- Hong Kong

- /

- Infrastructure

- /

- SEHK:1719

These 4 Measures Indicate That China Infrastructure & Logistics Group (HKG:1719) Is Using Debt Extensively

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, China Infrastructure & Logistics Group Ltd. (HKG:1719) does carry debt. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for China Infrastructure & Logistics Group

What Is China Infrastructure & Logistics Group's Net Debt?

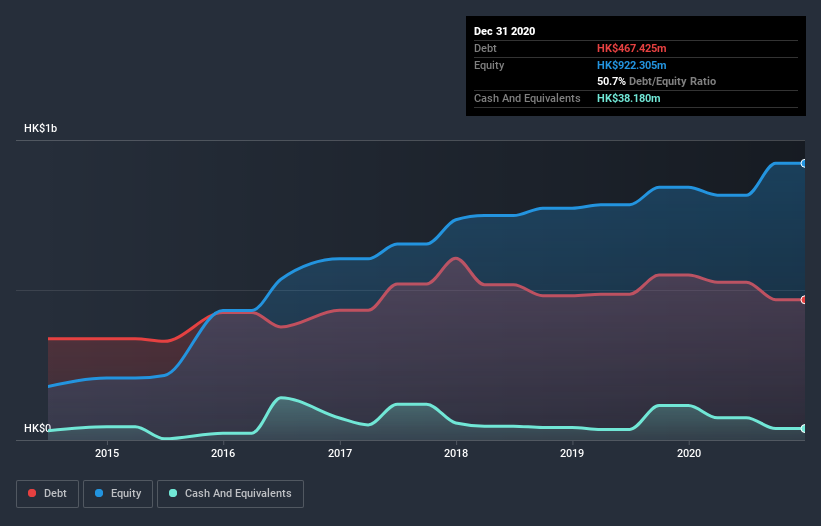

You can click the graphic below for the historical numbers, but it shows that China Infrastructure & Logistics Group had HK$467.4m of debt in December 2020, down from HK$549.6m, one year before. On the flip side, it has HK$38.2m in cash leading to net debt of about HK$429.2m.

How Strong Is China Infrastructure & Logistics Group's Balance Sheet?

The latest balance sheet data shows that China Infrastructure & Logistics Group had liabilities of HK$634.6m due within a year, and liabilities of HK$313.3m falling due after that. Offsetting this, it had HK$38.2m in cash and HK$206.0m in receivables that were due within 12 months. So it has liabilities totalling HK$703.7m more than its cash and near-term receivables, combined.

This deficit isn't so bad because China Infrastructure & Logistics Group is worth HK$1.21b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Weak interest cover of 0.015 times and a disturbingly high net debt to EBITDA ratio of 14.4 hit our confidence in China Infrastructure & Logistics Group like a one-two punch to the gut. This means we'd consider it to have a heavy debt load. Worse, China Infrastructure & Logistics Group's EBIT was down 98% over the last year. If earnings continue to follow that trajectory, paying off that debt load will be harder than convincing us to run a marathon in the rain. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since China Infrastructure & Logistics Group will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last three years, China Infrastructure & Logistics Group actually produced more free cash flow than EBIT. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Our View

On the face of it, China Infrastructure & Logistics Group's interest cover left us tentative about the stock, and its EBIT growth rate was no more enticing than the one empty restaurant on the busiest night of the year. But at least it's pretty decent at converting EBIT to free cash flow; that's encouraging. We should also note that Infrastructure industry companies like China Infrastructure & Logistics Group commonly do use debt without problems. Once we consider all the factors above, together, it seems to us that China Infrastructure & Logistics Group's debt is making it a bit risky. That's not necessarily a bad thing, but we'd generally feel more comfortable with less leverage. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 5 warning signs for China Infrastructure & Logistics Group (of which 2 shouldn't be ignored!) you should know about.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you decide to trade China Infrastructure & Logistics Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1719

China Infrastructure & Logistics Group

An investment holding company, develops, operates, and manages container and other ports in the People’s Republic of China.

Slight risk with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion