- Hong Kong

- /

- Tech Hardware

- /

- SEHK:3396

Here's Why It's Unlikely That Legend Holdings Corporation's (HKG:3396) CEO Will See A Pay Rise This Year

Key Insights

- Legend Holdings will host its Annual General Meeting on 27th of June

- CEO Peng Li's total compensation includes salary of CN¥1.25m

- Total compensation is 36% above industry average

- Legend Holdings' three-year loss to shareholders was 49% while its EPS was down 97% over the past three years

The results at Legend Holdings Corporation (HKG:3396) have been quite disappointing recently and CEO Peng Li bears some responsibility for this. Shareholders will be interested in what the board will have to say about turning performance around at the next AGM on 27th of June. It would also be an opportunity for shareholders to influence management through voting on company resolutions such as executive remuneration, which could impact the firm significantly. The data we present below explains why we think CEO compensation is not consistent with recent performance.

View our latest analysis for Legend Holdings

Comparing Legend Holdings Corporation's CEO Compensation With The Industry

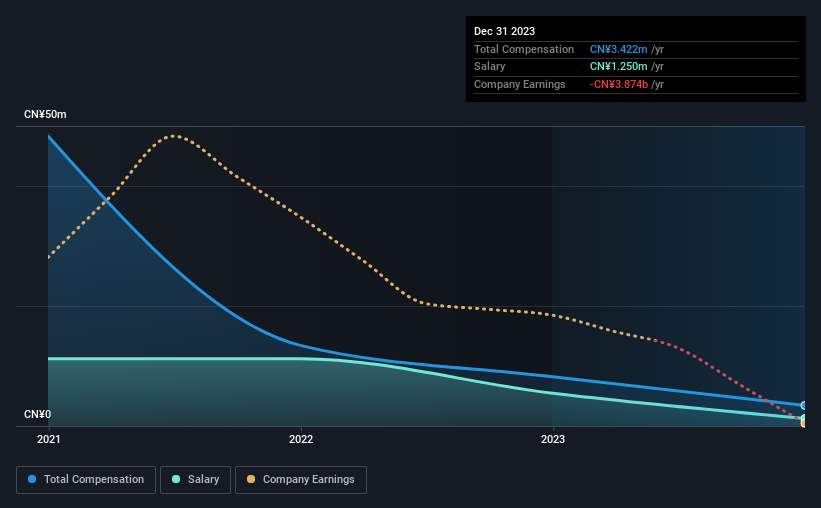

According to our data, Legend Holdings Corporation has a market capitalization of HK$15b, and paid its CEO total annual compensation worth CN¥3.4m over the year to December 2023. That's a notable decrease of 58% on last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at CN¥1.3m.

In comparison with other companies in the Hong Kong Tech industry with market capitalizations ranging from HK$7.8b to HK$25b, the reported median CEO total compensation was CN¥2.5m. Hence, we can conclude that Peng Li is remunerated higher than the industry median. Furthermore, Peng Li directly owns HK$3.5m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | CN¥1.3m | CN¥5.5m | 37% |

| Other | CN¥2.2m | CN¥2.8m | 63% |

| Total Compensation | CN¥3.4m | CN¥8.2m | 100% |

On an industry level, around 81% of total compensation represents salary and 19% is other remuneration. It's interesting to note that Legend Holdings allocates a smaller portion of compensation to salary in comparison to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

Legend Holdings Corporation's Growth

Over the last three years, Legend Holdings Corporation has shrunk its earnings per share by 97% per year. In the last year, its revenue is down 8.8%.

The decline in EPS is a bit concerning. And the impression is worse when you consider revenue is down year-on-year. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Legend Holdings Corporation Been A Good Investment?

Few Legend Holdings Corporation shareholders would feel satisfied with the return of -49% over three years. So shareholders would probably want the company to be less generous with CEO compensation.

To Conclude...

Along with the business performing poorly, shareholders have suffered with poor share price returns on their investments, suggesting that there's little to no chance of them being in favor of a CEO pay raise. At the upcoming AGM, management will get a chance to explain how they plan to get the business back on track and address the concerns from investors.

CEO compensation can have a massive impact on performance, but it's just one element. We did our research and spotted 1 warning sign for Legend Holdings that investors should look into moving forward.

Switching gears from Legend Holdings, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3396

Legend Holdings

Legend Holdings Corporation, along with its subsidiaries, operates in the industrial operations and industrial incubations and investments sectors in the People’s Republic of China and internationally.

Moderate growth potential with questionable track record.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success