- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:3393

What We Learned About Wasion Holdings' (HKG:3393) CEO Compensation

Zhao Hui Cao is the CEO of Wasion Holdings Limited (HKG:3393), and in this article, we analyze the executive's compensation package with respect to the overall performance of the company. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Wasion Holdings.

Check out our latest analysis for Wasion Holdings

How Does Total Compensation For Zhao Hui Cao Compare With Other Companies In The Industry?

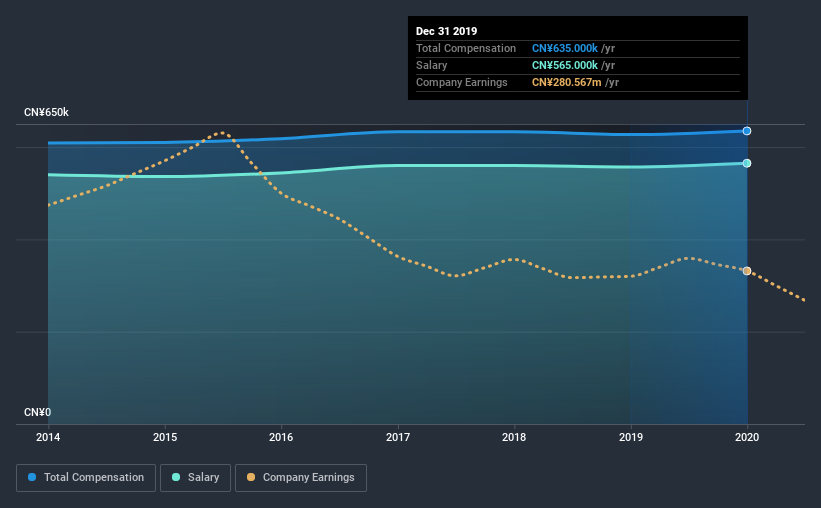

At the time of writing, our data shows that Wasion Holdings Limited has a market capitalization of HK$2.2b, and reported total annual CEO compensation of CN¥635k for the year to December 2019. That's mostly flat as compared to the prior year's compensation. We note that the salary portion, which stands at CN¥565.0k constitutes the majority of total compensation received by the CEO.

On examining similar-sized companies in the industry with market capitalizations between HK$775m and HK$3.1b, we discovered that the median CEO total compensation of that group was CN¥1.6m. In other words, Wasion Holdings pays its CEO lower than the industry median. Moreover, Zhao Hui Cao also holds HK$4.4m worth of Wasion Holdings stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | CN¥565k | CN¥557k | 89% |

| Other | CN¥70k | CN¥70k | 11% |

| Total Compensation | CN¥635k | CN¥627k | 100% |

On an industry level, around 76% of total compensation represents salary and 24% is other remuneration. Wasion Holdings pays out 89% of remuneration in the form of a salary, significantly higher than the industry average. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Wasion Holdings Limited's Growth

Wasion Holdings Limited has reduced its earnings per share by 5.1% a year over the last three years. In the last year, its revenue is down 5.3%.

Few shareholders would be pleased to read that EPS have declined. This is compounded by the fact revenue is actually down on last year. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Wasion Holdings Limited Been A Good Investment?

Given the total shareholder loss of 31% over three years, many shareholders in Wasion Holdings Limited are probably rather dissatisfied, to say the least. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

As we noted earlier, Wasion Holdings pays its CEO lower than the norm for similar-sized companies belonging to the same industry. While we are quite underwhelmed with EPS growth, the shareholder returns over the past three years have also failed to impress us. We can't say the CEO compensation is high, but shareholders will be cold to a bump at this stage, considering negative investor returns.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 1 warning sign for Wasion Holdings that you should be aware of before investing.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

When trading Wasion Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Wasion Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:3393

Wasion Holdings

An investment holding company, engages in the research and development, production, and sale of energy metering and energy efficiency management solutions for energy supply industries in the People’s Republic of China, Africa, the United States, Europe, and rest of Asia.

Undervalued with solid track record and pays a dividend.