- Hong Kong

- /

- Tech Hardware

- /

- SEHK:1810

Xiaomi (SEHK:1810) Valuation in Focus as BASF Coatings Collaboration Fuels Automotive Innovation

Reviewed by Simply Wall St

Xiaomi (SEHK:1810) is expanding its collaboration with BASF Coatings to co-develop 100 new car paint colors over the next three years. The goal is to offer greater personalization for smart vehicles. This move highlights Xiaomi's growing focus on automotive innovation.

See our latest analysis for Xiaomi.

While Xiaomi’s expanded partnership with BASF Coatings has kept the spotlight on its push into automotive tech, share price returns have cooled a bit in the last month, down nearly 18%. Still, momentum over the long run remains striking. The latest 1-year total shareholder return stands at 74%, and the return over three years is 386%, reflecting strong investor confidence in Xiaomi’s broader innovation story.

If you want to see what other automakers are driving change in the sector, check out See the full list for free.

With shares trading at a significant discount to analyst targets and big annual returns drawing attention, the key question for investors is whether Xiaomi is undervalued or if the market has already accounted for its future growth prospects.

Most Popular Narrative: 30.8% Undervalued

Xiaomi’s latest fair value, derived from the most widely followed narrative, comes in at HK$64.87. This is substantially above the last closing price of HK$44.92. This suggests that market participants see further upside, even after Xiaomi’s significant multi-year rally.

"The company's successful push into premiumization, evidenced by growing sales of high-end smartphones, appliances, and electric vehicles, along with the launch of proprietary 3nm chips and advanced AI features, supports higher average selling prices and improves net margins as Xiaomi captures greater value per customer."

The assumptions behind this fair value are bold. Imagine a blend of strong revenue growth, expanding profit margins, and ambitious product upgrades fueling Xiaomi’s numbers. Curious what projections power the rationale and what might have to go right for Xiaomi to meet these lofty expectations? You won’t believe the details until you see the narrative in full.

Result: Fair Value of $64.87 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent competition in mature smartphone markets and rising costs for key components could limit Xiaomi's margin improvements and earnings growth in the years ahead.

Find out about the key risks to this Xiaomi narrative.

Another View: What Do Market Ratios Say?

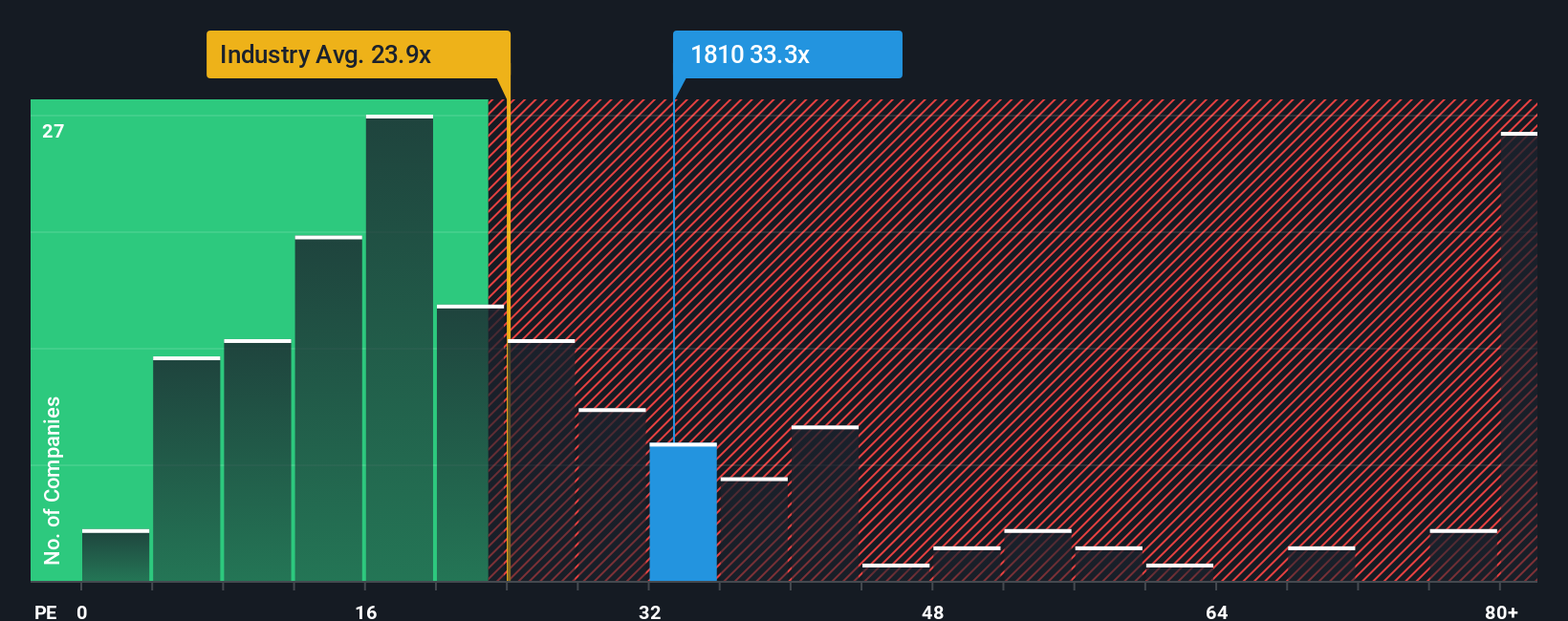

Looking at Xiaomi’s earnings ratio compared to others, there are some yellow flags for value-focused investors. Xiaomi trades at 28.7 times earnings, higher than both the average for the Asian Tech industry (24.3) and its peers (20.5). The fair ratio sits even lower at 26.1. This premium could either reflect investor optimism about Xiaomi’s future or signal a valuation risk if growth expectations are not met. Are investors taking on more risk for less value, or is there real upside still hidden in the story?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Xiaomi Narrative

If you see the story differently or want to put your own data to the test, you can build a Xiaomi narrative in just minutes. Do it your way

A great starting point for your Xiaomi research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Angles?

Don’t just watch from the sidelines. Take action with investment ideas designed to help you spot the biggest opportunities before others catch on.

- Maximize your returns by tapping into steady income opportunities with these 21 dividend stocks with yields > 3% offering yields above 3% and robust financial foundations.

- Position yourself at the forefront of market trends and innovation by tracking these 26 AI penny stocks making advances in automation, data, and next-generation analytics.

- Supercharge your portfolio’s potential for growth by targeting these 868 undervalued stocks based on cash flows where market prices lag behind underlying cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1810

Xiaomi

An investment holding company, engages in the development and sales of smartphones in Mainland China and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives