- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:1967

The Confidence Intelligence Holdings (HKG:1967) Share Price Has Gained 87% And Shareholders Are Hoping For More

If you want to compound wealth in the stock market, you can do so by buying an index fund. But you can significantly boost your returns by picking above-average stocks. For example, the Confidence Intelligence Holdings Limited (HKG:1967) share price is up 87% in the last year, clearly besting the market return of around 22% (not including dividends). That's a solid performance by our standards! Confidence Intelligence Holdings hasn't been listed for long, so it's still not clear if it is a long term winner.

View our latest analysis for Confidence Intelligence Holdings

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last year, Confidence Intelligence Holdings actually saw its earnings per share drop 58%.

This means it's unlikely the market is judging the company based on earnings growth. Therefore, it seems likely that investors are putting more weight on metrics other than EPS, at the moment.

Revenue was pretty stable on last year, so deeper research might be needed to explain the share price rise.

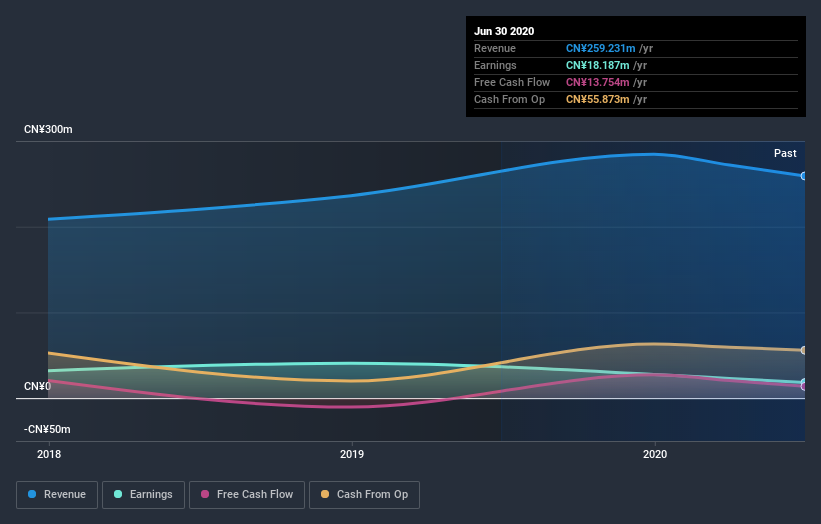

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. It might be well worthwhile taking a look at our free report on Confidence Intelligence Holdings' earnings, revenue and cash flow.

A Different Perspective

It's nice to see that Confidence Intelligence Holdings shareholders have gained 87% over the last year. And the share price momentum remains respectable, with a gain of 67% in the last three months. Demand for the stock from multiple parties is pushing the price higher; it could be that word is getting out about its virtues as a business. It's always interesting to track share price performance over the longer term. But to understand Confidence Intelligence Holdings better, we need to consider many other factors. To that end, you should learn about the 3 warning signs we've spotted with Confidence Intelligence Holdings (including 1 which is a bit unpleasant) .

Of course Confidence Intelligence Holdings may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you decide to trade Confidence Intelligence Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1967

Confidence Intelligence Holdings

An investment holding company, provides electronic manufacturing services in the People's Republic of China, Malaysia, and the United States.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives