As global markets experience a rebound, driven by cooling inflation and robust bank earnings in the U.S., investors are keeping a close eye on high-growth tech stocks that could benefit from these favorable conditions. In this environment, companies with strong innovation pipelines and the ability to adapt to changing economic landscapes may stand out as promising opportunities for those looking to navigate the evolving market dynamics.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Medley | 20.97% | 27.22% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

Click here to see the full list of 1225 stocks from our High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

BYD Electronic (International) (SEHK:285)

Simply Wall St Growth Rating: ★★★★☆☆

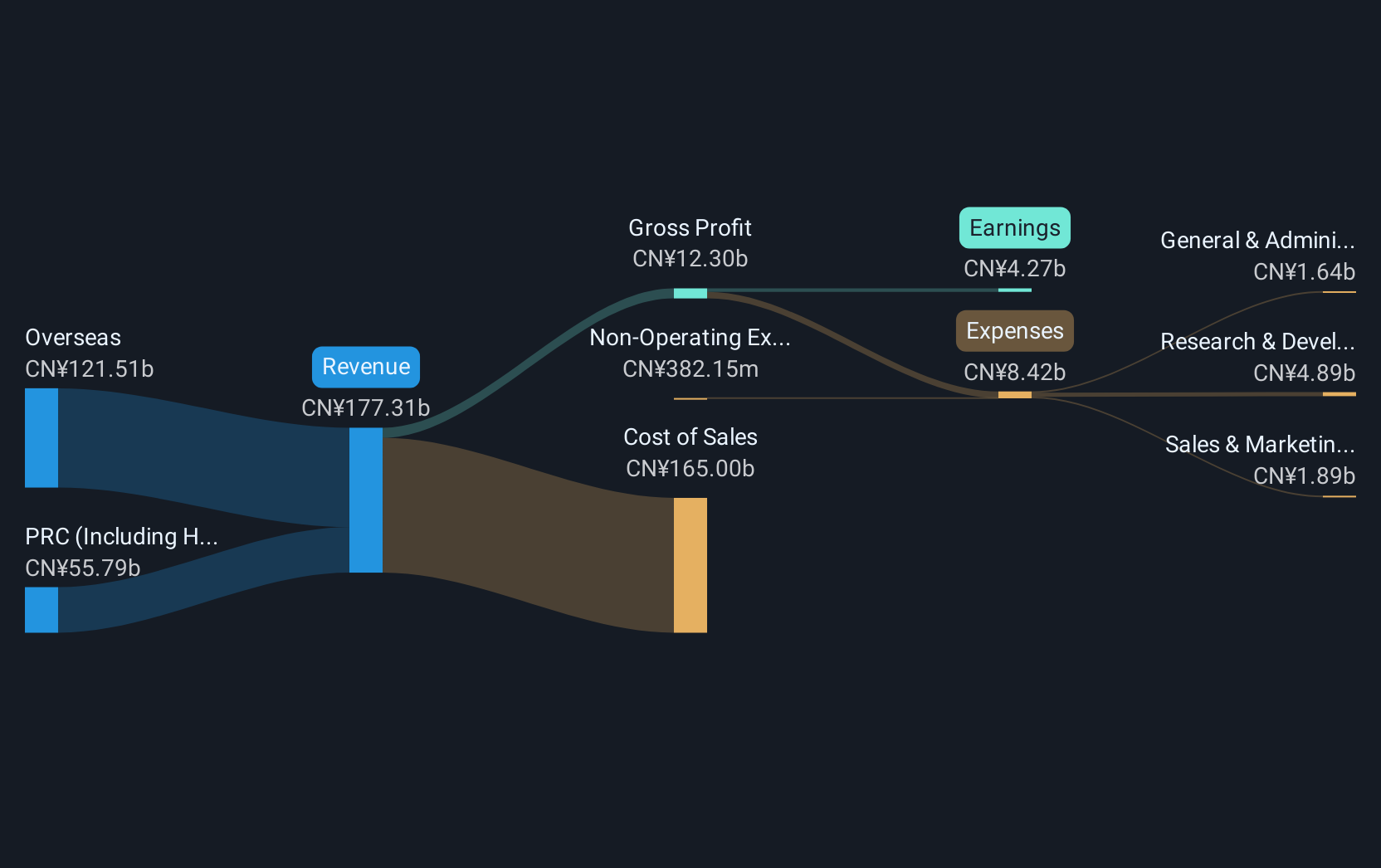

Overview: BYD Electronic (International) Company Limited is an investment holding company that focuses on the design, manufacture, assembly, and sale of mobile handset components and modules both in China and globally, with a market capitalization of approximately HK$92.61 billion.

Operations: The company generates revenue primarily from the manufacture, assembly, and sale of mobile handset components and modules, amounting to CN¥152.36 billion.

BYD Electronic (International) has demonstrated robust growth, with earnings surging by 47.6% over the past year, outpacing the Communications industry's average decline of 15.6%. This trend is set to continue, with projected annual earnings growth of 24.2%, significantly higher than Hong Kong's market average of 11.3%. The company's commitment to innovation is evident from its R&D investments, which are crucial for sustaining its competitive edge in rapidly evolving tech landscapes. Moreover, a recent shareholders meeting highlighted strategic initiatives like new supply agreements that could further bolster BYD's market position by enhancing its production capabilities and supply chain efficiency.

- Navigate through the intricacies of BYD Electronic (International) with our comprehensive health report here.

Understand BYD Electronic (International)'s track record by examining our Past report.

Vobile Group (SEHK:3738)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vobile Group Limited is an investment holding company that offers software as a service for digital content asset protection and transactions across the United States, Japan, Mainland China, and other international markets, with a market cap of approximately HK$7.71 billion.

Operations: Vobile Group generates revenue primarily through its software as a service (SaaS) offerings, which focus on digital content asset protection and transactions. The company's SaaS segment reported revenues of HK$2.18 billion.

Vobile Group has been making significant strides in the tech industry, particularly with its recent focus on copyright management services tailored for the generative AI ecosystem. The company's innovative approach is demonstrated by a robust 29% increase in quarterly revenue year-over-year and an impressive 32% rise in monthly recurring revenue. These financial achievements are complemented by strategic leadership changes, including the appointment of Laverna Jun Lin Chan as a non-executive director, poised to steer Vobile towards leveraging emerging tech trends. This direction is crucial as it navigates the complex landscape of digital rights in a rapidly evolving media and entertainment sector valued at $3 trillion.

- Click here to discover the nuances of Vobile Group with our detailed analytical health report.

Gain insights into Vobile Group's past trends and performance with our Past report.

Sensirion Holding (SWX:SENS)

Simply Wall St Growth Rating: ★★★★☆☆

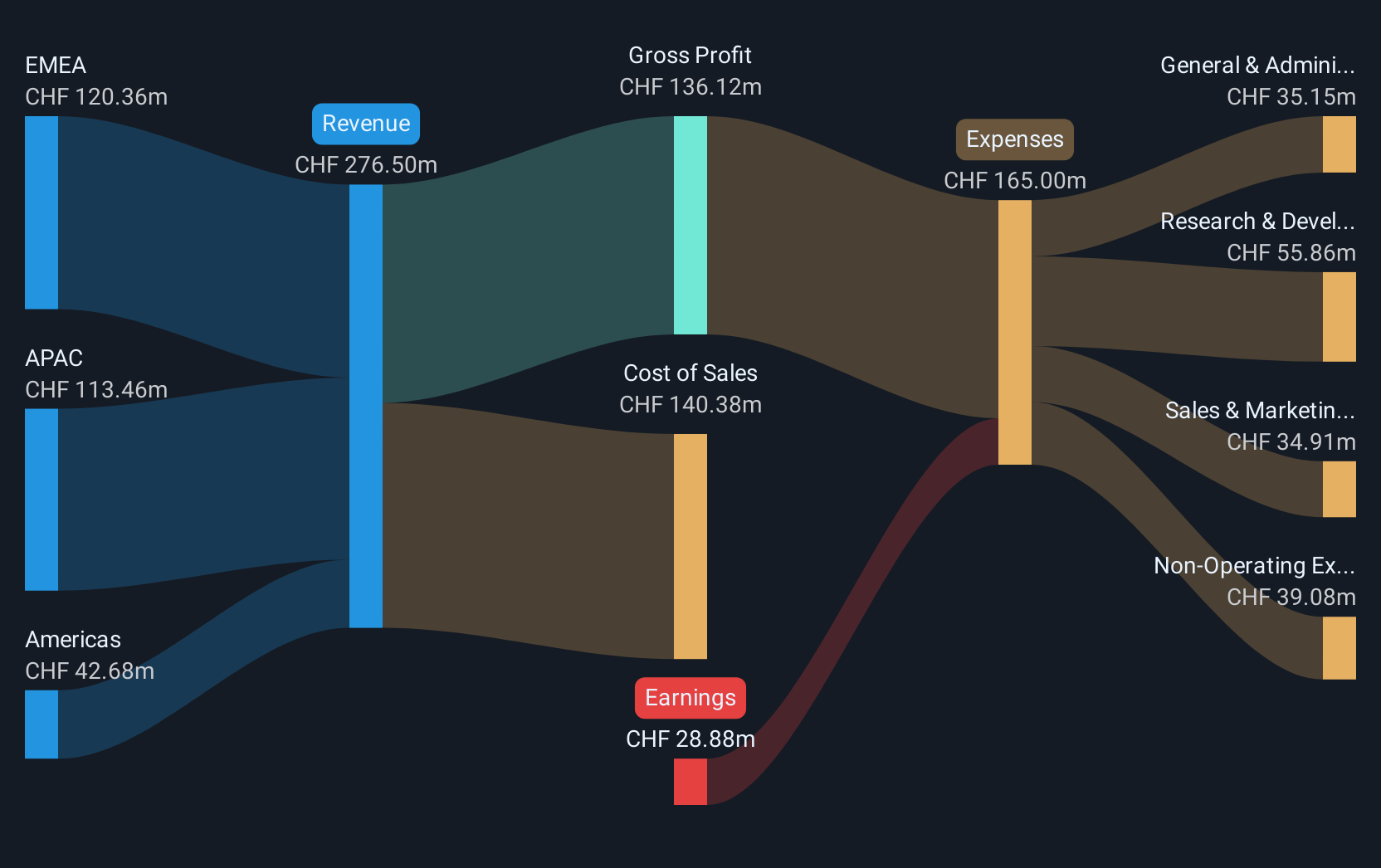

Overview: Sensirion Holding AG is a company that develops, produces, sells, and services sensor systems, modules, and components globally with a market cap of CHF931.99 million.

Operations: Sensirion generates revenue primarily from its sensor systems, modules, and components segment, amounting to CHF237.91 million.

Sensirion Holding is navigating a transformative path in the tech sector, underscored by its anticipated shift to profitability with earnings expected to surge by 102.6% annually. This growth trajectory is bolstered by a robust investment in R&D, committing significant resources that reflect an aggressive pursuit of innovation. Despite current unprofitability and market volatility, Sensirion's revenue growth projection stands at 13% per year, outpacing the Swiss market's 4.3%. This positions the company well within a competitive landscape as it gears up for future financial health and industry relevance.

Turning Ideas Into Actions

- Access the full spectrum of 1225 High Growth Tech and AI Stocks by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SENS

Sensirion Holding

Engages in the development, production, sale, and servicing of sensor systems, modules, and components worldwide.

Flawless balance sheet with reasonable growth potential.