- China

- /

- Metals and Mining

- /

- SZSE:002578

Discover Global Penny Stocks: New Universe Environmental Group And 2 More Hidden Opportunities

Reviewed by Simply Wall St

As global markets navigate a landscape of steady interest rates and mixed economic signals, investors continue to assess opportunities across various sectors. Penny stocks, often associated with smaller or newer companies, remain a compelling area for those seeking growth potential outside the mainstream indices. Despite being considered an outdated term by some, penny stocks can still offer significant returns when backed by strong financial health. In this article, we explore three such stocks that combine balance sheet resilience with promising prospects in the current market environment.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.40 | SGD9.56B | ✅ 5 ⚠️ 0 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.75 | SEK281.19M | ✅ 4 ⚠️ 3 View Analysis > |

| NEXG Berhad (KLSE:DSONIC) | MYR0.255 | MYR709.45M | ✅ 4 ⚠️ 2 View Analysis > |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.51B | ✅ 5 ⚠️ 0 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.03 | HK$45.16B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.39 | HK$820.24M | ✅ 4 ⚠️ 1 View Analysis > |

| Next 15 Group (AIM:NFG) | £3.145 | £312.79M | ✅ 4 ⚠️ 5 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.59 | £408.34M | ✅ 4 ⚠️ 1 View Analysis > |

| QinetiQ Group (LSE:QQ.) | £4.032 | £2.23B | ✅ 5 ⚠️ 1 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.23 | A$148.52M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 5,736 stocks from our Global Penny Stocks screener.

Let's review some notable picks from our screened stocks.

New Universe Environmental Group (SEHK:436)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: New Universe Environmental Group Limited, with a market cap of HK$206.43 million, primarily offers environmental treatment and disposal services in the People's Republic of China.

Operations: The company generates revenue from two main segments: Environmental Waste Treatment and Disposal, excluding Environmental Equipment Construction and Installation, which contributes HK$224.25 million, and Environmental Sewage Treatment, Management Services, Utilities and Facilities, contributing HK$125.16 million.

Market Cap: HK$206.43M

New Universe Environmental Group, with a market cap of HK$206.43 million, has shown resilience despite being unprofitable. The company reported HK$349.42 million in sales for 2024, though net losses have persisted at HK$26.34 million, slightly improved from the previous year. Its operating cash flow comfortably covers its debt levels by a significant margin (126.1%), and it holds more cash than total debt, indicating financial prudence. The board and management are seasoned with long tenures averaging over eight years each, providing stability amidst high stock volatility and ongoing challenges in profitability improvement efforts.

- Take a closer look at New Universe Environmental Group's potential here in our financial health report.

- Gain insights into New Universe Environmental Group's historical outcomes by reviewing our past performance report.

SiS International Holdings (SEHK:529)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: SiS International Holdings Limited is an investment trading and holding company involved in the distribution of mobile and IT products across Hong Kong, Japan, Singapore, and Thailand, with a market cap of HK$464.20 million.

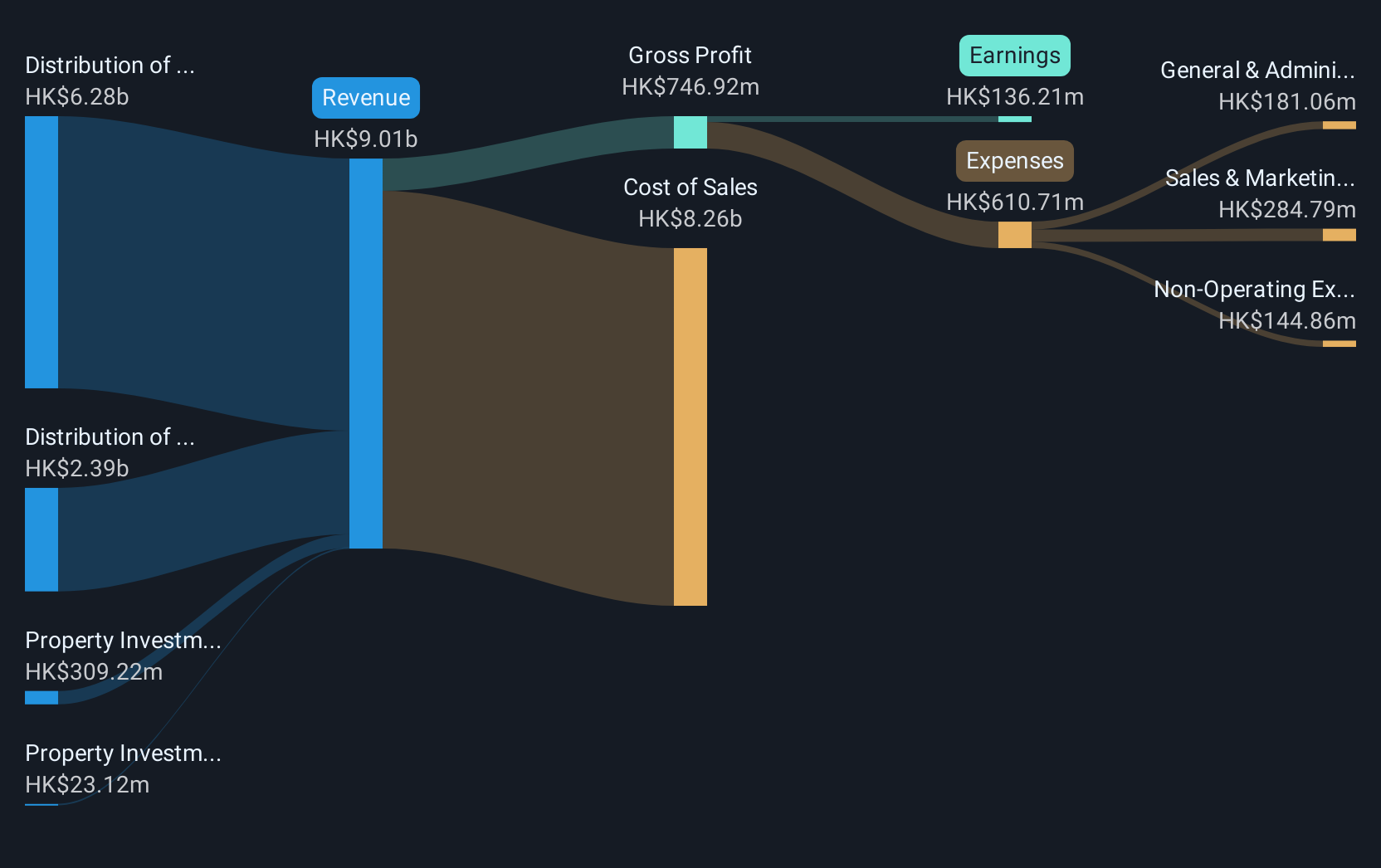

Operations: The company's revenue is derived from several segments, including HK$6.28 billion from the distribution of mobile and IT products in Thailand, HK$2.39 billion from similar distributions in Hong Kong, and HK$309.22 million from property investment and hotel operations in Japan, along with an additional HK$23.12 million from property investment and hotel operations in other regions.

Market Cap: HK$464.2M

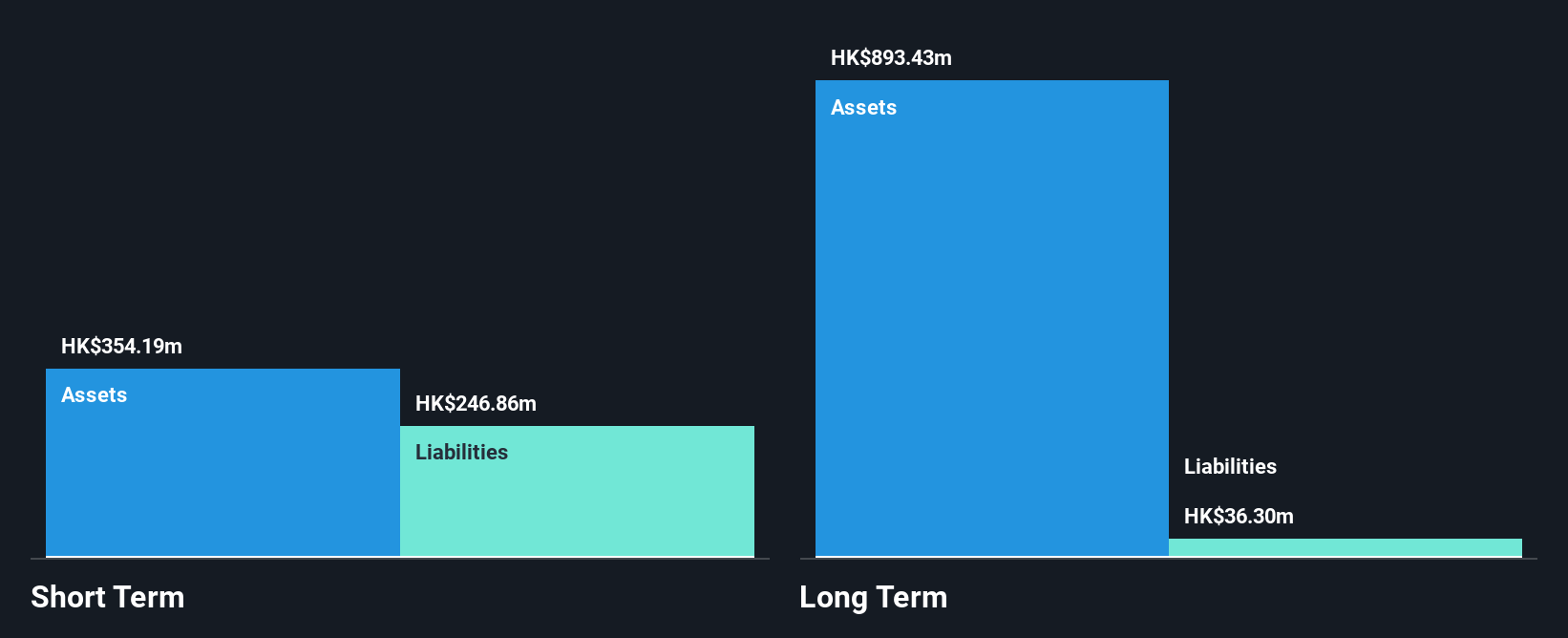

SiS International Holdings, with a market cap of HK$464.20 million, demonstrates financial stability through its diverse revenue streams across Asia. In 2024, the company reported HK$9 billion in sales and a net income increase to HK$136.21 million from the previous year, highlighting robust earnings growth despite low profit margins of 1.5%. The company's debt management is satisfactory with short-term assets exceeding liabilities and interest payments well covered by EBIT. However, both the board and management lack experience with average tenures under one year each. A proposed dividend reflects confidence in future cash flows amidst stable stock volatility.

- Unlock comprehensive insights into our analysis of SiS International Holdings stock in this financial health report.

- Learn about SiS International Holdings' historical performance here.

Fujian Minfa Aluminium (SZSE:002578)

Simply Wall St Financial Health Rating: ★★★★☆☆

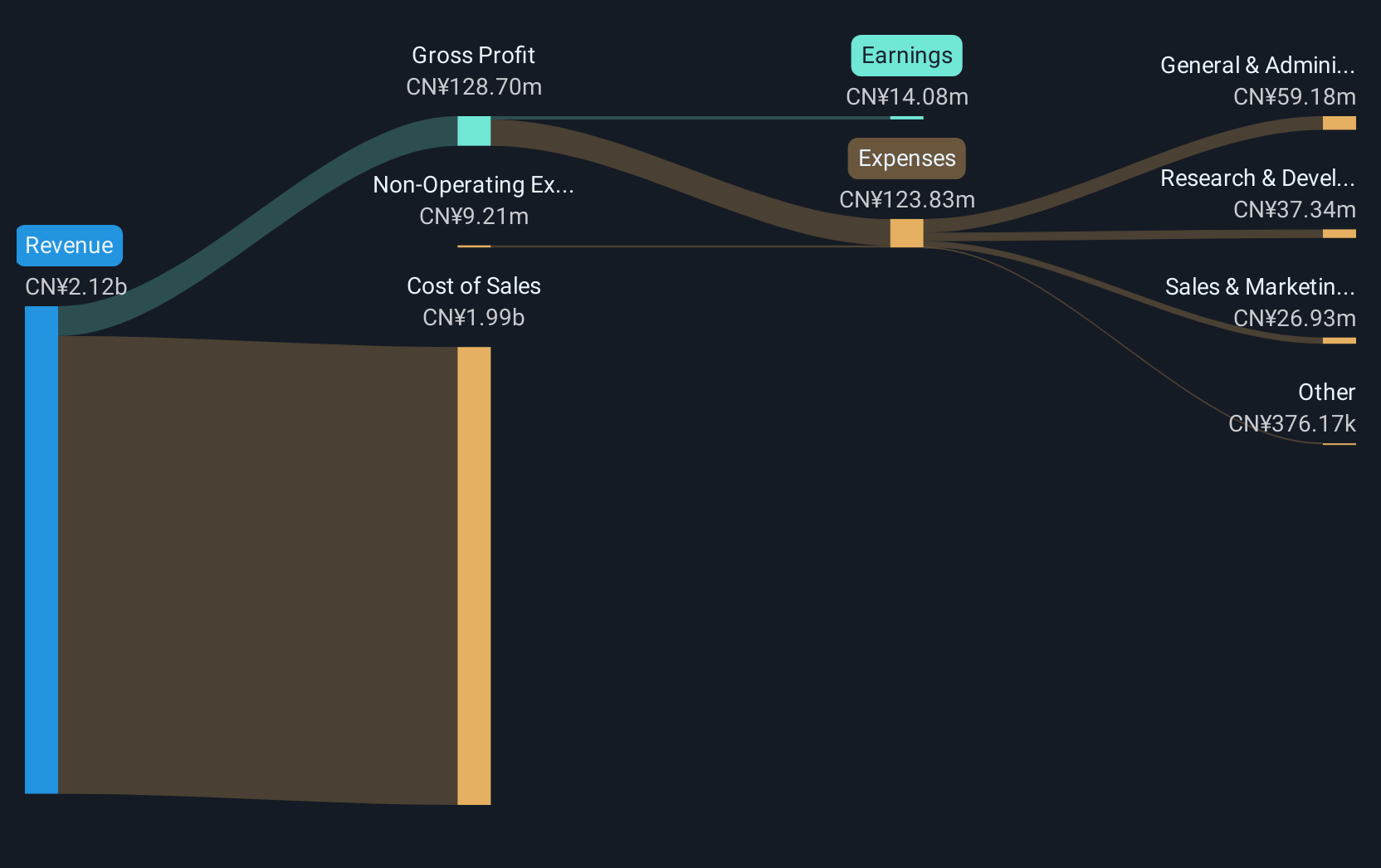

Overview: Fujian Minfa Aluminium Inc. develops, processes, and sells aluminum alloy extruded profiles for architecture, general engineering, and industrial applications in China with a market cap of CN¥3.12 billion.

Operations: No specific revenue segments are reported for Fujian Minfa Aluminium Inc.

Market Cap: CN¥3.12B

Fujian Minfa Aluminium, with a market cap of CN¥3.12 billion, presents a mixed financial picture. The company holds more cash than total debt and maintains stable weekly volatility at 6%. However, its Return on Equity is low at 1.7%, and earnings have declined by 14.2% annually over the past five years. The board's average tenure of 2.2 years indicates inexperience, while short-term assets comfortably cover both short- and long-term liabilities (CN¥1.8 billion vs CN¥888.1 million and CN¥25.1 million respectively). Despite high-quality earnings, profit margins have decreased from last year to 1.1%.

- Jump into the full analysis health report here for a deeper understanding of Fujian Minfa Aluminium.

- Assess Fujian Minfa Aluminium's previous results with our detailed historical performance reports.

Taking Advantage

- Take a closer look at our Global Penny Stocks list of 5,736 companies by clicking here.

- Seeking Other Investments? We've found 20 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002578

Fujian Minfa Aluminium

Develops, processes, and sells aluminum alloy extruded profiles for architecture, general engineering, and industry fields in China.

Adequate balance sheet low.

Market Insights

Community Narratives