- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:3302

Kinergy's (HKG:3302) Earnings Aren't As Good As They Appear

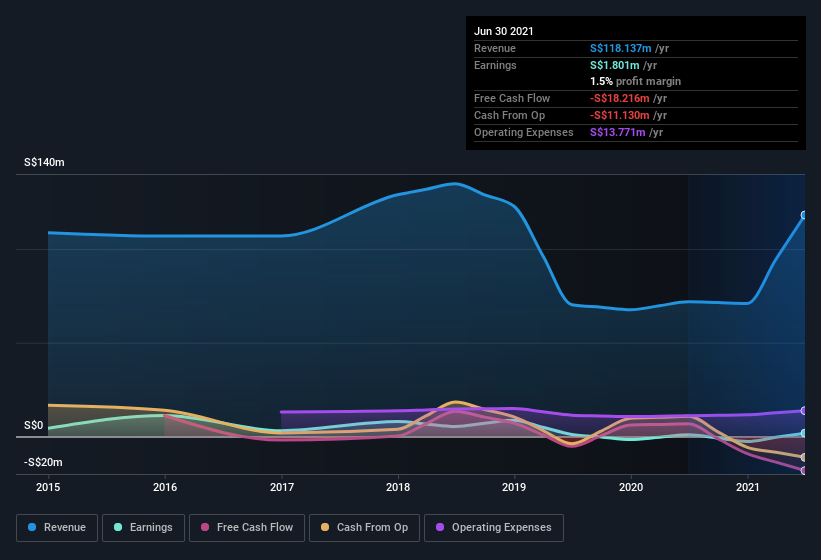

We didn't see Kinergy Corporation Ltd.'s (HKG:3302) stock surge when it reported robust earnings recently. We decided to have a deeper look, and we believe that investors might be worried about several concerning factors that we found.

Check out our latest analysis for Kinergy

A Closer Look At Kinergy's Earnings

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

For the year to June 2021, Kinergy had an accrual ratio of 0.26. Unfortunately, that means its free cash flow fell significantly short of its reported profits. Even though it reported a profit of S$1.80m, a look at free cash flow indicates it actually burnt through S$18m in the last year. We saw that FCF was S$6.8m a year ago though, so Kinergy has at least been able to generate positive FCF in the past. However, that's not the end of the story. We must also consider the impact of unusual items on statutory profit (and thus the accrual ratio), as well as note the ramifications of the company issuing new shares. The good news for shareholders is that Kinergy's accrual ratio was much better last year, so this year's poor reading might simply be a case of a short term mismatch between profit and FCF. As a result, some shareholders may be looking for stronger cash conversion in the current year.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Kinergy.

To understand the value of a company's earnings growth, it is imperative to consider any dilution of shareholders' interests. As it happens, Kinergy issued 7.3% more new shares over the last year. As a result, its net income is now split between a greater number of shares. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. Check out Kinergy's historical EPS growth by clicking on this link.

A Look At The Impact Of Kinergy's Dilution on Its Earnings Per Share (EPS).

Kinergy's net profit dropped by 67% per year over the last three years. The good news is that profit was up 107% in the last twelve months. But EPS was less impressive, up only 103% in that time. So you can see that the dilution has had a bit of an impact on shareholders.

In the long term, earnings per share growth should beget share price growth. So Kinergy shareholders will want to see that EPS figure continue to increase. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

How Do Unusual Items Influence Profit?

The fact that the company had unusual items boosting profit by S$1.2m, in the last year, probably goes some way to explain why its accrual ratio was so weak. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And that's as you'd expect, given these boosts are described as 'unusual'. Kinergy had a rather significant contribution from unusual items relative to its profit to June 2021. All else being equal, this would likely have the effect of making the statutory profit a poor guide to underlying earnings power.

Our Take On Kinergy's Profit Performance

Kinergy didn't back up its earnings with free cashflow, but this isn't too surprising given profits were inflated by unusual items. The dilution means the results are weaker when viewed from a per-share perspective. On reflection, the above-mentioned factors give us the strong impression that Kinergy'sunderlying earnings power is not as good as it might seem, based on the statutory profit numbers. If you want to do dive deeper into Kinergy, you'd also look into what risks it is currently facing. For example, we've found that Kinergy has 7 warning signs (2 are potentially serious!) that deserve your attention before going any further with your analysis.

Our examination of Kinergy has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Kinergy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:3302

Kinergy

Provides contract manufacturing, design, engineering, and assembly services for the electronics industry in Singapore, the Philippines, the United States, the Mainland China, Japan, and internationally.

Slight risk with mediocre balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026