As global markets navigate a complex landscape marked by rate cuts from the ECB and SNB, and anticipation of further action from the Federal Reserve, investors are keenly observing how these monetary policy shifts impact economic growth and inflation. Amidst this backdrop, the Nasdaq Composite has reached new heights while other major indices face challenges, highlighting the importance of selecting robust dividend stocks that can offer stability and income in uncertain times. A good dividend stock typically combines a strong track record of consistent payouts with solid fundamentals that can withstand varying market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.23% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.23% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.00% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.19% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.41% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.01% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.96% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.61% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.36% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.83% | ★★★★★★ |

Click here to see the full list of 1831 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

China Unicom (Hong Kong) (SEHK:762)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Unicom (Hong Kong) Limited is an investment holding company offering telecommunications and related value-added services in the People’s Republic of China, with a market cap of HK$212.05 billion.

Operations: China Unicom (Hong Kong) Limited generates revenue of CN¥381.03 billion from its Wireless Communications Services segment in the People’s Republic of China.

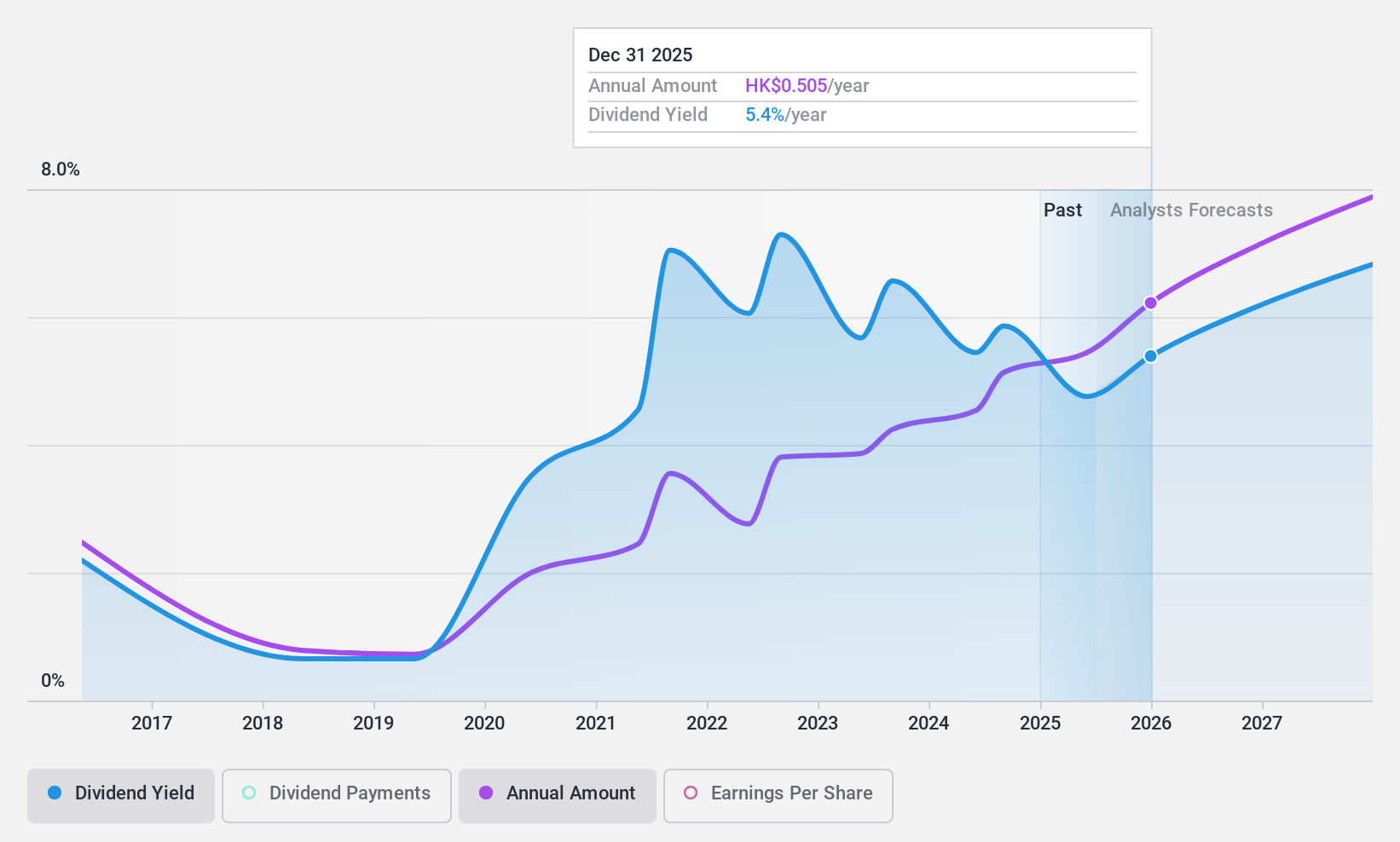

Dividend Yield: 5.2%

China Unicom (Hong Kong) reported strong earnings growth with net income rising to CNY 19.03 billion for the nine months ended September 2024. Its dividend payout is covered by both earnings and cash flows, with a payout ratio of 56.9% and cash payout ratio of 68%. However, its dividend history has been volatile and unreliable over the past decade, despite recent increases in payouts. The stock trades at a discount relative to its estimated fair value, offering potential value for investors.

- Click here and access our complete dividend analysis report to understand the dynamics of China Unicom (Hong Kong).

- The valuation report we've compiled suggests that China Unicom (Hong Kong)'s current price could be quite moderate.

Yamabiko (TSE:6250)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Yamabiko Corporation, along with its subsidiaries, manufactures and sells agricultural machinery across Japan, Europe, the United States, and other international markets with a market cap of ¥108.12 billion.

Operations: The company generates revenue from the manufacturing and sale of agricultural machinery in Japan, Europe, the United States, and various international markets.

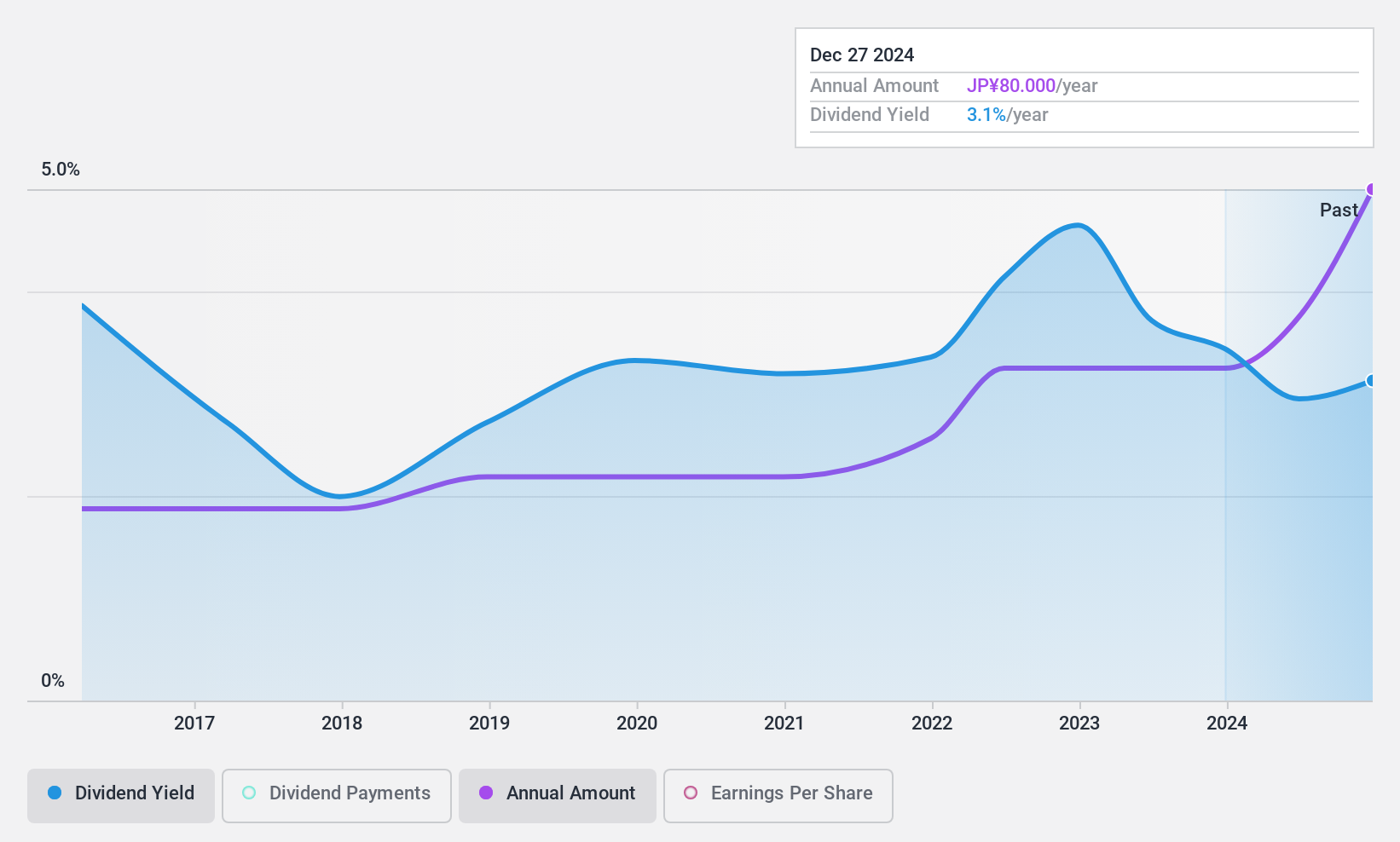

Dividend Yield: 3%

Yamabiko Corporation's dividends have been stable and reliable over the past decade, with consistent growth and a payout ratio of 31.6%, indicating sustainability. The dividend yield of 3.04% is lower than the top quartile in Japan but remains attractive given its coverage by earnings and cash flows, evidenced by a cash payout ratio of 48.6%. The company projects strong financial performance for 2024, with expected net sales of ¥162 billion and operating profit of ¥18.5 billion, supporting continued dividend payments.

- Unlock comprehensive insights into our analysis of Yamabiko stock in this dividend report.

- Upon reviewing our latest valuation report, Yamabiko's share price might be too optimistic.

Oiles (TSE:6282)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Oiles Corporation manufactures and sells bearings, structural equipment, and construction equipment in Japan and internationally, with a market cap of ¥75.54 billion.

Operations: Oiles Corporation generates revenue through its segments, with ¥13.82 billion from Structural Equipment, ¥6.20 billion from Construction Equipment, ¥14.48 billion from General Bearing Equipment, and ¥33.76 billion from Automotive Bearing Equipment.

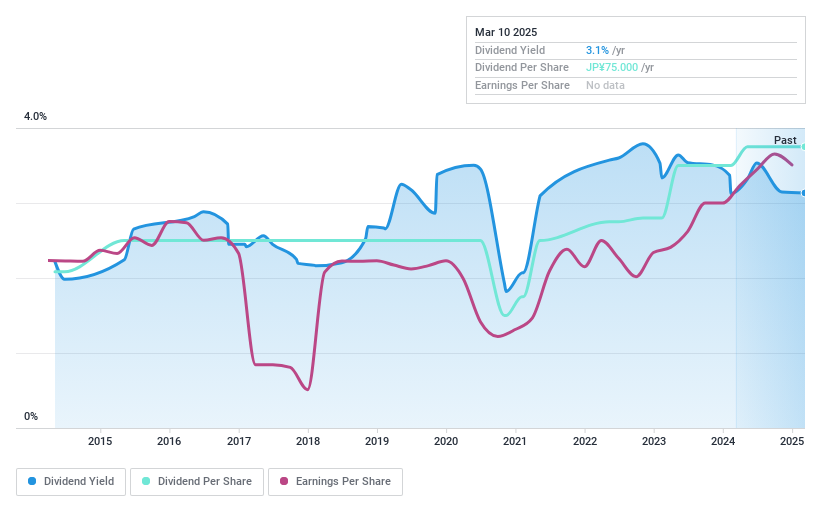

Dividend Yield: 3%

Oiles Corporation's dividend payments have been volatile over the past decade, despite being well covered by earnings and cash flows with payout ratios of 38.3% and 36.2%, respectively. The company recently announced a share buyback program to enhance shareholder returns, repurchasing up to ¥2 billion worth of shares. Revised earnings guidance indicates improved profitability, supporting future dividends, although the current yield of 3.02% is below Japan's top quartile for dividend payers.

- Navigate through the intricacies of Oiles with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Oiles is priced higher than what may be justified by its financials.

Taking Advantage

- Click this link to deep-dive into the 1831 companies within our Top Dividend Stocks screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6250

Yamabiko

Manufactures and sells agricultural machinery in Japan, Europe, the United States, and internationally.

Flawless balance sheet with solid track record and pays a dividend.