- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:2038

FIH Mobile (HKG:2038) spikes 11% this week, taking one-year gains to 38%

Passive investing in index funds can generate returns that roughly match the overall market. But you can significantly boost your returns by picking above-average stocks. To wit, the FIH Mobile Limited (HKG:2038) share price is 38% higher than it was a year ago, much better than the market return of around 30% (not including dividends) in the same period. If it can keep that out-performance up over the long term, investors will do very well! However, the longer term returns haven't been so impressive, with the stock up just 14% in the last three years.

Since the stock has added HK$926m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

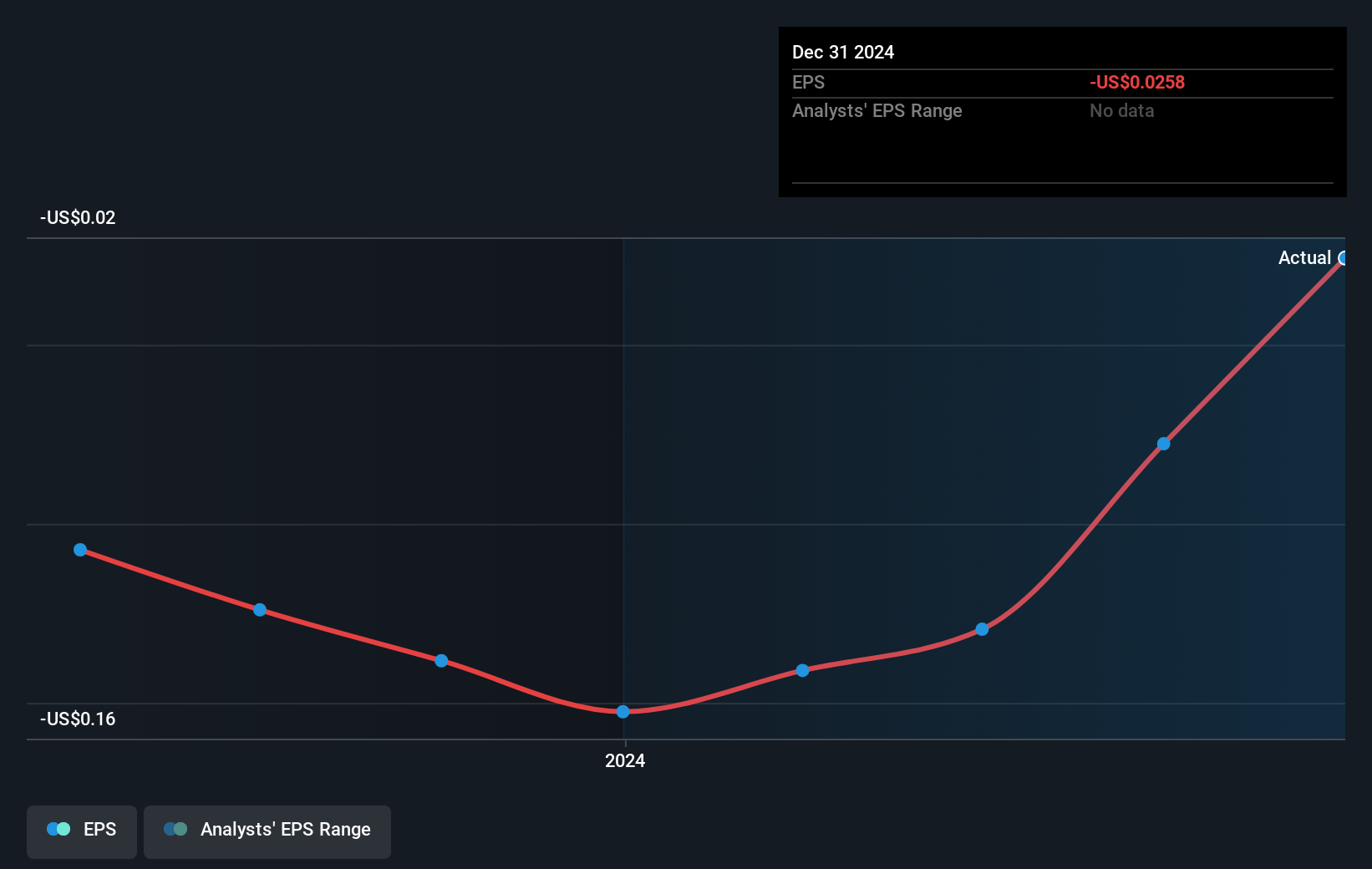

FIH Mobile was able to grow EPS by 83% in the last twelve months. We note, however, that extraordinary items have impacted earnings. It's fair to say that the share price gain of 38% did not keep pace with the EPS growth. Therefore, it seems the market isn't as excited about FIH Mobile as it was before. This could be an opportunity.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. Dive deeper into the earnings by checking this interactive graph of FIH Mobile's earnings, revenue and cash flow.

A Different Perspective

FIH Mobile shareholders have received returns of 38% over twelve months, which isn't far from the general market return. Most would be happy with a gain, and it helps that the year's return is actually better than the average return over five years, which was 6%. It is possible that management foresight will bring growth well into the future, even if the share price slows down. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that FIH Mobile is showing 1 warning sign in our investment analysis , you should know about...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: most of them are flying under the radar).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2038

FIH Mobile

An investment holding company, provides integrated manufacturing services for the handset industry worldwide.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives