- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:3969

China Railway Signal & Communication Corporation Limited's (HKG:3969) Earnings Are Not Doing Enough For Some Investors

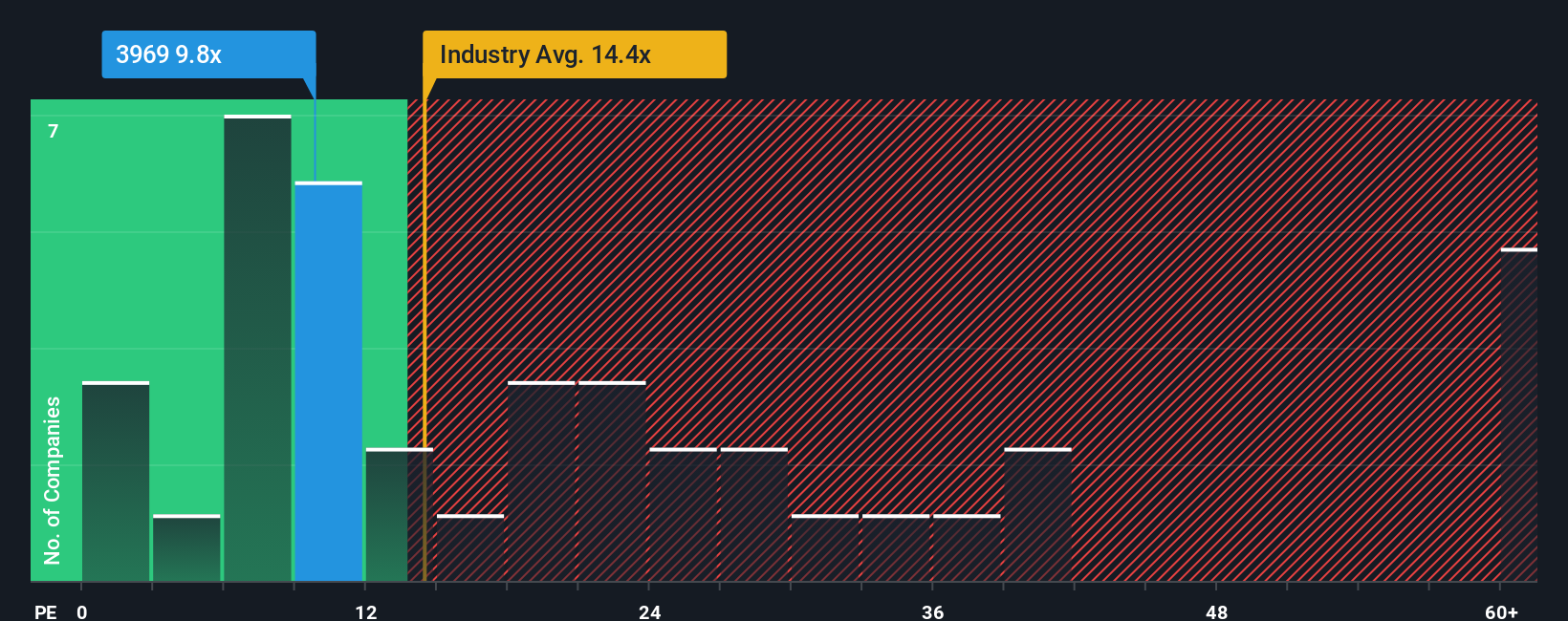

When close to half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") above 13x, you may consider China Railway Signal & Communication Corporation Limited (HKG:3969) as an attractive investment with its 9.8x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Recent times have been advantageous for China Railway Signal & Communication as its earnings have been rising faster than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for China Railway Signal & Communication

How Is China Railway Signal & Communication's Growth Trending?

In order to justify its P/E ratio, China Railway Signal & Communication would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered a decent 6.5% gain to the company's bottom line. The latest three year period has also seen a 5.4% overall rise in EPS, aided somewhat by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

Shifting to the future, estimates from the four analysts covering the company suggest earnings should grow by 6.9% per year over the next three years. Meanwhile, the rest of the market is forecast to expand by 14% each year, which is noticeably more attractive.

In light of this, it's understandable that China Railway Signal & Communication's P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of China Railway Signal & Communication's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 2 warning signs for China Railway Signal & Communication (1 is potentially serious!) that we have uncovered.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3969

China Railway Signal & Communication

Provides rail transportation control system solutions in China and internationally.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.