- Hong Kong

- /

- Communications

- /

- SEHK:2342

One Comba Telecom Systems Holdings Limited (HKG:2342) Analyst Has Been Cutting Their Forecasts Enthusiastically

The analyst covering Comba Telecom Systems Holdings Limited (HKG:2342) delivered a dose of negativity to shareholders today, by making a substantial revision to their statutory forecasts for this year. This report focused on revenue estimates, and it looks as though the consensus view of the business has become substantially more conservative.

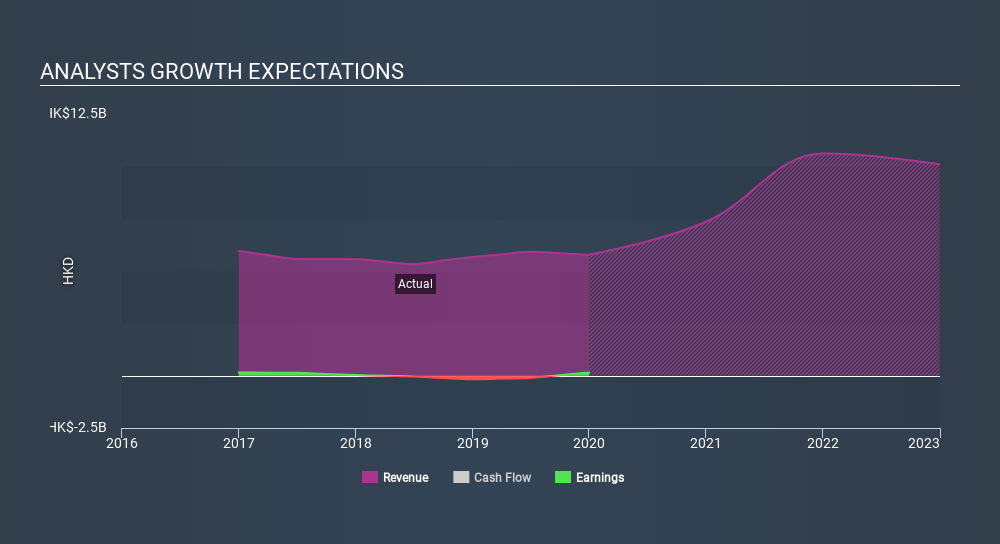

Following the downgrade, the current consensus from Comba Telecom Systems Holdings's lone analyst is for revenues of HK$7.4b in 2020 which - if met - would reflect a substantial 27% increase on its sales over the past 12 months. Before the latest update, the analyst was foreseeing HK$9.1b of revenue in 2020. It looks like forecasts have become a fair bit less optimistic on Comba Telecom Systems Holdings, given the measurable cut to revenue estimates.

Check out our latest analysis for Comba Telecom Systems Holdings

The consensus price target fell 10% to HK$2.96, with the analyst clearly less optimistic about Comba Telecom Systems Holdings's valuation following this update.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. One thing stands out from these estimates, which is that Comba Telecom Systems Holdings is forecast to grow faster in the future than it has in the past, with revenues expected to grow 27%. If achieved, this would be a much better result than the 4.8% annual decline over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in the industry are forecast to see their revenue grow 16% per year. Not only are Comba Telecom Systems Holdings's revenues expected to improve, it seems that the analyst is also expecting it to grow faster than the wider industry.

The Bottom Line

The clear low-light was that the analyst slashing their revenue forecasts for Comba Telecom Systems Holdings this year. The analyst also expects revenues to grow faster than the wider market. The consensus price target fell measurably, with the analyst seemingly not reassured by recent business developments, leading to a lower estimate of Comba Telecom Systems Holdings's future valuation. Often, one downgrade can set off a daisy-chain of cuts, especially if an industry is in decline. So we wouldn't be surprised if the market became a lot more cautious on Comba Telecom Systems Holdings after today.

Unsatisfied? We have forecasts for Comba Telecom Systems Holdings from one covering analyst, and you can see them free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SEHK:2342

Comba Telecom Systems Holdings

An investment holding company, engages in the research and development, manufacture, and sale of wireless telecommunications network system equipment and related engineering services.

Flawless balance sheet and overvalued.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026