- Hong Kong

- /

- Communications

- /

- SEHK:8043

Investors Who Bought Atlinks Group (HKG:8043) Shares A Year Ago Are Now Down 56%

Investing in stocks comes with the risk that the share price will fall. Anyone who held Atlinks Group Limited (HKG:8043) over the last year knows what a loser feels like. To wit the share price is down 56% in that time. Atlinks Group hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. The silver lining is that the stock is up 2.0% in about a week.

Check out our latest analysis for Atlinks Group

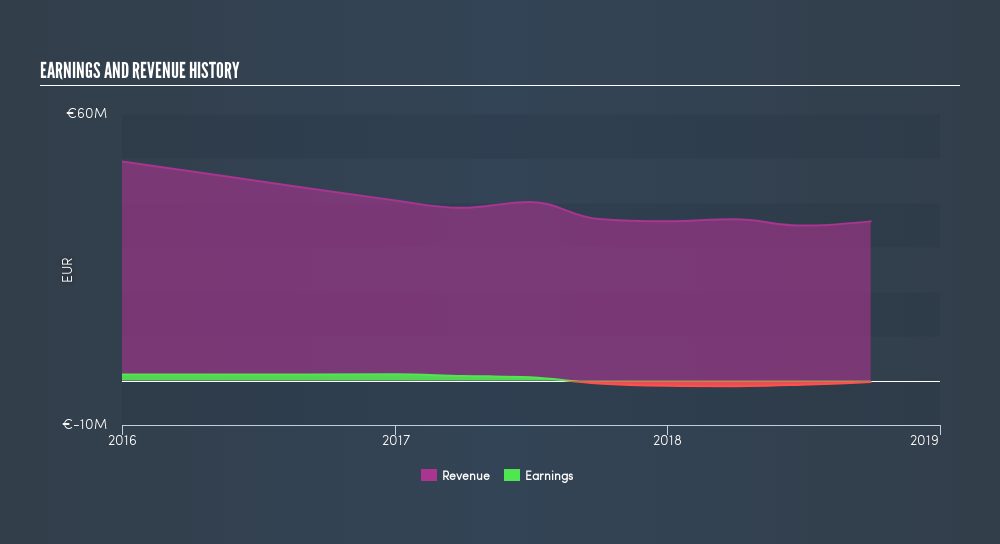

Because Atlinks Group is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In just one year Atlinks Group saw its revenue fall by 1.5%. That's not what investors generally want to see. In the absence of profits, it's not unreasonable that the share price fell 56%. Having said that, if growth is coming in the future now may be the low ebb for the company. We have a natural aversion to companies that are losing money, not growing revenue, and losing favour with the market. But perhaps we shouldn't.

The graphic below shows how revenue and earnings have changed as management guided the business forward. If you want to see cashflow, you can click on the chart.

You can see how its balance sheet has strengthened (or weakened) over time in this freeinteractive graphic.

A Different Perspective

Atlinks Group shareholders are down 56% for the year, even worse than the market loss of 6.0%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. With the stock down 5.7% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

If you are like me, then you will not want to miss this freelist of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SEHK:8043

Atlinks Group

An investment holding company, designs, develops, and sells home and office telecommunication products through consumer retail chain stores, telecom operators, and distributors worldwide.

Good value slight.

Similar Companies

Market Insights

Community Narratives