As global markets navigate through a period of fluctuating economic indicators, the Hong Kong stock market has seen its benchmark Hang Seng Index decline by over 2%, reflecting broader concerns about economic growth and deflationary pressures in China. In this environment, identifying undervalued stocks can be particularly appealing to investors looking for opportunities that might offer potential value gains once market conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows In Hong Kong

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| BYD Electronic (International) (SEHK:285) | HK$32.95 | HK$63.50 | 48.1% |

| Plover Bay Technologies (SEHK:1523) | HK$5.32 | HK$10.14 | 47.5% |

| Giant Biogene Holding (SEHK:2367) | HK$54.00 | HK$99.24 | 45.6% |

| Kuaishou Technology (SEHK:1024) | HK$45.25 | HK$88.40 | 48.8% |

| MicroPort NeuroScientific (SEHK:2172) | HK$9.79 | HK$18.85 | 48.1% |

| Hangzhou SF Intra-city Industrial (SEHK:9699) | HK$10.12 | HK$19.54 | 48.2% |

| Semiconductor Manufacturing International (SEHK:981) | HK$28.50 | HK$54.41 | 47.6% |

| Shanghai INT Medical Instruments (SEHK:1501) | HK$29.90 | HK$55.73 | 46.4% |

| CSC Financial (SEHK:6066) | HK$9.37 | HK$17.25 | 45.7% |

| Ming Yuan Cloud Group Holdings (SEHK:909) | HK$2.52 | HK$4.62 | 45.5% |

Here we highlight a subset of our preferred stocks from the screener.

MicroPort NeuroScientific (SEHK:2172)

Overview: MicroPort NeuroScientific Corporation focuses on the research, development, production, and sale of neuro-interventional medical devices in China and internationally, with a market cap of HK$5.68 billion.

Operations: The company generates revenue from its Surgical & Medical Equipment segment, amounting to CN¥774.66 million.

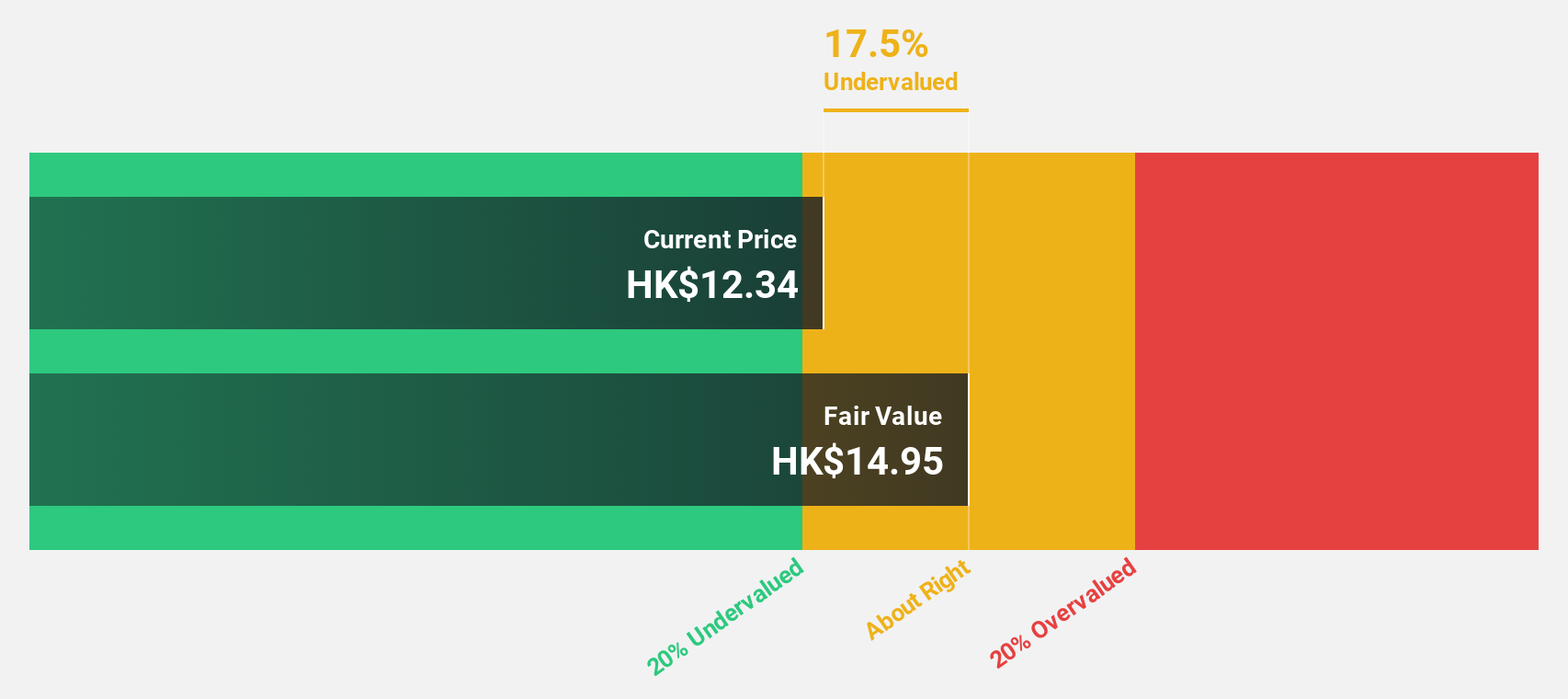

Estimated Discount To Fair Value: 48.1%

MicroPort NeuroScientific is trading at HK$9.79, significantly below its estimated fair value of HK$18.85, suggesting it may be undervalued based on discounted cash flow analysis. Earnings are forecast to grow 25.3% per year, outpacing the Hong Kong market's growth rate of 12.2%. Recent share repurchase plans worth HK$200 million could enhance earnings per share and net asset value, leveraging available cash reserves for strategic financial improvements.

- The analysis detailed in our MicroPort NeuroScientific growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of MicroPort NeuroScientific.

FIT Hon Teng (SEHK:6088)

Overview: FIT Hon Teng Limited manufactures and sells mobile and wireless devices and connectors in Taiwan and internationally, with a market cap of HK$20.33 billion.

Operations: The company's revenue segments include Consumer Products at $690.95 million and Intermediate Products at $3.94 billion.

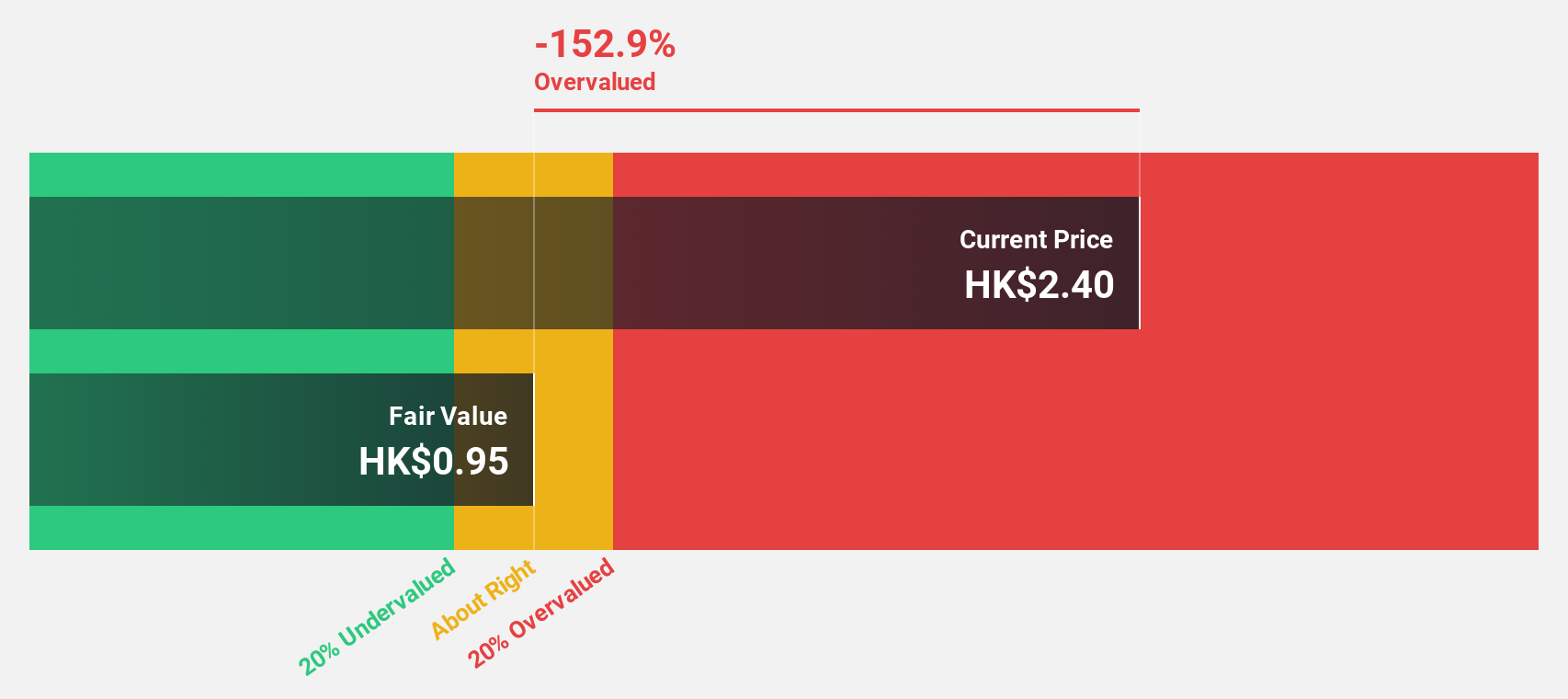

Estimated Discount To Fair Value: 36.7%

FIT Hon Teng, trading at HK$2.87, is considered undervalued with an estimated fair value of HK$4.53 based on discounted cash flow analysis. Recent earnings showed a significant turnaround, with net income reaching US$32.52 million from a previous loss, and revenue increasing to US$2.07 billion. Earnings are projected to grow 32.2% annually over the next three years, surpassing the Hong Kong market average growth rate of 12.2%.

- Our growth report here indicates FIT Hon Teng may be poised for an improving outlook.

- Get an in-depth perspective on FIT Hon Teng's balance sheet by reading our health report here.

Techtronic Industries (SEHK:669)

Overview: Techtronic Industries Company Limited designs, manufactures, and markets power tools, outdoor power equipment, and floorcare and cleaning products across North America, Europe, and internationally with a market cap of HK$206.52 billion.

Operations: The company's revenue is primarily derived from its Power Equipment segment, which generated $13.23 billion, and its Floorcare & Cleaning segment, which contributed $965.09 million.

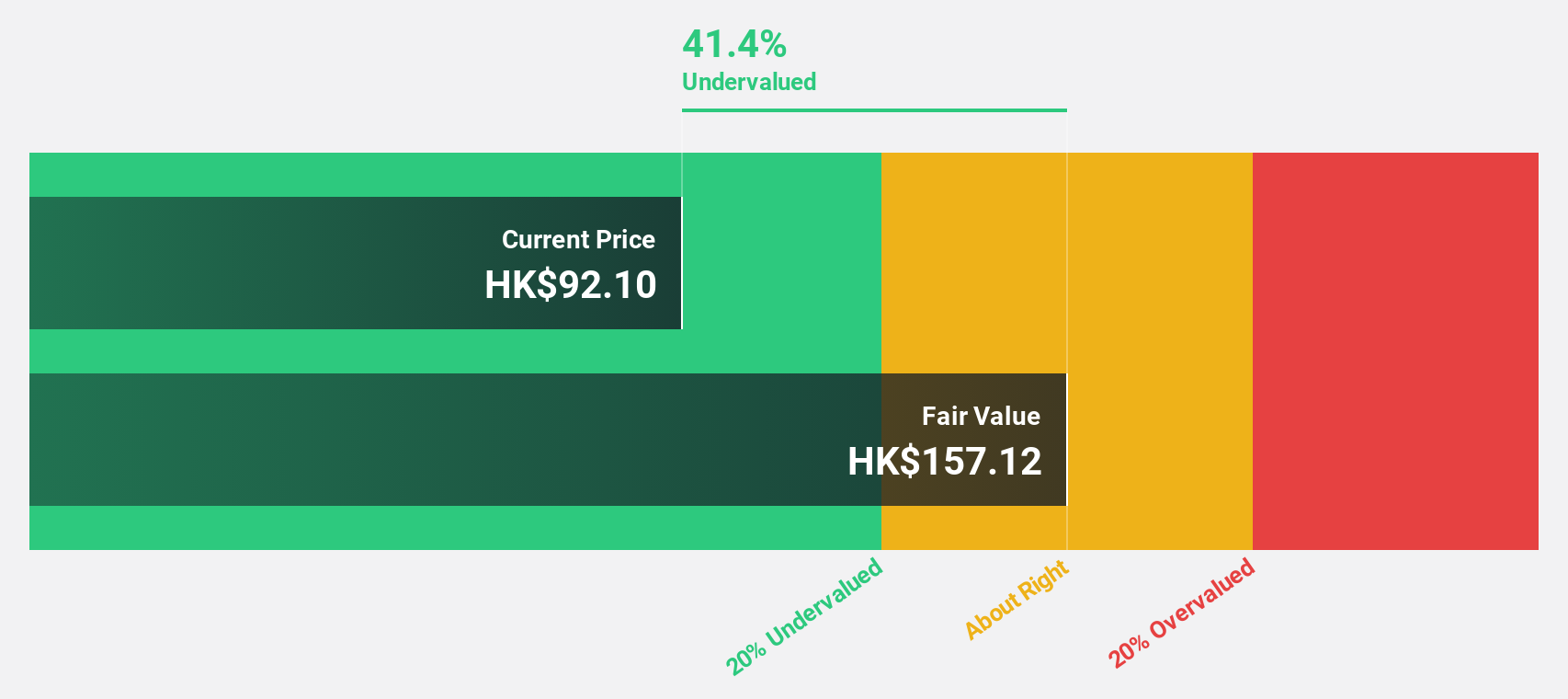

Estimated Discount To Fair Value: 23.9%

Techtronic Industries is trading at HK$112.7, significantly below its estimated fair value of HK$148.11, suggesting it may be undervalued based on cash flows. The company reported revenue of US$7.31 billion for the first half of 2024, with net income rising to US$550.37 million from the previous year. Earnings are forecast to grow 15.3% annually, outpacing the Hong Kong market's average growth rate of 12.2%.

- Our comprehensive growth report raises the possibility that Techtronic Industries is poised for substantial financial growth.

- Take a closer look at Techtronic Industries' balance sheet health here in our report.

Turning Ideas Into Actions

- Access the full spectrum of 38 Undervalued SEHK Stocks Based On Cash Flows by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Techtronic Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:669

Techtronic Industries

Engages in designing, manufacturing, and marketing of power tools, outdoor power equipment, and floorcare and cleaning products in the North America, Europe, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives