- Hong Kong

- /

- Marine and Shipping

- /

- SEHK:1919

COSCO SHIPPING Holdings (SEHK:1919): Is the Market Undervaluing Its Recent Performance?

Reviewed by Simply Wall St

Price-to-Earnings of 4x: Is it justified?

COSCO SHIPPING Holdings is currently trading at a price-to-earnings (P/E) ratio of 4x, which is significantly below both its peer group (7.9x) and the broader Asian Shipping industry average (10.6x). This suggests the stock appears undervalued relative to comparable companies and industry benchmarks.

The P/E ratio measures the price investors are willing to pay for each dollar of earnings. In the shipping sector, where earnings can fluctuate, a lower multiple may signal market hesitation or potentially overlooked value, especially when compared to similar firms.

For COSCO SHIPPING Holdings, this valuation implies that the market may be underestimating its future profit potential or pricing in a higher degree of risk than its peers. Whether this discount is justified will depend on how the company's earnings trajectory plays out in the coming years.

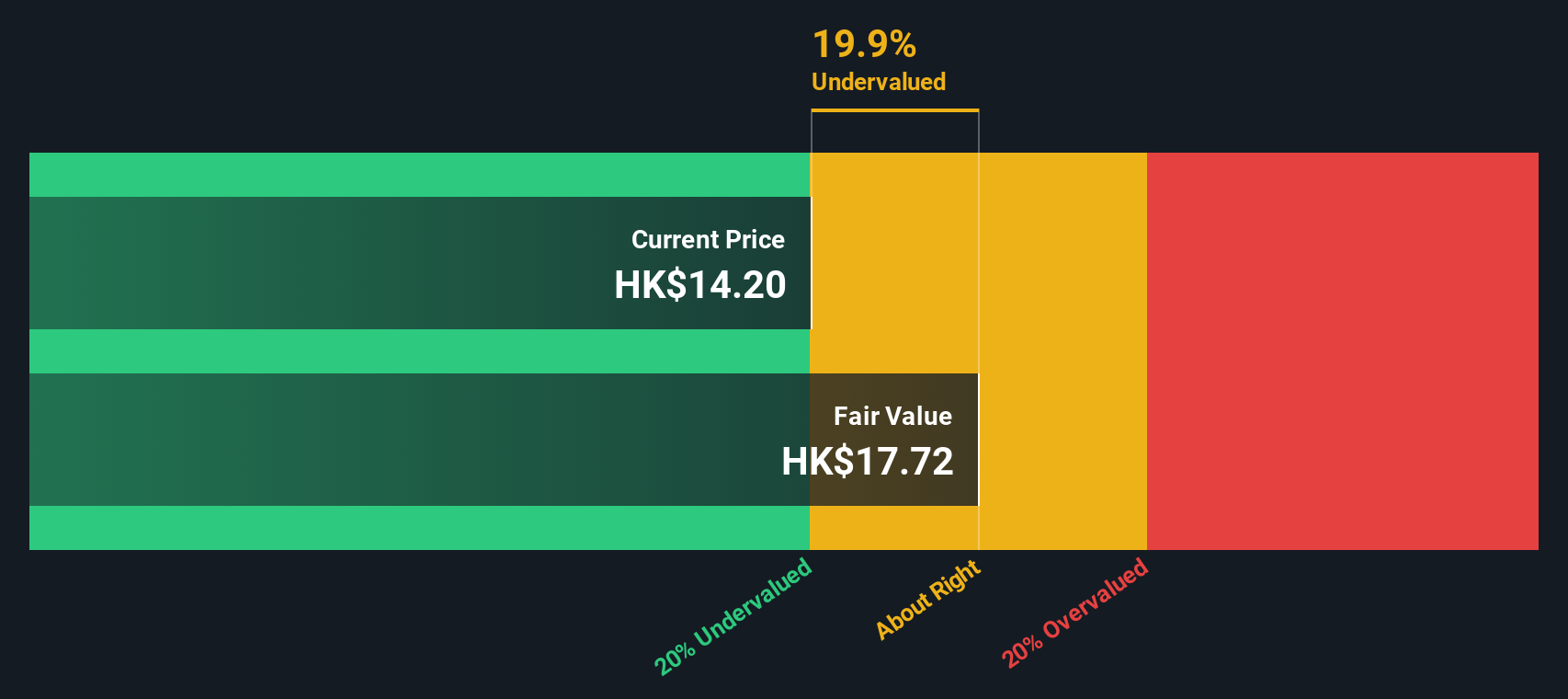

Result: Fair Value of $33.15 (UNDERVALUED)

See our latest analysis for COSCO SHIPPING Holdings.However, cooling revenue growth and a sharp decline in annual net income may signal tougher times ahead if current industry headwinds continue.

Find out about the key risks to this COSCO SHIPPING Holdings narrative.Another View: What Does the SWS DCF Model Say?

Looking from a different angle, the SWS DCF model also indicates that COSCO SHIPPING Holdings is undervalued, which reinforces the message from the earlier valuation. But does this agreement reveal opportunity, or is something being missed?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own COSCO SHIPPING Holdings Narrative

If you see the story differently or want to dive deeper into the data yourself, you can shape your own view in just a few minutes. Do it your way

A great starting point for your COSCO SHIPPING Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Take your investing game to the next level with handpicked stock ideas you might regret missing. Uncover fresh opportunities before everyone else does.

- Tap into market trends and spot up-and-coming businesses with strong financials by checking out penny stocks with strong financials.

- Capture future breakthroughs by targeting companies at the forefront of artificial intelligence through AI penny stocks.

- Maximize your potential returns and see which stocks look undervalued based on their cash flows with undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About SEHK:1919

COSCO SHIPPING Holdings

An investment holding company, engages in the container shipping in the United States, Europe, the Asia Pacific, Mainland China, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives