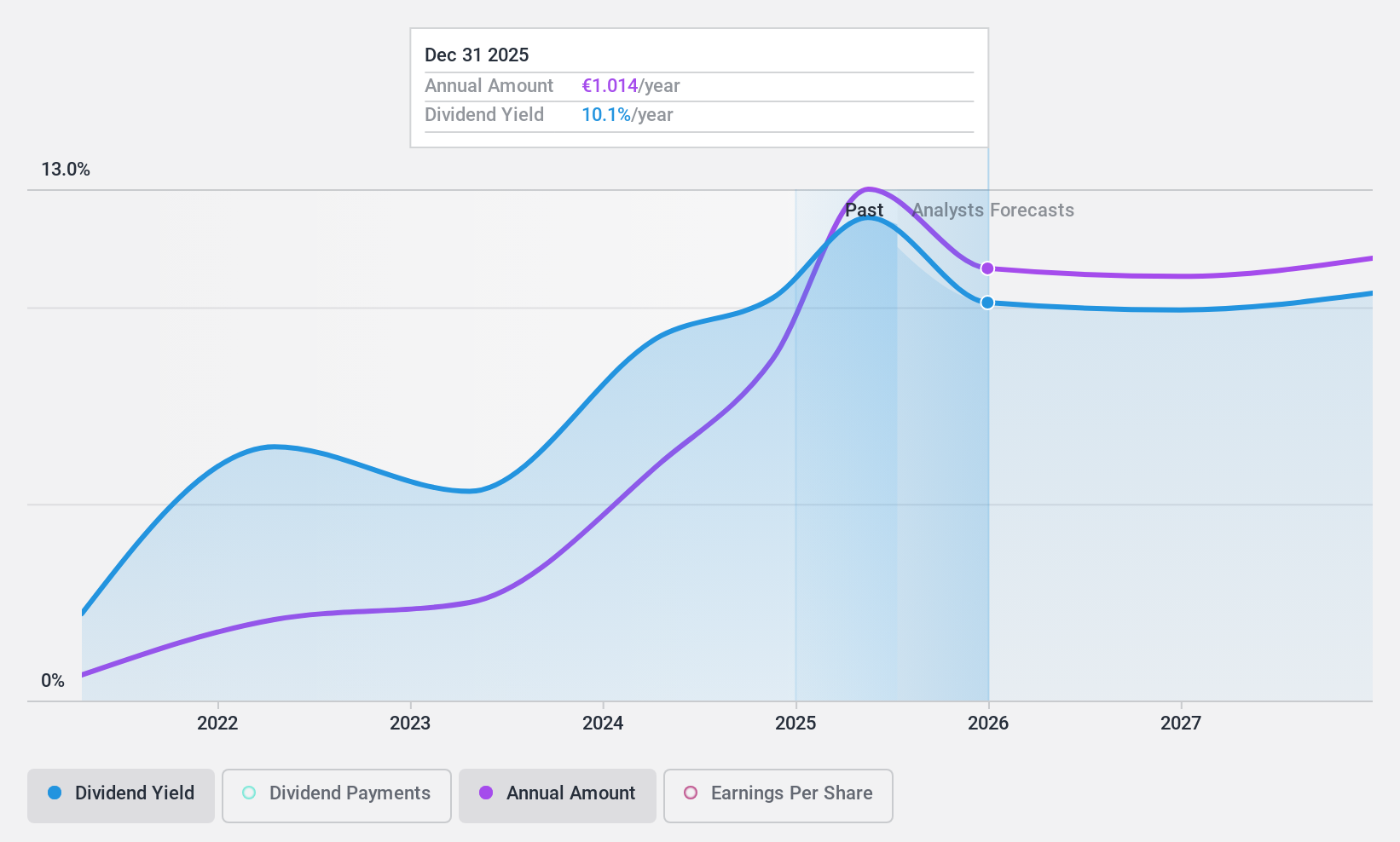

Banco BPM (BIT:BAMI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Banco BPM S.p.A. is an Italian bank offering a range of banking and financial products and services to individual, business, and corporate customers, with a market cap of €13.45 billion.

Operations: Banco BPM S.p.A. generates revenue through diverse banking and financial services tailored to individual, business, and corporate clients in Italy.

Dividend Yield: 6.3%

Banco BPM's dividend yield of 6.25% ranks in the top 25% of Italian market payers, though it has only paid dividends for four years. The payout ratio is currently sustainable at 60.9%, with future coverage expected to remain reasonable at 75.3%. However, earnings are projected to decline by an average of 11% annually over the next three years. Additionally, Banco BPM faces a hostile takeover bid from UniCredit valued at €10.1 billion, potentially affecting future dividend policies and stability.

- Delve into the full analysis dividend report here for a deeper understanding of Banco BPM.

- According our valuation report, there's an indication that Banco BPM's share price might be on the cheaper side.

Pacific Basin Shipping (SEHK:2343)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Pacific Basin Shipping Limited is an investment holding company that provides dry bulk shipping services globally, with a market capitalization of HK$8.62 billion.

Operations: Pacific Basin Shipping Limited generates its revenue primarily from dry bulk shipping services, amounting to $2.43 billion.

Dividend Yield: 5.8%

Pacific Basin Shipping's dividend yield of 5.75% is below the top quartile in Hong Kong. Although dividends are covered by earnings and cash flows with payout ratios at 44.6% and 30.1%, respectively, they have been volatile over the past decade, reflecting an unstable track record. Recent board changes include appointing experienced directors Ms. Kalpana Desai and Ms. Wang Xiaojun Heather, which may influence future governance and strategic direction amidst current challenges in profit margins and dividend reliability.

- Take a closer look at Pacific Basin Shipping's potential here in our dividend report.

- The valuation report we've compiled suggests that Pacific Basin Shipping's current price could be quite moderate.

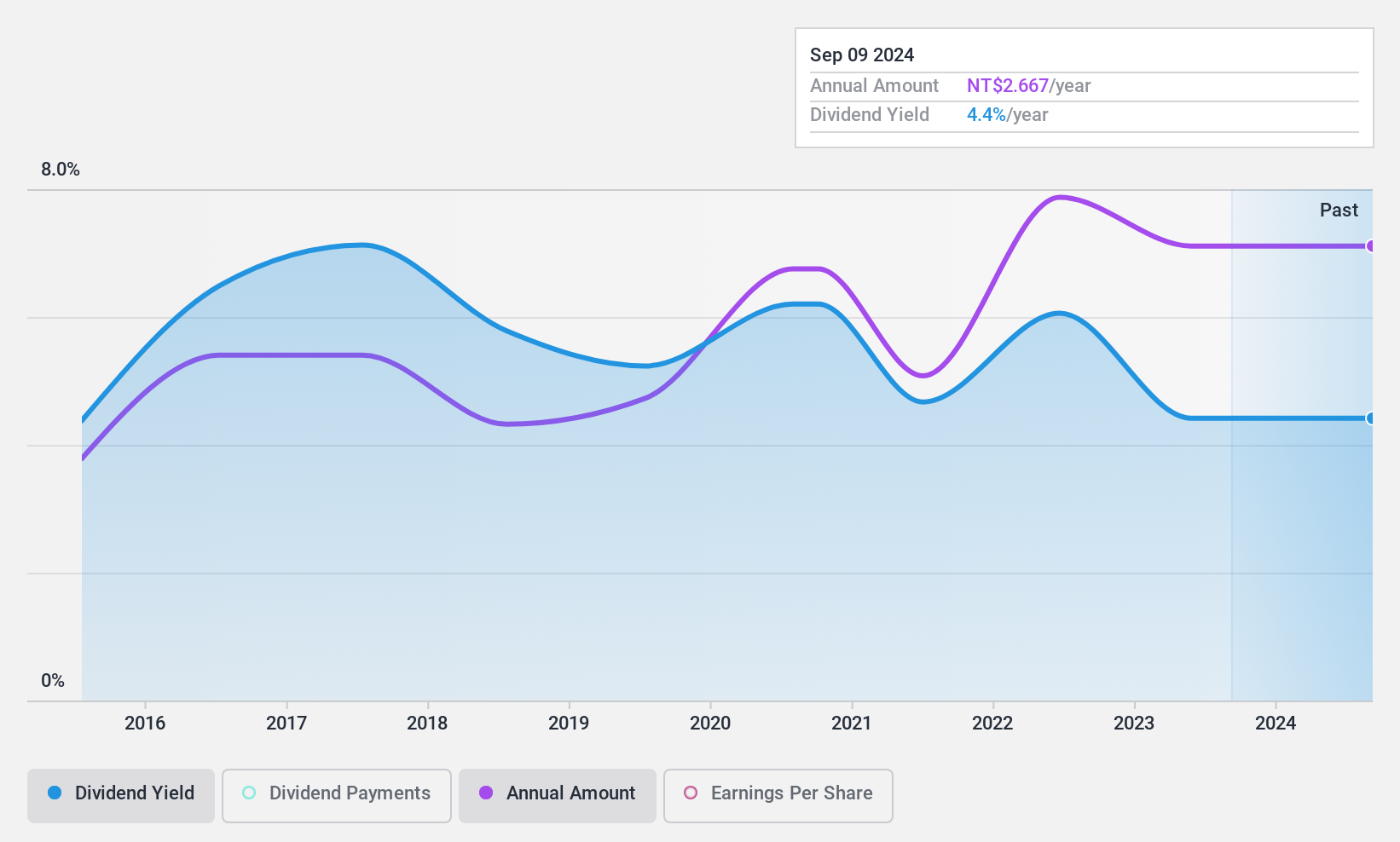

Sanlien Technology (TPEX:5493)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sanlien Technology Corp. manufactures and sells specialty chemicals for the semiconductor industry in Taiwan, Asia, and internationally, with a market cap of NT$34.95 billion.

Operations: Sanlien Technology Corp. generates revenue primarily through its Electronic Materials Division, which accounts for NT$3.68 billion, followed by the Automation Monitoring Division at NT$544.30 million, and the Foreign Sensors and Equipment Department contributing NT$61.91 million.

Dividend Yield: 3.1%

Sanlien Technology's dividend payments, covered by both earnings and cash flows with payout ratios of 43% and 17.2%, respectively, have been volatile over the past decade despite some growth. The dividend yield of 3.1% is lower than Taiwan's top payers. Recent earnings showed increased sales but a drop in net income, affecting EPS from TWD 1.95 to TWD 0.33 year-on-year for Q3, highlighting potential concerns for dividend stability moving forward.

- Get an in-depth perspective on Sanlien Technology's performance by reading our dividend report here.

- The analysis detailed in our Sanlien Technology valuation report hints at an deflated share price compared to its estimated value.

Summing It All Up

- Delve into our full catalog of 1955 Top Dividend Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2343

Pacific Basin Shipping

An investment holding company, engages in the provision of dry bulk shipping services in Hong Kong and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Near zero debt, Japan centric focus provides future growth

Corning's Revenue Will Climb by 12.73% in Just Five Years

GE Vernova revenue will grow by 13% with a future PE of 64.7x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026