- Hong Kong

- /

- Telecom Services and Carriers

- /

- SEHK:1883

CITIC Telecom International Holdings (HKG:1883) Seems To Use Debt Quite Sensibly

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that CITIC Telecom International Holdings Limited (HKG:1883) does use debt in its business. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for CITIC Telecom International Holdings

What Is CITIC Telecom International Holdings's Debt?

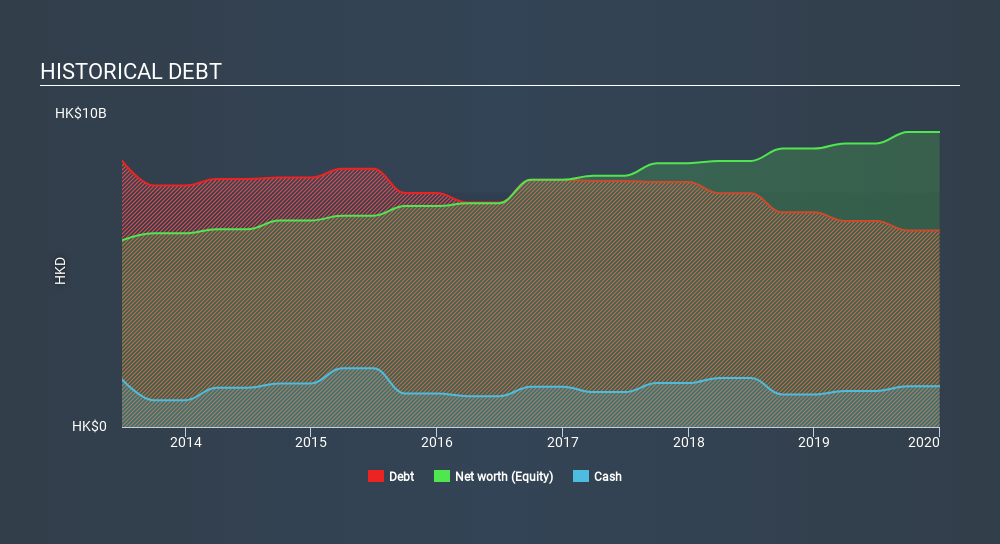

The image below, which you can click on for greater detail, shows that CITIC Telecom International Holdings had debt of HK$6.28b at the end of December 2019, a reduction from HK$6.86b over a year. However, it also had HK$1.30b in cash, and so its net debt is HK$4.97b.

How Healthy Is CITIC Telecom International Holdings's Balance Sheet?

We can see from the most recent balance sheet that CITIC Telecom International Holdings had liabilities of HK$2.26b falling due within a year, and liabilities of HK$6.70b due beyond that. On the other hand, it had cash of HK$1.30b and HK$1.83b worth of receivables due within a year. So it has liabilities totalling HK$5.83b more than its cash and near-term receivables, combined.

While this might seem like a lot, it is not so bad since CITIC Telecom International Holdings has a market capitalization of HK$10.1b, and so it could probably strengthen its balance sheet by raising capital if it needed to. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

CITIC Telecom International Holdings's net debt is sitting at a very reasonable 2.2 times its EBITDA, while its EBIT covered its interest expense just 5.1 times last year. While that doesn't worry us too much, it does suggest the interest payments are somewhat of a burden. CITIC Telecom International Holdings grew its EBIT by 6.5% in the last year. Whilst that hardly knocks our socks off it is a positive when it comes to debt. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if CITIC Telecom International Holdings can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we always check how much of that EBIT is translated into free cash flow. Happily for any shareholders, CITIC Telecom International Holdings actually produced more free cash flow than EBIT over the last three years. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

On our analysis CITIC Telecom International Holdings's conversion of EBIT to free cash flow should signal that it won't have too much trouble with its debt. However, our other observations weren't so heartening. For instance it seems like it has to struggle a bit to handle its total liabilities. Considering this range of data points, we think CITIC Telecom International Holdings is in a good position to manage its debt levels. But a word of caution: we think debt levels are high enough to justify ongoing monitoring. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should be aware of the 2 warning signs we've spotted with CITIC Telecom International Holdings .

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SEHK:1883

CITIC Telecom International Holdings

An investment holding company, engages in the provision of international telecommunications services in Hong Kong, China, Macau, Singapore, and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives