Stock Analysis

- Hong Kong

- /

- Communications

- /

- SEHK:2342

Investors in Comba Telecom Systems Holdings (HKG:2342) from three years ago are still down 65%, even after 11% gain this past week

Comba Telecom Systems Holdings Limited (HKG:2342) shareholders will doubtless be very grateful to see the share price up 31% in the last quarter. But that is small recompense for the exasperating returns over three years. In that time, the share price dropped 66%. So it is really good to see an improvement. Perhaps the company has turned over a new leaf.

While the last three years has been tough for Comba Telecom Systems Holdings shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

View our latest analysis for Comba Telecom Systems Holdings

Given that Comba Telecom Systems Holdings only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

In the last three years, Comba Telecom Systems Holdings saw its revenue grow by 7.5% per year, compound. Given it's losing money in pursuit of growth, we are not really impressed with that. It's likely this weak growth has contributed to an annualised return of 18% for the last three years. It can be well worth keeping an eye on growth stocks that disappoint the market, because sometimes they re-accelerate. Keep in mind it isn't unusual for good businesses to have a tough time or a couple of uninspiring years.

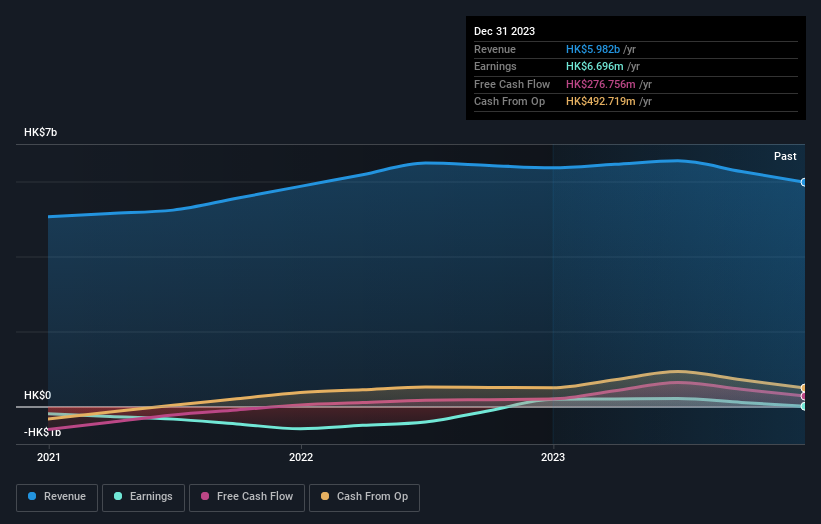

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

Investors in Comba Telecom Systems Holdings had a tough year, with a total loss of 55%, against a market gain of about 6.8%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 10% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Comba Telecom Systems Holdings you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: most of them are flying under the radar).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2342

Comba Telecom Systems Holdings

An investment holding company, research, develops, manufactures, and sells wireless telecommunications network system equipment and related engineering services in Mainland China, rest of Asia Pacific, the Americas, the European Union, the Middle East, and internationally.

Excellent balance sheet and good value.