I Ran A Stock Scan For Earnings Growth And K & P International Holdings (HKG:675) Passed With Ease

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In contrast to all that, I prefer to spend time on companies like K & P International Holdings (HKG:675), which has not only revenues, but also profits. While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

See our latest analysis for K & P International Holdings

How Fast Is K & P International Holdings Growing Its Earnings Per Share?

In business, though not in life, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS). So like the hint of a smile on a face that I love, growing EPS generally makes me look twice. It is therefore awe-striking that K & P International Holdings's EPS went from HK$0.066 to HK$0.25 in just one year. Even though that growth rate is unlikely to be repeated, that looks like a breakout improvement.

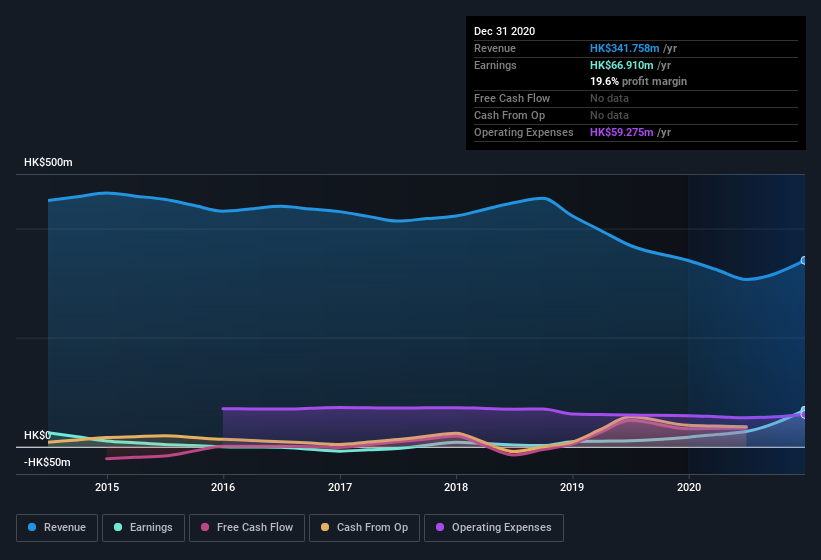

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. This approach makes K & P International Holdings look pretty good, on balance; although revenue is flattish, EBIT margins improved from 5.3% to 14% in the last year. That's something to smile about.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

K & P International Holdings isn't a huge company, given its market capitalization of HK$230m. That makes it extra important to check on its balance sheet strength.

Are K & P International Holdings Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

The first bit of good news is that no K & P International Holdings insiders reported share sales in the last twelve months. Even better, though, is that the Founder, Pei Lai, bought a whopping HK$2.9m worth of shares, paying about HK$0.55 per share, on average. Big buys like that give me a sense of opportunity; actions speak louder than words.

And the insider buying isn't the only sign of alignment between shareholders and the board, since K & P International Holdings insiders own more than a third of the company. Actually, with 47% of the company to their names, insiders are profoundly invested in the business. I'm reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. Valued at only HK$230m K & P International Holdings is really small for a listed company. So despite a large proportional holding, insiders only have HK$108m worth of stock. That might not be a huge sum but it should be enough to keep insiders motivated!

Is K & P International Holdings Worth Keeping An Eye On?

K & P International Holdings's earnings have taken off like any random crypto-currency did, back in 2017. The incing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. Because of the potential that it has reached an inflection point, I'd suggest K & P International Holdings belongs on the top of your watchlist. Before you take the next step you should know about the 4 warning signs for K & P International Holdings that we have uncovered.

The good news is that K & P International Holdings is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade K & P International Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if K & P International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:675

K & P International Holdings

An investment holding company, manufactures and sells precision parts and components in Hong Kong, Mainland China, Japan and other Asian countries, North America, South America, Europe, and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026