- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:2382

Sunny Optical Technology (Group) Company Limited (HKG:2382) Shares Slammed 33% But Getting In Cheap Might Be Difficult Regardless

Sunny Optical Technology (Group) Company Limited (HKG:2382) shareholders that were waiting for something to happen have been dealt a blow with a 33% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 56% share price decline.

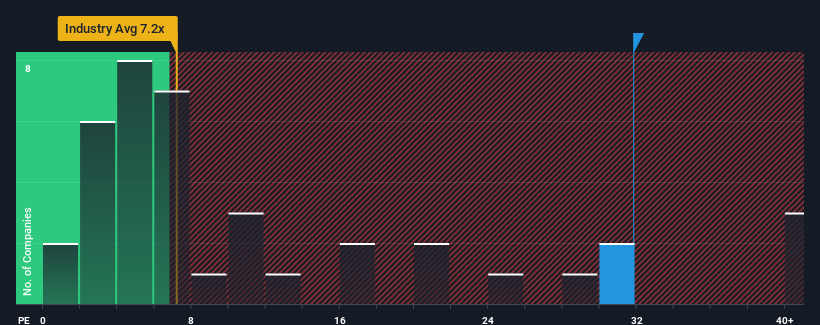

Even after such a large drop in price, given close to half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") below 8x, you may still consider Sunny Optical Technology (Group) as a stock to avoid entirely with its 31.8x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

With earnings that are retreating more than the market's of late, Sunny Optical Technology (Group) has been very sluggish. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Sunny Optical Technology (Group)

Is There Enough Growth For Sunny Optical Technology (Group)?

Sunny Optical Technology (Group)'s P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Retrospectively, the last year delivered a frustrating 59% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 65% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 49% per year over the next three years. Meanwhile, the rest of the market is forecast to only expand by 16% each year, which is noticeably less attractive.

In light of this, it's understandable that Sunny Optical Technology (Group)'s P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Sunny Optical Technology (Group)'s shares may have retreated, but its P/E is still flying high. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Sunny Optical Technology (Group) maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Having said that, be aware Sunny Optical Technology (Group) is showing 1 warning sign in our investment analysis, you should know about.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2382

Sunny Optical Technology (Group)

An investment holding company, engages in designing, researching, developing, manufacturing, and selling optical and optical related products, and scientific instruments.

Flawless balance sheet with moderate growth potential.