- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:6088

Exploring Three High Growth Tech Stocks In Hong Kong

Reviewed by Simply Wall St

As global markets experience fluctuations, with Chinese equities recently declining and the Hang Seng Index falling significantly, investors are keenly observing how Hong Kong's tech sector might respond amidst these dynamics. In this environment, identifying high-growth tech stocks can involve looking for companies that demonstrate resilience and innovation in the face of economic challenges, offering potential opportunities for growth despite broader market sentiment.

Top 10 High Growth Tech Companies In Hong Kong

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Wasion Holdings | 22.37% | 25.47% | ★★★★★☆ |

| MedSci Healthcare Holdings | 48.74% | 48.78% | ★★★★★☆ |

| Inspur Digital Enterprise Technology | 25.31% | 39.04% | ★★★★★☆ |

| RemeGen | 26.30% | 52.19% | ★★★★★☆ |

| Innovent Biologics | 21.80% | 59.60% | ★★★★★☆ |

| Akeso | 33.44% | 53.00% | ★★★★★★ |

| Cowell e Holdings | 31.68% | 35.44% | ★★★★★★ |

| Biocytogen Pharmaceuticals (Beijing) | 21.53% | 109.17% | ★★★★★☆ |

| Beijing Airdoc Technology | 37.47% | 93.35% | ★★★★★☆ |

| Sichuan Kelun-Biotech Biopharmaceutical | 24.70% | 8.53% | ★★★★★☆ |

Click here to see the full list of 43 stocks from our SEHK High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Cowell e Holdings (SEHK:1415)

Simply Wall St Growth Rating: ★★★★★★

Overview: Cowell e Holdings Inc. is an investment holding company that designs, develops, manufactures, trades in, and sells optical modules and systems integration products for smartphones, multimedia tablets, smart driving, and other mobile devices across various international markets with a market cap of approximately HK$20.22 billion.

Operations: Cowell e Holdings generates revenue primarily from its photographic equipment and supplies segment, amounting to $1.14 billion. The company operates in the People’s Republic of China, India, the Republic of Korea, and other international markets.

Cowell e Holdings, amidst a challenging landscape, demonstrated resilience with a significant sales increase to USD 585.93 million from USD 366.73 million year-over-year. Despite this growth, net income slightly decreased to USD 16.04 million from USD 18.03 million, reflecting a complex operational environment but underscoring the company's capacity to generate revenue under pressure. Notably, the firm is positioned for robust future growth with expected annual revenue and earnings expansions at rates of 31.7% and 35.4%, respectively—outpacing broader Hong Kong market projections significantly. These figures suggest strategic R&D investments are likely underway to foster innovation and maintain competitive advantage in its sector.

Plover Bay Technologies (SEHK:1523)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Plover Bay Technologies Limited is an investment holding company that designs, develops, and markets software-defined wide area network routers with a market capitalization of HK$5.22 billion.

Operations: The company's revenue primarily comes from the sales of software-defined wide area network routers, with mobile-first connectivity contributing $59.87 million and fixed-first connectivity adding $15.19 million. Additionally, software licenses and warranty and support services generate $31.86 million in revenue.

Plover Bay Technologies has demonstrated a robust growth trajectory, with a 28.4% increase in sales to USD 57.3 million and net income surging by 55% to USD 19.1 million for the first half of 2024, compared to the same period last year. This financial uplift is mirrored by strategic board enhancements aimed at bolstering corporate governance and intellectual property management, as evidenced by the recent appointment of Ms. Chiu Chi Ying as an executive director. The company's commitment to shareholder returns is also evident from its recent dividend announcement of HKD 0.1083 per share, underscoring its financial health and optimism about future prospects.

- Take a closer look at Plover Bay Technologies' potential here in our health report.

Assess Plover Bay Technologies' past performance with our detailed historical performance reports.

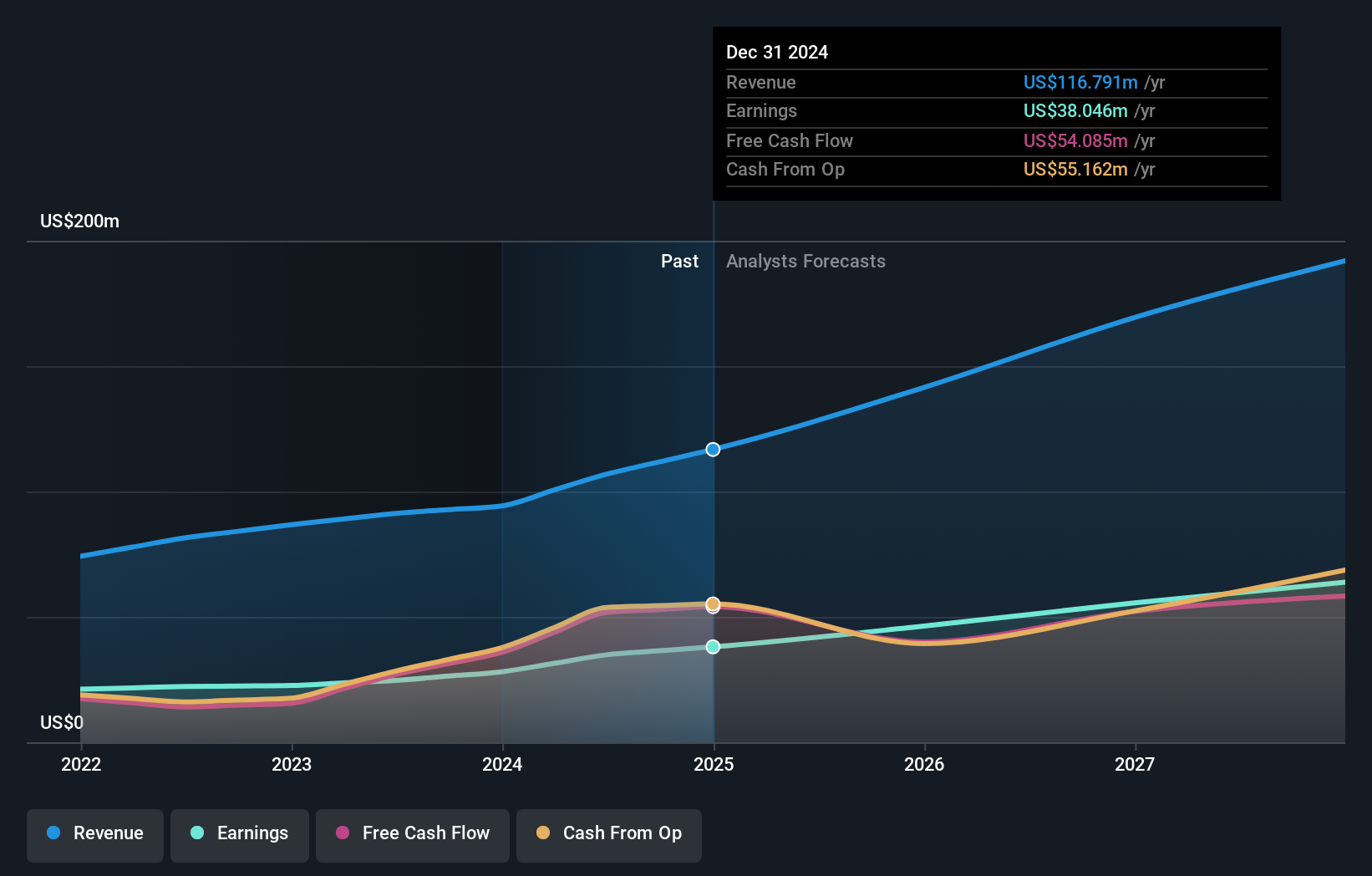

FIT Hon Teng (SEHK:6088)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: FIT Hon Teng Limited is a company that manufactures and sells mobile and wireless devices and connectors, operating both in Taiwan and internationally, with a market cap of HK$20.90 billion.

Operations: FIT Hon Teng Limited generates revenue primarily from intermediate products, contributing significantly more than consumer products. The company's market cap is approximately HK$20.90 billion.

FIT Hon Teng's recent performance underscores its potential in the high-growth tech sector of Hong Kong, with a notable increase in sales from USD 1.78 billion to USD 2.07 billion, reflecting an 18.4% growth year-over-year. This financial upswing is complemented by a shift from a net loss of USD 8.95 million to a net income of USD 32.52 million for the first half of 2024, illustrating significant recovery and operational improvement. The company's commitment to innovation is evident from its R&D expenses, which are crucial for sustaining long-term growth in the competitive tech landscape; however, specific figures on R&D spending were not disclosed in the latest reports. Looking ahead, earnings are expected to grow by an impressive 32.2% annually, positioning FIT Hon Teng well for future expansions and market competitiveness.

- Click to explore a detailed breakdown of our findings in FIT Hon Teng's health report.

Examine FIT Hon Teng's past performance report to understand how it has performed in the past.

Taking Advantage

- Explore the 43 names from our SEHK High Growth Tech and AI Stocks screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6088

FIT Hon Teng

Manufactures and sells mobile and wireless devices and connectors in Taiwan and internationally.

Excellent balance sheet and good value.