- Hong Kong

- /

- Infrastructure

- /

- SEHK:1199

COSCO SHIPPING Ports (SEHK:1199): Valuation Insights After Interim Dividend and Scrip Share Option Announcement

Reviewed by Simply Wall St

COSCO SHIPPING Ports (SEHK:1199) caught the market’s attention after announcing its first interim dividend for the year. Shareholders will have the option to take cash or scrip shares instead. This decision highlights the company’s flexible approach to rewarding investors.

See our latest analysis for COSCO SHIPPING Ports.

The upbeat mood around COSCO SHIPPING Ports has coincided with solid performance, as the stock logged a 25% year-to-date share price return and boasts a 1-year total shareholder return of nearly 28%. Momentum has clearly been picking up, supported by investor optimism after recent dividend flexibility and manageable growth in underlying business metrics.

If COSCO SHIPPING Ports’ latest dividend move has you curious about broader opportunities, consider broadening your search and discover fast growing stocks with high insider ownership.

But with shares near recent highs and optimism running strong, is COSCO SHIPPING Ports still trading at a discount, or has the market already priced in its future growth, leaving little room for a bargain?

Most Popular Narrative: 20% Overvalued

The current narrative puts COSCO SHIPPING Ports' fair value at HK$5.71, higher than its recent close. This presents a bullish outlook driven by technological transformation and global expansion.

Strategic enhancements to COSCO's port network, such as investment in smart port technology, automation (large-scale application of unmanned trucks, EAM and AI systems), and advanced digitalization, are reducing operating costs and boosting efficiency. This is improving net margins and long-term earnings power.

Want to know the playbook behind this premium price tag? The most popular narrative is powered by projections of deep automation, fresh revenue streams, and a sharply higher future earnings multiple. Intrigued by the details behind this jump in fair value? Find out which bold financial assumptions anchor these valuations.

Result: Fair Value of $5.71 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, global shipping volatility and rising competition in key markets remain factors that could quickly shift expectations for COSCO SHIPPING Ports.

Find out about the key risks to this COSCO SHIPPING Ports narrative.

Another View: Multiples Point to Value

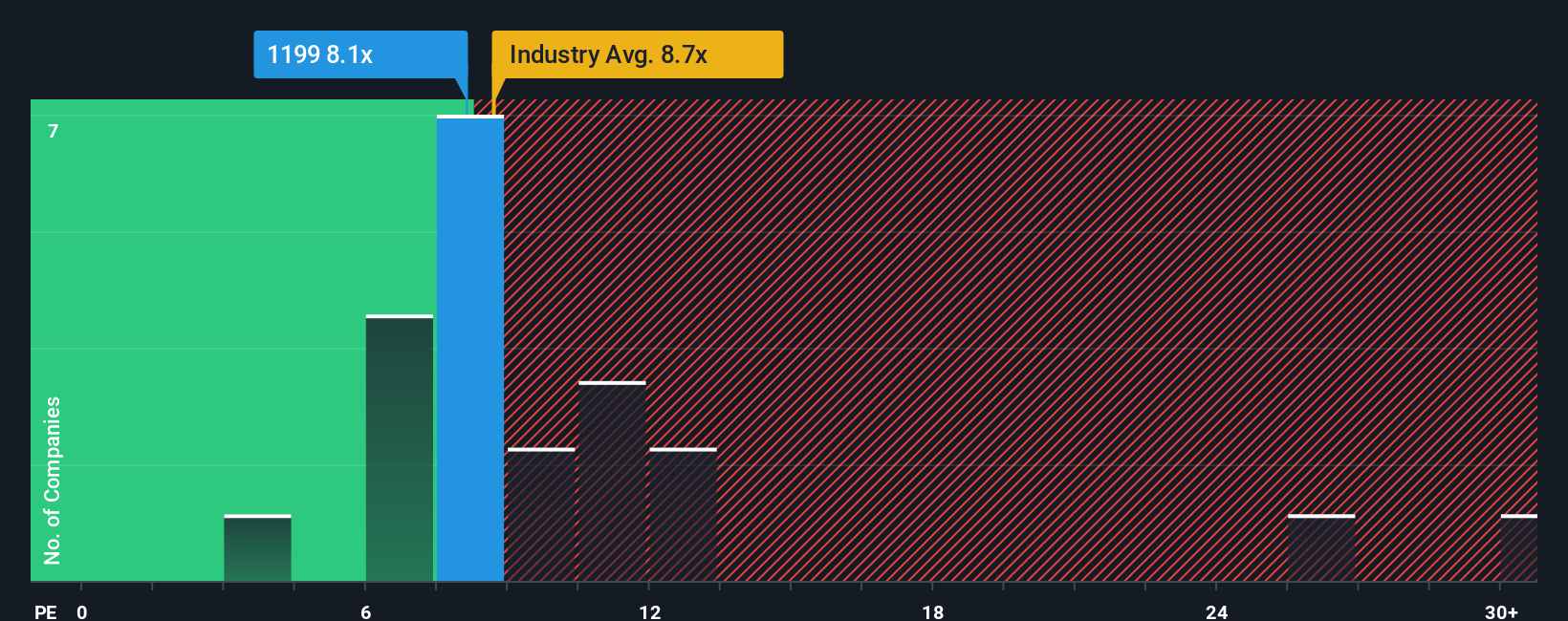

While the consensus price target suggests COSCO SHIPPING Ports might be fairly priced or even overvalued, a look at its price-to-earnings ratio offers a more upbeat signal. The company trades at 8.1x earnings, lower than both the industry average of 8.7x and the peer average of 9.8x. It is also below its own fair ratio of 8.9x. This gap hints at a discount and suggests there could be value left on the table.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own COSCO SHIPPING Ports Narrative

If the current outlook does not match your perspective or you prefer hands-on research, you can shape your own narrative in just a few minutes with Do it your way.

A great starting point for your COSCO SHIPPING Ports research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t limit yourself to just one opportunity when there are so many dynamic stocks waiting for your attention. Expand your search today and find tomorrow’s leaders.

- Catch high yields and steady growth by uncovering potential in these 17 dividend stocks with yields > 3%. Reliable payouts can mean long-term rewards.

- Find tomorrow’s tech winners by targeting these 24 AI penny stocks, which are packed with disruptive innovation and artificial intelligence breakthroughs you do not want to miss.

- Capitalize on shifting market trends by accessing these 79 cryptocurrency and blockchain stocks. Blockchain pioneers are transforming digital finance and payments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1199

COSCO SHIPPING Ports

An investment holding company, manages and operates ports and terminals in Mainland China, Hong Kong, Europe, and internationally.

Undervalued with proven track record.

Market Insights

Community Narratives