- Hong Kong

- /

- Telecom Services and Carriers

- /

- SEHK:1883

CITIC Telecom International Holdings Limited's (HKG:1883) Fundamentals Look Pretty Strong: Could The Market Be Wrong About The Stock?

CITIC Telecom International Holdings (HKG:1883) has had a rough three months with its share price down 6.3%. But if you pay close attention, you might gather that its strong financials could mean that the stock could potentially see an increase in value in the long-term, given how markets usually reward companies with good financial health. Particularly, we will be paying attention to CITIC Telecom International Holdings' ROE today.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

See our latest analysis for CITIC Telecom International Holdings

How To Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for CITIC Telecom International Holdings is:

11% = HK$1.0b ÷ HK$9.4b (Based on the trailing twelve months to June 2020).

The 'return' is the amount earned after tax over the last twelve months. One way to conceptualize this is that for each HK$1 of shareholders' capital it has, the company made HK$0.11 in profit.

Why Is ROE Important For Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

A Side By Side comparison of CITIC Telecom International Holdings' Earnings Growth And 11% ROE

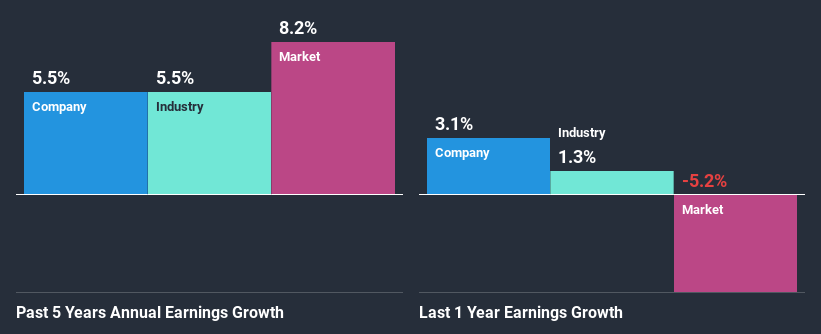

To start with, CITIC Telecom International Holdings' ROE looks acceptable. Further, the company's ROE compares quite favorably to the industry average of 3.8%. This probably laid the ground for CITIC Telecom International Holdings' moderate 5.5% net income growth seen over the past five years.

We then performed a comparison between CITIC Telecom International Holdings' net income growth with the industry, which revealed that the company's growth is similar to the average industry growth of 5.5% in the same period.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. If you're wondering about CITIC Telecom International Holdings''s valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is CITIC Telecom International Holdings Efficiently Re-investing Its Profits?

CITIC Telecom International Holdings has a significant three-year median payout ratio of 67%, meaning that it is left with only 33% to reinvest into its business. This implies that the company has been able to achieve decent earnings growth despite returning most of its profits to shareholders.

Additionally, CITIC Telecom International Holdings has paid dividends over a period of at least ten years which means that the company is pretty serious about sharing its profits with shareholders. Upon studying the latest analysts' consensus data, we found that the company is expected to keep paying out approximately 74% of its profits over the next three years. Accordingly, forecasts suggest that CITIC Telecom International Holdings' future ROE will be 11% which is again, similar to the current ROE.

Conclusion

In total, we are pretty happy with CITIC Telecom International Holdings' performance. We are particularly impressed by the considerable earnings growth posted by the company, which was likely backed by its high ROE. While the company is paying out most of its earnings as dividends, it has been able to grow its earnings in spite of it, so that's probably a good sign. We also studied the latest analyst forecasts and found that the company's earnings growth is expected be similar to its current growth rate. To know more about the company's future earnings growth forecasts take a look at this free report on analyst forecasts for the company to find out more.

If you decide to trade CITIC Telecom International Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:1883

CITIC Telecom International Holdings

An investment holding company, engages in the provision of international telecommunications services in Hong Kong, China, Macau, Singapore, and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives