- Hong Kong

- /

- Wireless Telecom

- /

- SEHK:941

China Mobile Limited's (HKG:941) Shareholders Might Be Looking For Exit

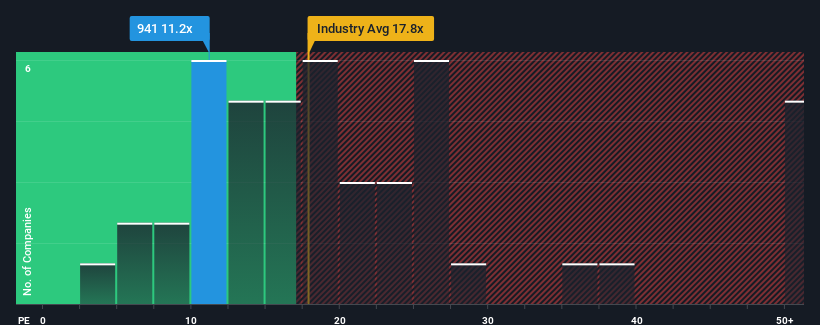

With a median price-to-earnings (or "P/E") ratio of close to 10x in Hong Kong, you could be forgiven for feeling indifferent about China Mobile Limited's (HKG:941) P/E ratio of 11.2x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

China Mobile certainly has been doing a good job lately as it's been growing earnings more than most other companies. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for China Mobile

Is There Some Growth For China Mobile?

In order to justify its P/E ratio, China Mobile would need to produce growth that's similar to the market.

Retrospectively, the last year delivered a decent 3.3% gain to the company's bottom line. The solid recent performance means it was also able to grow EPS by 15% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been respectable for the company.

Turning to the outlook, the next three years should generate growth of 3.2% per annum as estimated by the analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 13% each year, which is noticeably more attractive.

In light of this, it's curious that China Mobile's P/E sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

The Final Word

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that China Mobile currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for China Mobile with six simple checks.

If these risks are making you reconsider your opinion on China Mobile, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:941

China Mobile

Provides telecommunications and information related services in Mainland China and Hong Kong.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success