- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:2382

Sunny Optical Technology (Group) Company Limited (HKG:2382) Stocks Pounded By 25% But Not Lagging Market On Growth Or Pricing

To the annoyance of some shareholders, Sunny Optical Technology (Group) Company Limited (HKG:2382) shares are down a considerable 25% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 58% loss during that time.

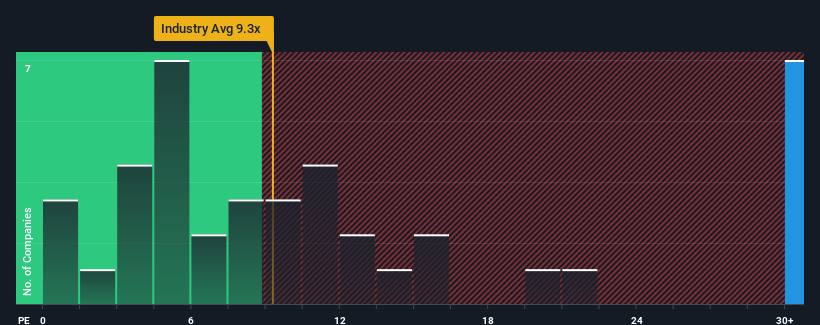

In spite of the heavy fall in price, Sunny Optical Technology (Group)'s price-to-earnings (or "P/E") ratio of 36.4x might still make it look like a strong sell right now compared to the market in Hong Kong, where around half of the companies have P/E ratios below 9x and even P/E's below 5x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

While the market has experienced earnings growth lately, Sunny Optical Technology (Group)'s earnings have gone into reverse gear, which is not great. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Check out our latest analysis for Sunny Optical Technology (Group)

Does Growth Match The High P/E?

In order to justify its P/E ratio, Sunny Optical Technology (Group) would need to produce outstanding growth well in excess of the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 54%. As a result, earnings from three years ago have also fallen 77% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 42% per annum during the coming three years according to the analysts following the company. With the market only predicted to deliver 15% per year, the company is positioned for a stronger earnings result.

In light of this, it's understandable that Sunny Optical Technology (Group)'s P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

A significant share price dive has done very little to deflate Sunny Optical Technology (Group)'s very lofty P/E. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Sunny Optical Technology (Group)'s analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

Having said that, be aware Sunny Optical Technology (Group) is showing 1 warning sign in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on Sunny Optical Technology (Group), explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2382

Sunny Optical Technology (Group)

An investment holding company, engages in designing, researching, developing, manufacturing, and selling optical and optical related products, and scientific instruments.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives