- Hong Kong

- /

- Communications

- /

- SEHK:6869

Yangtze Optical Fibre And Cable Joint Stock Limited Company's (HKG:6869) 27% Price Boost Is Out Of Tune With Earnings

The Yangtze Optical Fibre And Cable Joint Stock Limited Company (HKG:6869) share price has done very well over the last month, posting an excellent gain of 27%. The last month tops off a massive increase of 160% in the last year.

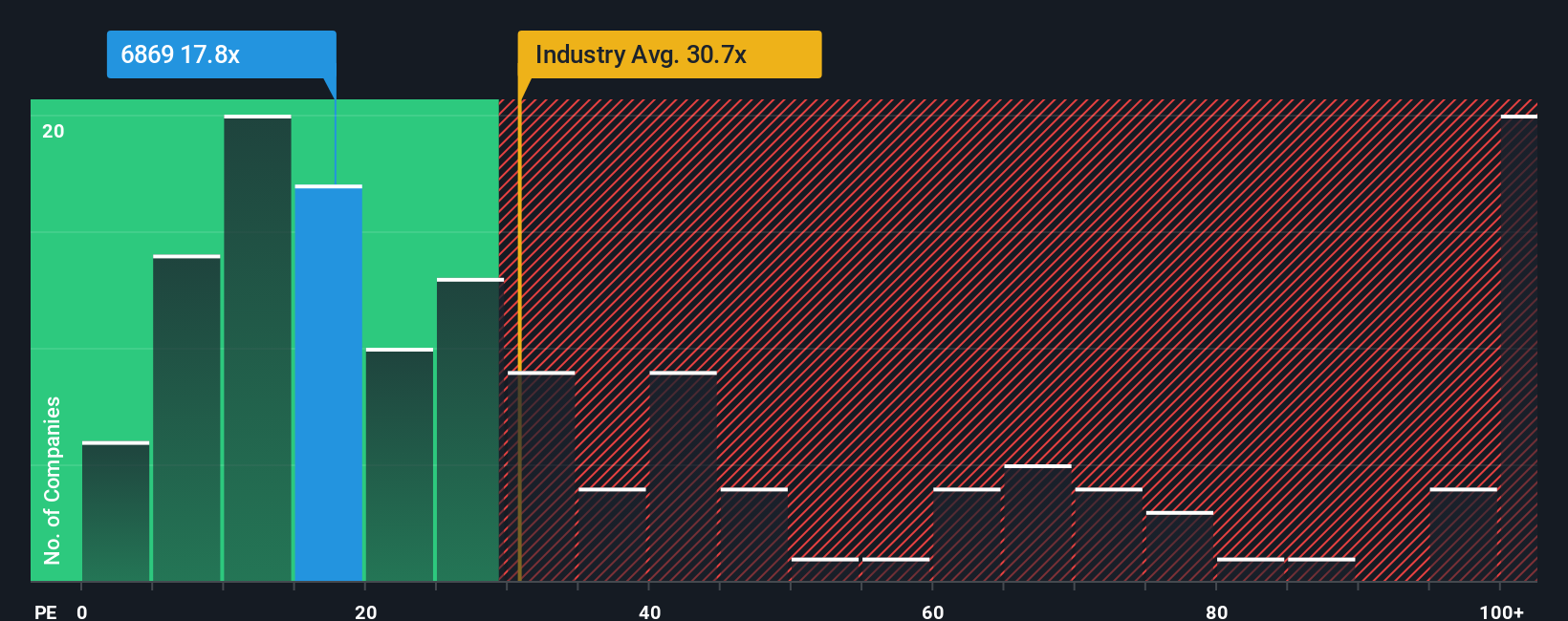

Since its price has surged higher, Yangtze Optical Fibre And Cable Limited's price-to-earnings (or "P/E") ratio of 17.8x might make it look like a strong sell right now compared to the market in Hong Kong, where around half of the companies have P/E ratios below 11x and even P/E's below 6x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

While the market has experienced earnings growth lately, Yangtze Optical Fibre And Cable Limited's earnings have gone into reverse gear, which is not great. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Check out our latest analysis for Yangtze Optical Fibre And Cable Limited

Is There Enough Growth For Yangtze Optical Fibre And Cable Limited?

In order to justify its P/E ratio, Yangtze Optical Fibre And Cable Limited would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 32%. As a result, earnings from three years ago have also fallen 7.3% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the five analysts covering the company suggest earnings should grow by 15% per annum over the next three years. With the market predicted to deliver 14% growth per annum, the company is positioned for a comparable earnings result.

In light of this, it's curious that Yangtze Optical Fibre And Cable Limited's P/E sits above the majority of other companies. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/E falls to levels more in line with the growth outlook.

The Bottom Line On Yangtze Optical Fibre And Cable Limited's P/E

The strong share price surge has got Yangtze Optical Fibre And Cable Limited's P/E rushing to great heights as well. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Yangtze Optical Fibre And Cable Limited's analyst forecasts revealed that its market-matching earnings outlook isn't impacting its high P/E as much as we would have predicted. Right now we are uncomfortable with the relatively high share price as the predicted future earnings aren't likely to support such positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Yangtze Optical Fibre And Cable Limited you should know about.

If these risks are making you reconsider your opinion on Yangtze Optical Fibre And Cable Limited, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6869

Yangtze Optical Fibre And Cable Limited

Engages in the production and sale of optical fiber preforms rods, optical fiber, and optical fiber cables in China and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026