As global markets navigate a landscape of easing monetary policies and fluctuating trade tensions, investors are keenly observing the potential opportunities within Asian equities. Penny stocks, often associated with speculative trading, remain relevant for their ability to offer unique growth prospects when supported by strong financial fundamentals. In this article, we explore three Asian penny stocks that demonstrate financial robustness and potential for substantial returns in today’s evolving market conditions.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| JBM (Healthcare) (SEHK:2161) | HK$2.94 | HK$2.39B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.50 | HK$927.78M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.61 | HK$2.17B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.21 | SGD490.4M | ✅ 4 ⚠️ 1 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.72 | THB2.83B | ✅ 3 ⚠️ 3 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.094 | SGD49.21M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.26 | SGD12.83B | ✅ 5 ⚠️ 1 View Analysis > |

| Anton Oilfield Services Group (SEHK:3337) | HK$1.11 | HK$3B | ✅ 4 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.97 | NZ$138.07M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.40 | THB8.89B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 951 stocks from our Asian Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Yeebo (International Holdings) (SEHK:259)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Yeebo (International Holdings) Limited, along with its subsidiaries, is engaged in the manufacturing and sale of liquid crystal displays and modules, with a market capitalization of approximately HK$4.47 billion.

Operations: The company's revenue primarily comes from its Displays and Other Services segment, which generated HK$1.04 billion.

Market Cap: HK$4.47B

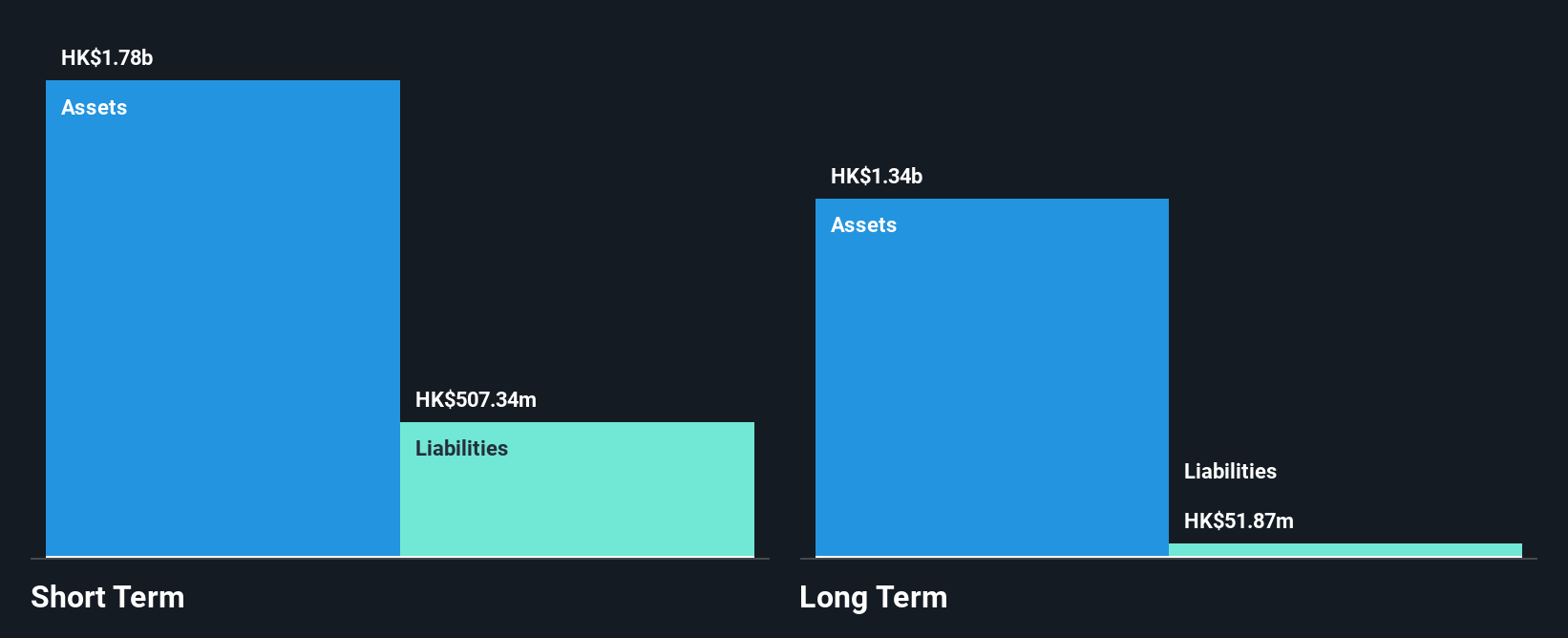

Yeebo (International Holdings) demonstrates strong financial health with earnings growth of 1477.7% over the past year, significantly surpassing industry averages. The company maintains a solid balance sheet, with short-term assets exceeding both its short and long-term liabilities, and more cash than total debt. Its Return on Equity stands at an impressive 75.9%, highlighting operational efficiency. Despite high share price volatility, Yeebo's management is experienced, averaging over a decade in tenure. Recent activities include declaring a final dividend and completing a share buyback program, reflecting shareholder value initiatives amidst stable profit margins improvement.

- Click here and access our complete financial health analysis report to understand the dynamics of Yeebo (International Holdings).

- Examine Yeebo (International Holdings)'s past performance report to understand how it has performed in prior years.

Bosideng International Holdings (SEHK:3998)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Bosideng International Holdings Limited operates in the apparel industry within the People's Republic of China and has a market capitalization of approximately HK$56.61 billion.

Operations: The company's revenue is primarily derived from its Down Apparels segment, generating CN¥21.71 billion, followed by Original Equipment Manufacturing (OEM) Management at CN¥3.42 billion, Ladieswear Apparels contributing CN¥651.15 million, and Diversified Apparels adding CN¥231.76 million.

Market Cap: HK$56.61B

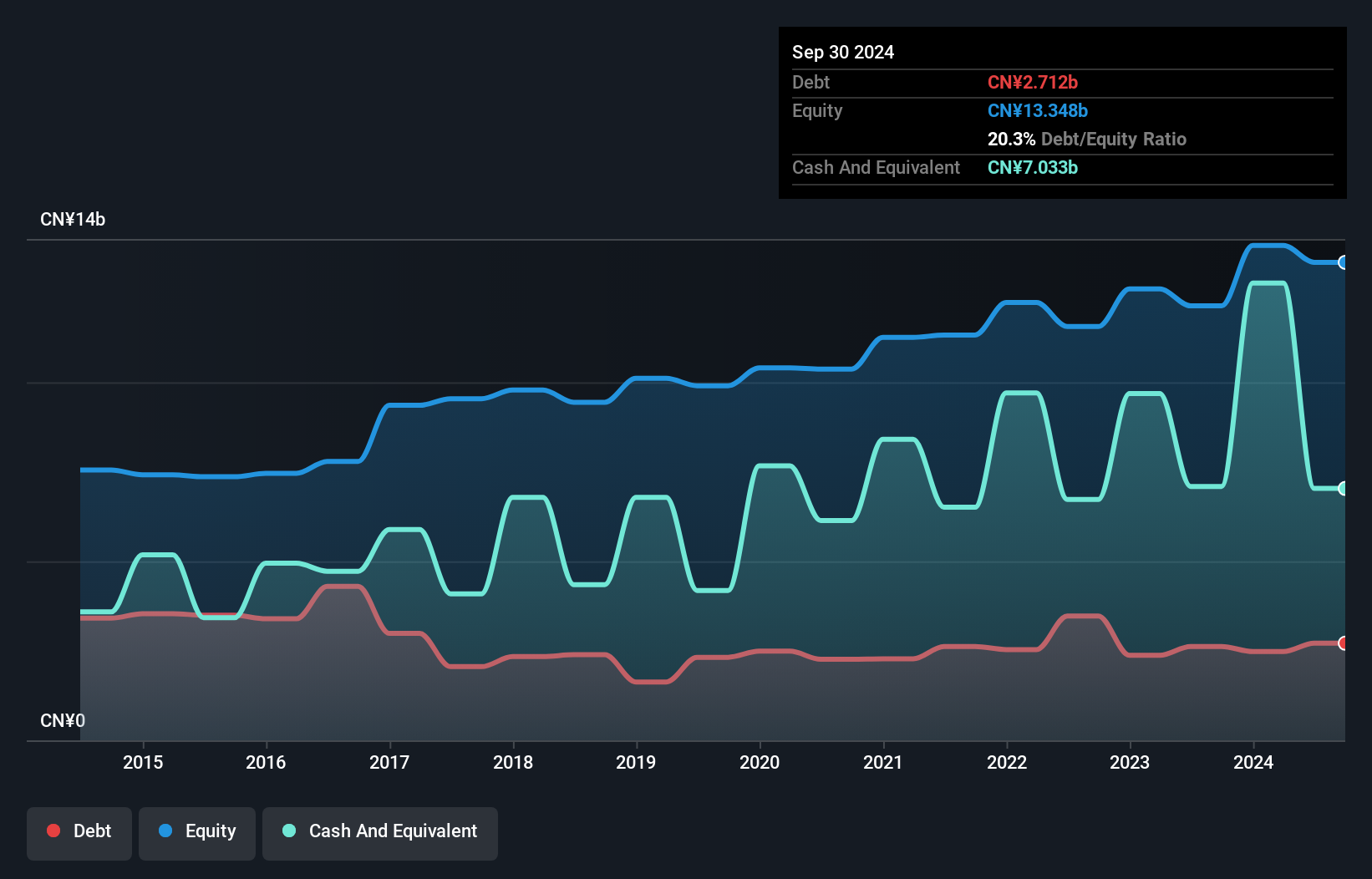

Bosideng International Holdings exhibits financial resilience with its earnings growing 14.3% over the past year, supported by a robust balance sheet where short-term assets of CN¥19.2 billion exceed both short and long-term liabilities. The company's debt is well-managed, with more cash than total debt and operating cash flow covering debt significantly. Its Return on Equity is high at 20.9%, indicating strong profitability, though dividend coverage by free cash flow remains weak at 5.68%. Recent actions include a final dividend declaration and completion of a share buyback program, underscoring its commitment to shareholder returns amidst stable profit margins improvement.

- Click to explore a detailed breakdown of our findings in Bosideng International Holdings' financial health report.

- Understand Bosideng International Holdings' earnings outlook by examining our growth report.

Cosmos Group (SZSE:002133)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cosmos Group Co., Ltd. operates in the real estate development sector in China and has a market cap of CN¥2.94 billion.

Operations: The company generates revenue primarily from its real estate segment, which accounts for CN¥3.27 billion, followed by trading activities contributing CN¥1.90 billion.

Market Cap: CN¥2.94B

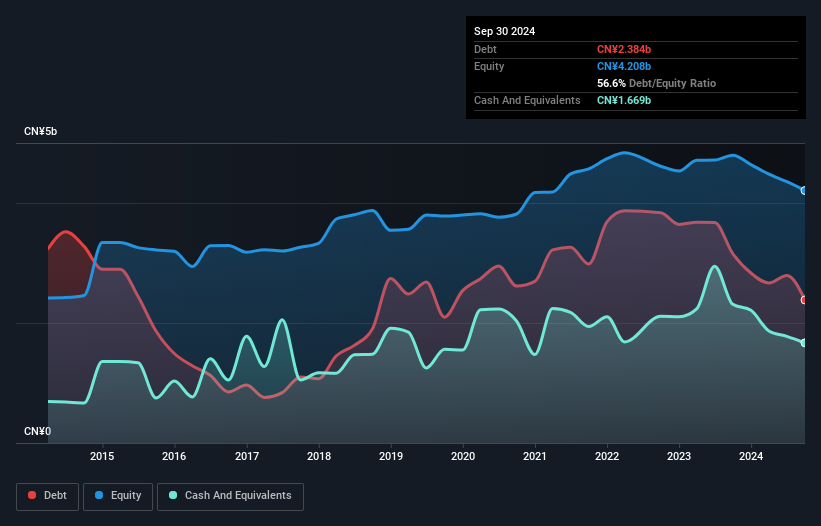

Cosmos Group Co., Ltd. faces challenges as it remains unprofitable, with losses increasing at a significant rate over the past five years. Despite this, the company has shown financial stability with short-term assets of CN¥6.2 billion exceeding both short and long-term liabilities. The net debt to equity ratio is satisfactory at 1.1%, indicating prudent debt management, further supported by operating cash flow covering 66.8% of its debt obligations. Recent strategic moves include a share buyback and interim dividend distribution, reflecting efforts to enhance shareholder value amid ongoing financial restructuring and board changes aimed at strengthening governance.

- Click here to discover the nuances of Cosmos Group with our detailed analytical financial health report.

- Evaluate Cosmos Group's historical performance by accessing our past performance report.

Where To Now?

- Gain an insight into the universe of 951 Asian Penny Stocks by clicking here.

- Curious About Other Options? The end of cancer? These 28 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bosideng International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3998

Bosideng International Holdings

Engages in the apparel business in the People’s Republic of China.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives