- Hong Kong

- /

- Tech Hardware

- /

- SEHK:992

What Lenovo Group (SEHK:992)'s AI Networking Upgrade Means for Shareholders

Reviewed by Sasha Jovanovic

- In a recent announcement, Cornelis revealed that its CN5000 Omni-Path networking solution has been successfully qualified and integrated into Lenovo’s ThinkSystem V3 and V4 servers, now supporting Lenovo’s EveryScale Solution for high-performance AI and HPC workloads.

- This integration is designed to eliminate network bottlenecks and deliver ultra-low latency, potentially strengthening Lenovo’s position in the competitive AI and technical computing infrastructure market.

- Let’s explore how the enhanced AI and HPC networking capabilities from the Cornelis CN5000 integration could influence Lenovo’s investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Lenovo Group Investment Narrative Recap

To believe in Lenovo Group as a shareholder, you’d need confidence that its focus on expanding AI and high-performance computing (HPC) infrastructure, exemplified by the Cornelis CN5000 integration, will translate into operating leverage and margin improvement. While this innovation could strengthen Lenovo’s Infrastructure Solutions Group and improve its competitive standing in AI infrastructure, the group's sustained R&D investment remains a key short-term risk if these newer offerings do not scale quickly enough to offset operating losses and margin pressure.

Of the company’s recent announcements, the October 2025 launch of the ThinkCentre PCs with AMD Ryzen AI processors stands out for investors. Like the Cornelis partnership, it underscores Lenovo’s push to capture value in AI-enabled hardware, directly supporting the catalyst of rising adoption of AI workloads in enterprise computing and complementing efforts to diversify beyond traditional PCs.

Yet even as innovation accelerates, investors should also be aware of concentrated manufacturing risks outside China, where higher costs from supply chain shifts could...

Read the full narrative on Lenovo Group (it's free!)

Lenovo Group's outlook anticipates $88.5 billion in revenue and $2.1 billion in earnings by 2028. This implies a 6.9% annual revenue growth rate and a $0.5 billion increase in earnings from the current $1.6 billion level.

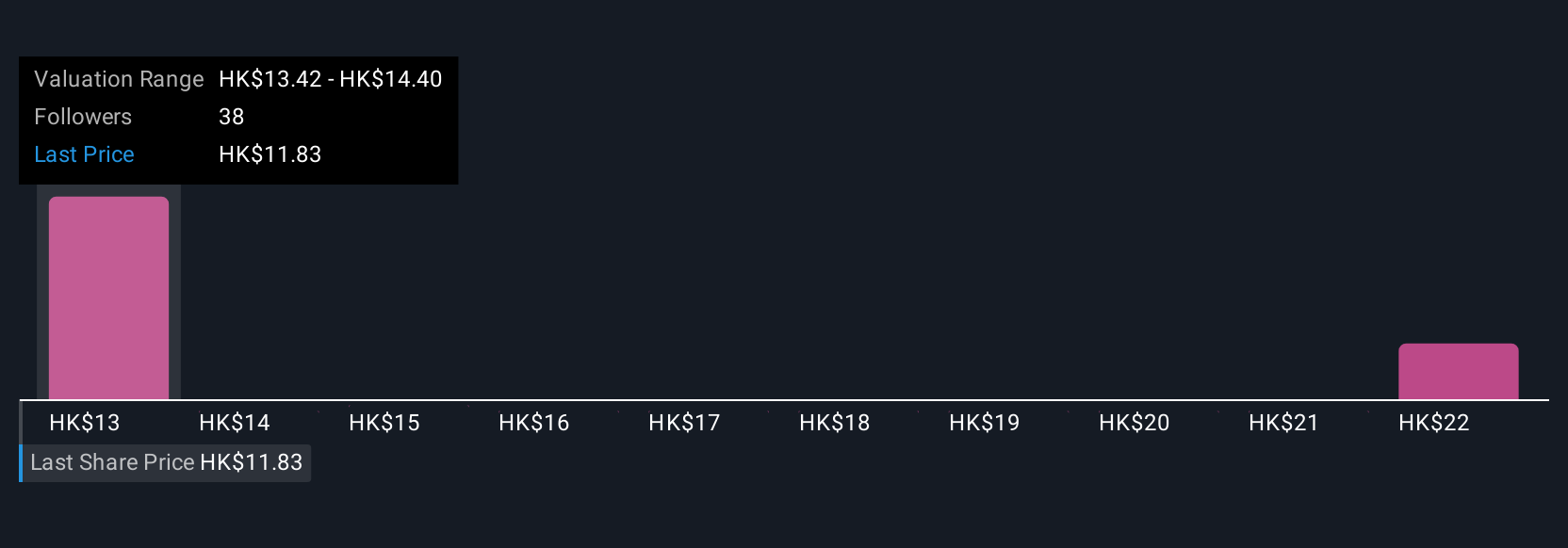

Uncover how Lenovo Group's forecasts yield a HK$13.56 fair value, a 23% upside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community span HK$10.03 to HK$22.73 (5 perspectives), with many seeing strong upside. Ongoing investment in AI infrastructure may impact margins and long-term profitability, so weighing these views can help you see how opinions vary on Lenovo’s future.

Explore 5 other fair value estimates on Lenovo Group - why the stock might be worth 9% less than the current price!

Build Your Own Lenovo Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lenovo Group research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Lenovo Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lenovo Group's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:992

Lenovo Group

An investment holding company, develops, manufactures, and markets technology products and services.

Very undervalued with outstanding track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives