- Philippines

- /

- Hospitality

- /

- PSE:PLUS

February 2025's Top Stocks Estimated To Be Trading Below Intrinsic Value

Reviewed by Simply Wall St

As global markets navigate a period of volatility marked by fluctuating interest rates and competitive pressures in the technology sector, investors are closely watching for opportunities that might be trading below their intrinsic value. In this context, identifying stocks that are undervalued can be particularly appealing, offering potential for growth even amidst broader market challenges.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zhongji Innolight (SZSE:300308) | CN¥98.25 | CN¥195.83 | 49.8% |

| North American Construction Group (TSX:NOA) | CA$27.04 | CA$53.73 | 49.7% |

| Decisive Dividend (TSXV:DE) | CA$5.90 | CA$11.79 | 50% |

| Northwest Bancshares (NasdaqGS:NWBI) | US$13.17 | US$26.31 | 49.9% |

| Emporiki Eisagogiki Aftokiniton Ditrohon kai Mihanon Thalassis Societe Anonyme (ATSE:MOTO) | €2.72 | €5.43 | 49.9% |

| Telefonaktiebolaget LM Ericsson (OM:ERIC B) | SEK83.22 | SEK165.90 | 49.8% |

| Spin Master (TSX:TOY) | CA$30.23 | CA$60.17 | 49.8% |

| Coastal Financial (NasdaqGS:CCB) | US$86.74 | US$172.68 | 49.8% |

| Equifax (NYSE:EFX) | US$266.77 | US$531.78 | 49.8% |

| Facephi Biometria (BME:FACE) | €2.23 | €4.45 | 49.8% |

We're going to check out a few of the best picks from our screener tool.

DigiPlus Interactive (PSE:PLUS)

Overview: DigiPlus Interactive Corp. operates general amusement, recreation enterprises, hotels, and gaming facilities in the Philippines, with a market cap of ₱131.79 billion.

Operations: The company's revenue segments include the Casino Group with ₱501.05 million, Retail Group with ₱61.84 billion, Property Group with ₱82.19 million, and Network and License Group with ₱402.91 million.

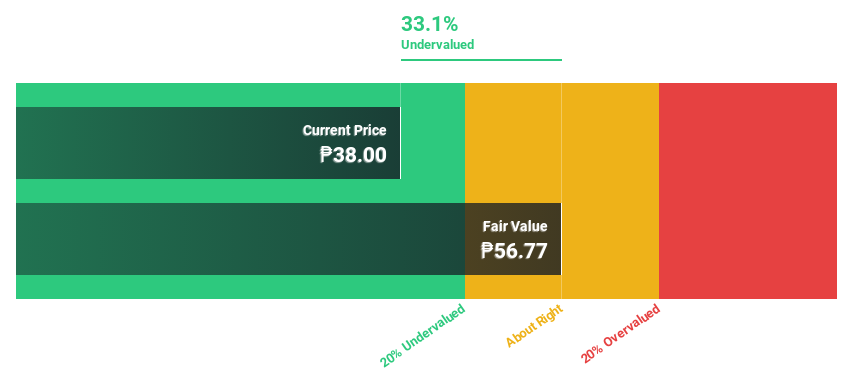

Estimated Discount To Fair Value: 48.1%

DigiPlus Interactive is highly undervalued, trading at ₱31.3, significantly below its estimated fair value of ₱60.35. Its earnings grew by 327.6% last year and are forecast to grow annually by 19.69%, outpacing the Philippine market's growth rates in both revenue and profit forecasts. Recent board changes demonstrate a commitment to strong corporate governance, potentially enhancing investor confidence as the company continues its impressive financial trajectory.

- The growth report we've compiled suggests that DigiPlus Interactive's future prospects could be on the up.

- Click here to discover the nuances of DigiPlus Interactive with our detailed financial health report.

BYD Electronic (International) (SEHK:285)

Overview: BYD Electronic (International) Company Limited is an investment holding company involved in the design, manufacture, assembly, and sale of mobile handset components and modules both within China and internationally, with a market cap of HK$98.69 billion.

Operations: The company's revenue primarily stems from the manufacture, assembly, and sale of mobile handset components and modules, generating CN¥152.36 billion.

Estimated Discount To Fair Value: 48.9%

BYD Electronic (International) is trading at HK$44.95, significantly below its estimated fair value of HK$88, highlighting its undervaluation based on cash flows. Earnings grew by 47.6% last year and are expected to grow 24.4% annually, outpacing the Hong Kong market's growth rate of 11.3%. However, forecasted revenue growth of 12.2% per year remains below the ideal benchmark but exceeds market expectations, reflecting a mixed outlook for potential investors.

- Our comprehensive growth report raises the possibility that BYD Electronic (International) is poised for substantial financial growth.

- Dive into the specifics of BYD Electronic (International) here with our thorough financial health report.

Chifeng Jilong Gold MiningLtd (SHSE:600988)

Overview: Chifeng Jilong Gold Mining Co., Ltd. is a company engaged in the mining of gold and non-ferrous metals, with a market capitalization of CN¥29.48 billion.

Operations: Chifeng Jilong Gold Mining Co., Ltd. generates its revenue primarily through the extraction and sale of gold and non-ferrous metals.

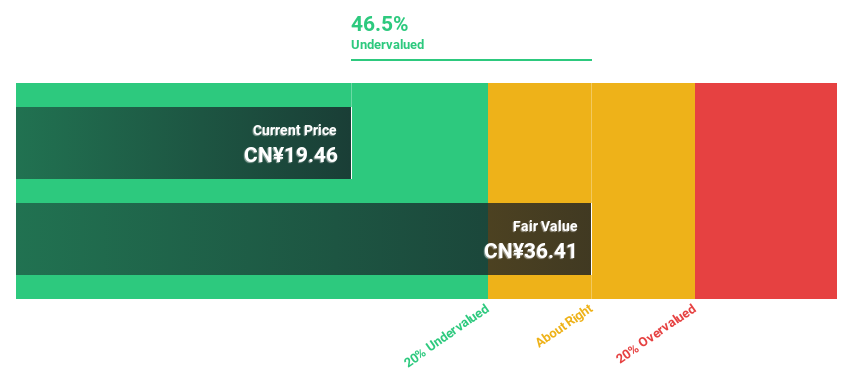

Estimated Discount To Fair Value: 48.6%

Chifeng Jilong Gold Mining Ltd. is trading at CN¥19.39, significantly below its estimated fair value of CN¥37.75, suggesting undervaluation based on cash flows. Despite being removed from key indices, the company shows strong fundamentals with past earnings growth of 141.7% and a forecasted annual earnings increase of 21.86%. While revenue growth is expected to be slower than ideal at 14.9%, it still surpasses the broader Chinese market's rate of 13.3%.

- Our expertly prepared growth report on Chifeng Jilong Gold MiningLtd implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of Chifeng Jilong Gold MiningLtd.

Seize The Opportunity

- Navigate through the entire inventory of 935 Undervalued Stocks Based On Cash Flows here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:PLUS

DigiPlus Interactive

Through its subsidiaries, operates as a digital entertainment company in the Philippines.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives