- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:2498

Robosense Technology (SEHK:2498): Assessing Valuation After Mixed Q3 and Nine‑Month Results

Reviewed by Simply Wall St

Robosense Technology (SEHK:2498) just posted Q3 and nine month results that paint a mixed picture, including flat quarterly sales, a wider Q3 loss, but a meaningfully smaller year to date net loss.

See our latest analysis for Robosense Technology.

At HK$32.86, Robosense Technology’s recent Q3 update seems to be stabilising sentiment, with a 1 year to date share price return of 12.53% but a weaker 90 day share price return of 14.87% signalling fading short term momentum versus an improving longer term total shareholder return of 14.49%.

If Robosense’s mixed quarter has you reassessing growth stories, it could be a good moment to see what else is out there among high growth tech and AI stocks.

With losses narrowing year to date but quarterly momentum stalling, and the shares trading well below analyst targets, is Robosense a misunderstood LiDAR growth play, or has the market already priced in the recovery story?

Most Popular Narrative: 30.7% Undervalued

Compared with the last close at HK$32.86, the most popular narrative points to a meaningfully higher fair value, hinging on powerful long term growth and margin assumptions.

The company's ability to reduce raw material procurement costs and the successful roll out of its in house developed SOC processing chips, which have lower costs than third party alternatives, has led to marked gross margin improvements (overall gross margin rising from 13.6% to 25.9% YoY), supporting a structural improvement in profitability and better operating leverage for future earnings.

Want to see what happens when rapid revenue expansion meets sharply higher margins and a richer future earnings multiple, all in one modelled roadmap? Read on.

Result: Fair Value of $47.45 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as heavy reliance on a few ADAS customers and falling LiDAR selling prices could still derail the optimistic growth and margin narrative.

Find out about the key risks to this Robosense Technology narrative.

Another Lens on Valuation

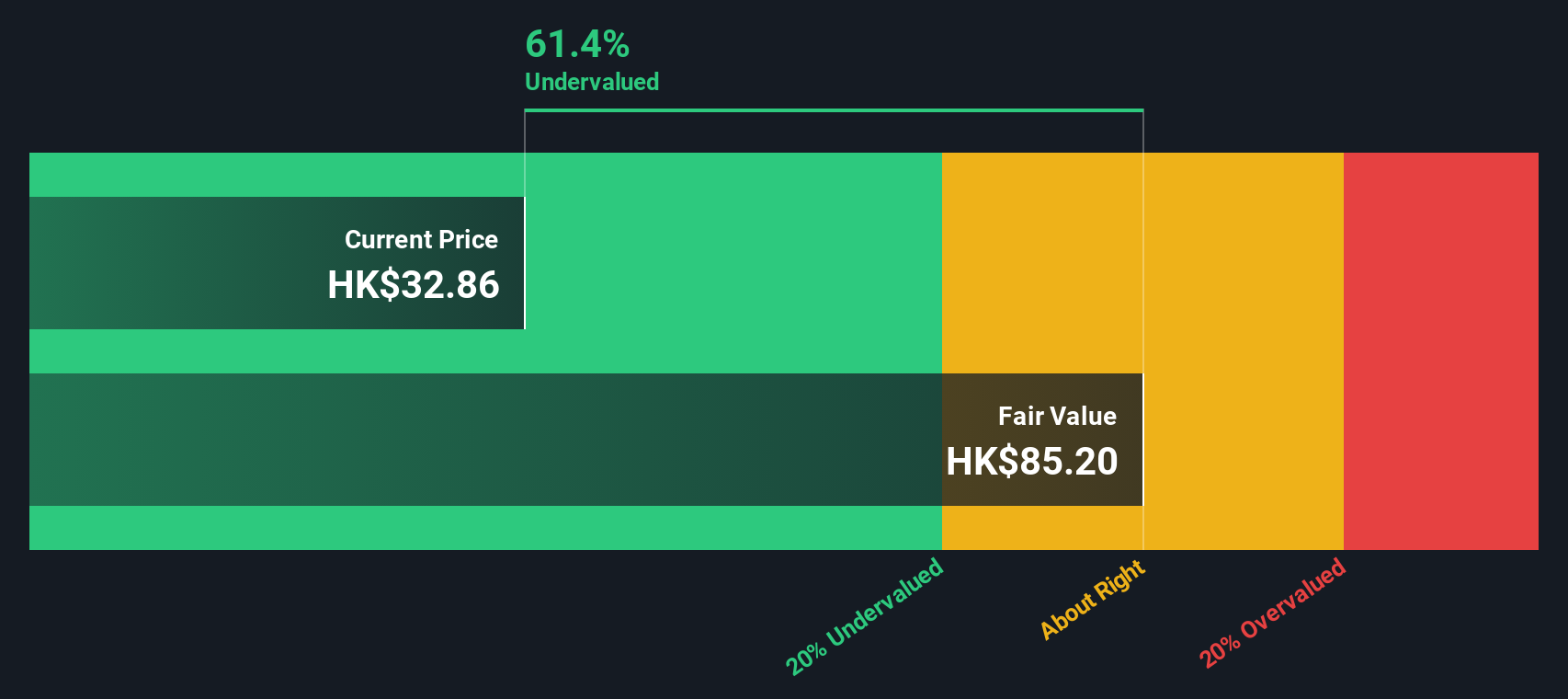

Our DCF model presents a more pronounced perspective than the narrative based fair value. It suggests Robosense’s shares, at HK$32.86, sit roughly 61% below an intrinsic value near HK$85. That indicates the potential upside case may be significantly higher, but it also raises the question of whether those long range cash flow assumptions are realistic.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Robosense Technology Narrative

If you are unconvinced or would rather dive into the numbers yourself, you can shape a personalised view of Robosense in minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Robosense Technology.

Looking for more investment ideas?

Do not leave your next opportunity to chance. Put the Simply Wall St Screener to work and move toward your next high conviction idea today.

- Capture early stage momentum by scanning these 3576 penny stocks with strong financials that pair tiny market caps with financial strength and room to surprise.

- Position yourself at the heart of automation by focusing on these 26 AI penny stocks powering developments in intelligent software, data analytics, and machine decision making.

- Explore potential value before the broader market reacts by targeting these 906 undervalued stocks based on cash flows where cash flows may point to opportunities ahead of shifts in sentiment.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2498

Robosense Technology

An investment holding company, provides LiDAR and perception solutions in the People’s Republic of China and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026