Does TC Orient Lighting Holdings (HKG:515) Have A Healthy Balance Sheet?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about. So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, TC Orient Lighting Holdings Limited (HKG:515) does carry debt. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for TC Orient Lighting Holdings

How Much Debt Does TC Orient Lighting Holdings Carry?

The image below, which you can click on for greater detail, shows that TC Orient Lighting Holdings had debt of HK$177.2m at the end of June 2019, a reduction from HK$185.8m over a year. However, it does have HK$23.8m in cash offsetting this, leading to net debt of about HK$153.4m.

How Strong Is TC Orient Lighting Holdings's Balance Sheet?

According to the last reported balance sheet, TC Orient Lighting Holdings had liabilities of HK$552.4m due within 12 months, and liabilities of HK$14.3m due beyond 12 months. On the other hand, it had cash of HK$23.8m and HK$440.3m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by HK$102.5m.

This deficit isn't so bad because TC Orient Lighting Holdings is worth HK$225.6m, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since TC Orient Lighting Holdings will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year TC Orient Lighting Holdings had negative earnings before interest and tax, and actually shrunk its revenue by 35%, to HK$282m. That makes us nervous, to say the least.

Caveat Emptor

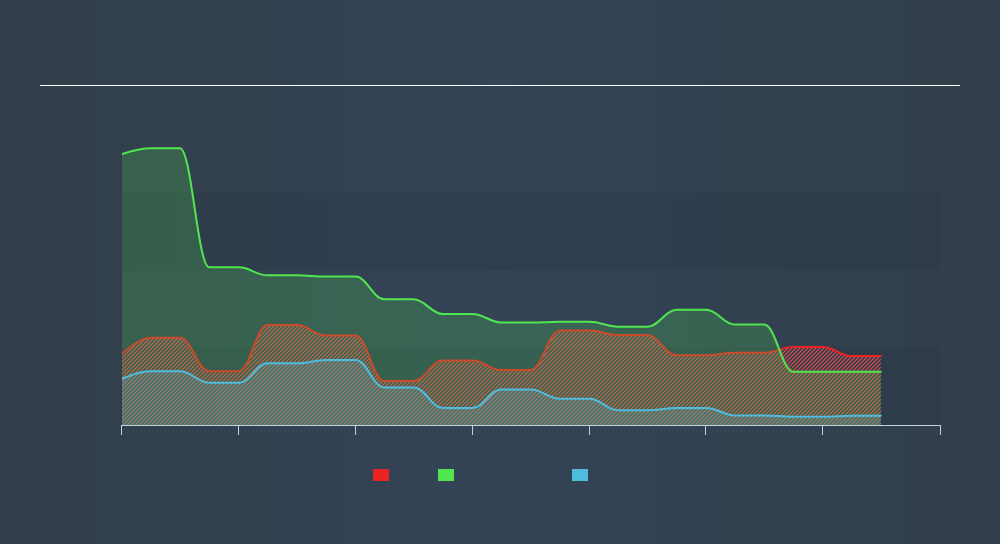

Not only did TC Orient Lighting Holdings's revenue slip over the last twelve months, but it also produced negative earnings before interest and tax (EBIT). Indeed, it lost a very considerable HK$83m at the EBIT level. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. So we think its balance sheet is a little strained, though not beyond repair. However, it doesn't help that it burned through HK$59m of cash over the last year. So suffice it to say we consider the stock very risky. When we look at a riskier company, we like to check how their profits (or losses) are trending over time. Today, we're providing readers this interactive graph showing how TC Orient Lighting Holdings's profit, revenue, and operating cashflow have changed over the last few years.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SEHK:515

China Silver Technology Holdings

An investment holding company, manufactures and trades in light emitting diode (LED) lighting products and printed circuit boards (PCBs) in the People’s Republic of China, Hong Kong, other Asian countries, Hungary, Turkey, Germany, and rest of Europe.

Slight with weak fundamentals.

Market Insights

Community Narratives