- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:8070

Keen Ocean International Holding Limited (HKG:8070) Soars 52% But It's A Story Of Risk Vs Reward

The Keen Ocean International Holding Limited (HKG:8070) share price has done very well over the last month, posting an excellent gain of 52%. The last month tops off a massive increase of 115% in the last year.

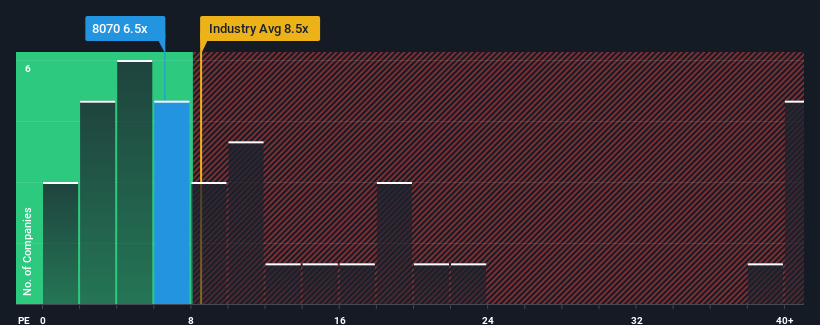

In spite of the firm bounce in price, Keen Ocean International Holding may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 6.5x, since almost half of all companies in Hong Kong have P/E ratios greater than 11x and even P/E's higher than 20x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

For instance, Keen Ocean International Holding's receding earnings in recent times would have to be some food for thought. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Keen Ocean International Holding

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Keen Ocean International Holding's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 21%. Still, the latest three year period has seen an excellent 94% overall rise in EPS, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 21% shows it's noticeably more attractive on an annualised basis.

In light of this, it's peculiar that Keen Ocean International Holding's P/E sits below the majority of other companies. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Final Word

Keen Ocean International Holding's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Keen Ocean International Holding currently trades on a much lower than expected P/E since its recent three-year growth is higher than the wider market forecast. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low if recent medium-term earnings trends continue, but investors seem to think future earnings could see a lot of volatility.

Before you take the next step, you should know about the 2 warning signs for Keen Ocean International Holding that we have uncovered.

Of course, you might also be able to find a better stock than Keen Ocean International Holding. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Keen Ocean International Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8070

Keen Ocean International Holding

An investment holding company, designs, develops, manufactures, and sells transformers, switching mode power supplies, electronic parts and components, and electric healthcare products in Hong Kong and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives