As global markets navigate a landscape marked by record highs in major indexes like the S&P 500 and Nasdaq Composite, contrasted with declines in the Russell 2000, growth stocks have notably outperformed their value counterparts. In this environment of mixed economic indicators and geopolitical developments, identifying high-growth tech stocks involves focusing on companies that demonstrate strong innovation potential and resilience amidst market fluctuations.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 24.68% | 97.53% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1289 stocks from our High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Pharma Mar (BME:PHM)

Simply Wall St Growth Rating: ★★★★★★

Overview: Pharma Mar, S.A. is a biopharmaceutical company focused on the research, development, production, and commercialization of bio-active principles for oncology across various international markets with a market cap of approximately €1.38 billion.

Operations: The company generates revenue primarily from its oncology segment, amounting to €154.75 million. It operates across various international markets, including key regions such as Spain, Italy, Germany, and the United States.

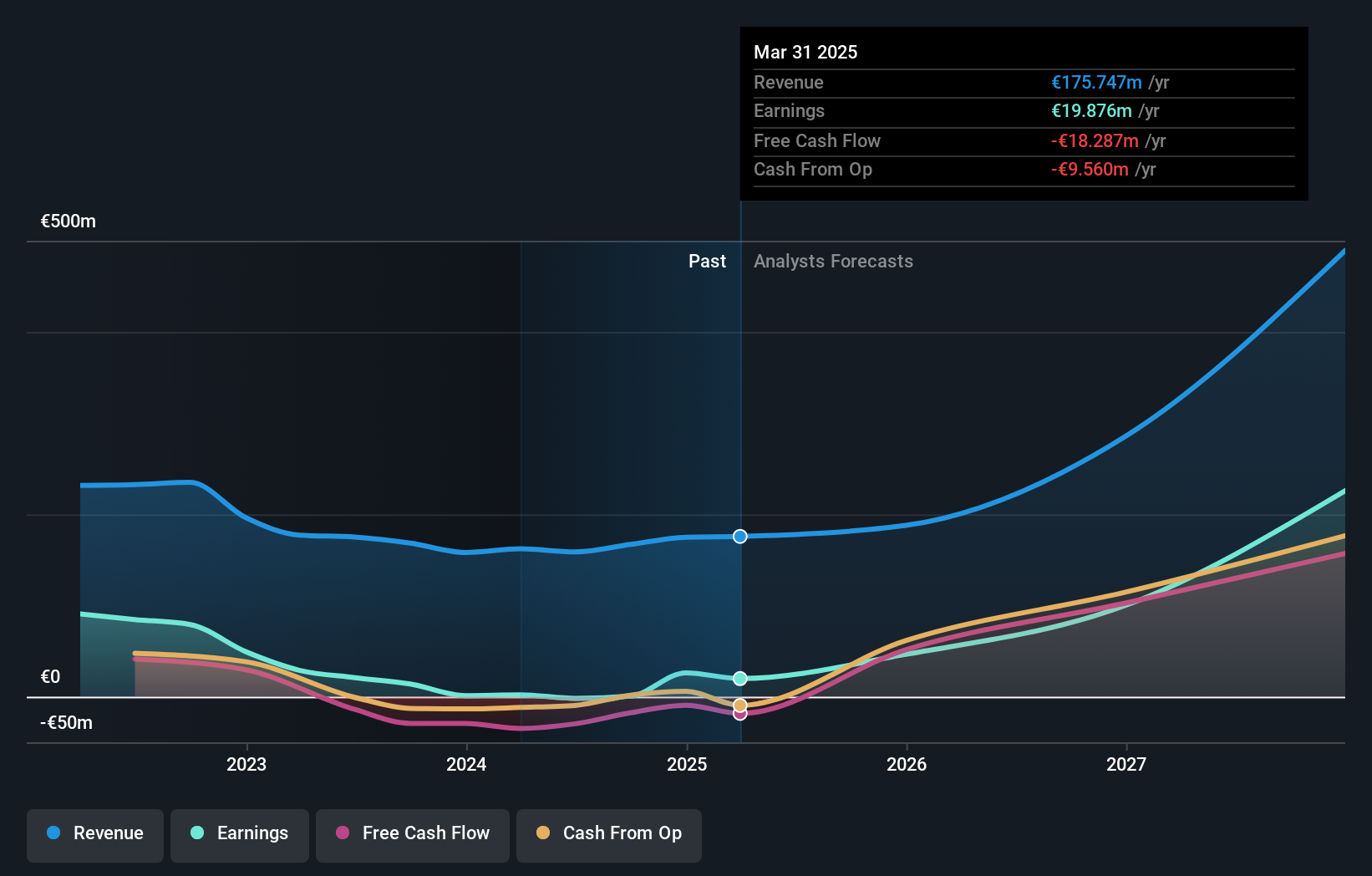

Pharma Mar's recent advancements and financial outcomes underscore its dynamic role in the high-growth tech landscape, particularly within biotechnology. Despite a slight dip in sales to EUR 57.02 million from EUR 60.09 million year-over-year, the company showcased a robust increase in overall revenue, rising to EUR 126.49 million from EUR 117.64 million due to strategic initiatives and product developments like Zepzelca®. This drug, pivotal in treating Small Cell Lung Cancer, marked significant clinical success, potentially boosting Pharma Mar's market presence upon European approval expected by mid-2025. Moreover, Pharma Mar's R&D commitment is evident as it navigates through challenging industry dynamics where innovation is crucial for survival and growth. The firm’s projected annual revenue growth at an impressive rate of 25.4% surpasses the broader Spanish market forecast of just 4.9%. Additionally, earnings are expected to surge by approximately 56.2% annually—a reflection of both aggressive research endeavors and strategic market positioning which may well set Pharma Mar apart despite its current low profit margins of only 0.4%, signaling potential for future financial health improvement.

FIT Hon Teng (SEHK:6088)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: FIT Hon Teng Limited is a company that manufactures and sells mobile and wireless devices and connectors, operating both in Taiwan and internationally, with a market capitalization of approximately HK$24.44 billion.

Operations: FIT Hon Teng generates revenue primarily from consumer products and intermediate products, with the latter contributing significantly more at $3.94 billion compared to $690.95 million for consumer products. The company operates internationally, focusing on the manufacturing and sale of mobile and wireless devices and connectors.

FIT Hon Teng's recent unveiling of AI data center connectivity and immersion-cooling technologies at the 2024 OCP Global Summit marks a significant stride in addressing the complex challenges of modern AI-driven infrastructures. These innovations, crucial for enhancing signal integrity and managing heat dissipation in high-density environments, reflect FIT's proactive approach to capturing growth opportunities within tech sectors reliant on advanced data handling capabilities. Financially, FIT is poised for robust expansion with an anticipated earnings growth of 30.8% annually, outpacing the Hong Kong market's forecasted 11.4%. This projection aligns with their R&D commitment which has significantly contributed to a remarkable past year earnings increase of 125.6%, showcasing their ability to not only innovate but also effectively translate these advancements into financial success.

- Click here and access our complete health analysis report to understand the dynamics of FIT Hon Teng.

Gain insights into FIT Hon Teng's historical performance by reviewing our past performance report.

JMDC (TSE:4483)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: JMDC Inc. is a Japanese company specializing in medical statistics data services, with a market capitalization of ¥267.38 billion.

Operations: The company generates revenue primarily through its Healthcare-Big Data segment, which contributes ¥30.74 billion, complemented by Tele-Medicine and Pharmacy Support services at ¥5.90 billion and ¥1.25 billion respectively.

With a forecasted annual earnings growth of 24.8%, JMDC is positioned to outperform the broader Japanese market's growth rate of 7.9%. This robust projection is underpinned by significant R&D investments, which have risen to represent a substantial portion of revenue, aligning with industry trends towards more intensive innovation cycles. Particularly noteworthy is JMDC’s strategic focus on developing proprietary technologies, which not only enhances its competitive edge but also drives higher revenue growth at an impressive rate of 17.6% annually. These financial and strategic maneuvers suggest JMDC's strong potential in navigating the tech landscape effectively, despite facing challenges like fluctuating profit margins year-over-year.

- Delve into the full analysis health report here for a deeper understanding of JMDC.

Examine JMDC's past performance report to understand how it has performed in the past.

Next Steps

- Discover the full array of 1289 High Growth Tech and AI Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:PHM

Pharma Mar

A biopharmaceutical company, engages in the research, development, production, and commercialization of bio-active principles for the use in oncology in Spain, Italy, Germany, Ireland, France, rest of the European Union, the United States, and internationally.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives