Computime Group (HKG:320) Is Paying Out A Larger Dividend Than Last Year

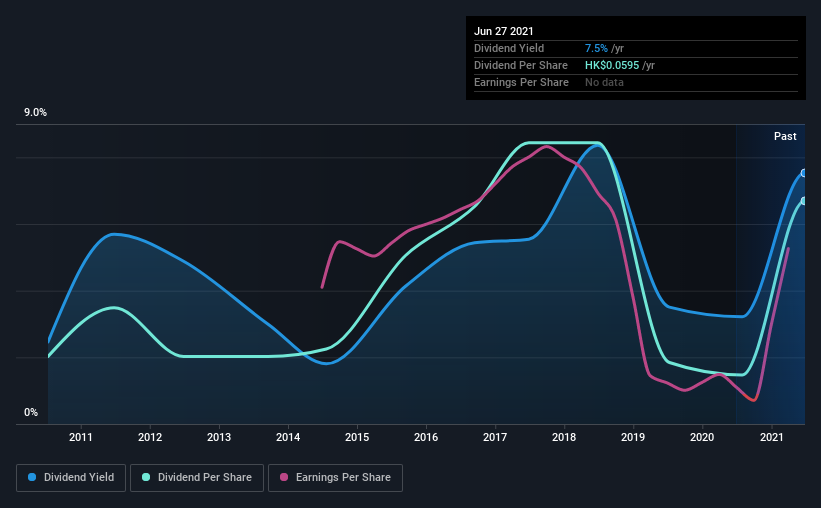

Computime Group Limited's (HKG:320) dividend will be increasing to HK$0.059 on 5th of October. This will take the annual payment from 7.5% to 7.5% of the stock price, which is above what most companies in the industry pay.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Investors will be pleased to see that Computime Group's stock price has increased by 93% in the last 3 months, which is good for shareholders and can also explain a decrease in the dividend yield.

Check out our latest analysis for Computime Group

Computime Group's Earnings Easily Cover the Distributions

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. Prior to this announcement, Computime Group's dividend was comfortably covered by both cash flow and earnings. This indicates that quite a large proportion of earnings is being invested back into the business.

Unless the company can turn things around, EPS could fall by 3.7% over the next year. If the dividend continues along the path it has been on recently, we estimate the payout ratio could be 61%, which is definitely feasible to continue.

Dividend Volatility

The company has a long dividend track record, but it doesn't look great with cuts in the past. The first annual payment during the last 10 years was HK$0.018 in 2011, and the most recent fiscal year payment was HK$0.059. This works out to be a compound annual growth rate (CAGR) of approximately 13% a year over that time. Computime Group has grown distributions at a rapid rate despite cutting the dividend at least once in the past. Companies that cut once often cut again, so we would be cautious about buying this stock solely for the dividend income.

Computime Group May Find It Hard To Grow The Dividend

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. In the last five years, Computime Group's earnings per share has shrunk at approximately 3.7% per annum. If earnings continue declining, the company may have to make the difficult choice of reducing the dividend or even stopping it completely - the opposite of dividend growth.

In Summary

Overall, we always like to see the dividend being raised, but we don't think Computime Group will make a great income stock. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. We don't think Computime Group is a great stock to add to your portfolio if income is your focus.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. However, there are other things to consider for investors when analysing stock performance. To that end, Computime Group has 4 warning signs (and 1 which is a bit concerning) we think you should know about. If you are a dividend investor, you might also want to look at our curated list of high performing dividend stock.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:320

Computime Group

An investment holding company, engages in the research and development, design, manufacture, trading, and distribution of electronic control products in the Americas, Europe, Oceania, and Asia.

Established dividend payer and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026