- Hong Kong

- /

- Tech Hardware

- /

- SEHK:1810

Xiaomi (SEHK:1810): Assessing Valuation After Recent Share Price Pullback

Reviewed by Simply Wall St

Xiaomi (SEHK:1810) shares have been active in recent sessions, catching investor interest amid shifts in Hong Kong’s tech sector. Traders are considering how recent market conditions may affect Xiaomi’s performance and valuation in the coming months.

See our latest analysis for Xiaomi.

Xiaomi’s share price has pulled back by over 10% in the past month after some earlier momentum. It is still sitting on a remarkable year-to-date gain of nearly 28%. Even more striking, the stock’s one-year total shareholder return stands at 56%, with a massive 322% total return in the past three years as optimism in the tech space continues to fuel long-term growth expectations.

If you’re looking to discover other innovative tech names with a similar growth profile, now’s a great moment to explore See the full list for free..

With these impressive returns and strong financial growth, investors are now weighing a key question: is Xiaomi's recent dip a chance to pick up future gains at a discount, or has the market already factored in its growth story?

Most Popular Narrative: 30.9% Undervalued

The narrative consensus points to a fair value for Xiaomi notably above its recent close, reflecting confidence in the company’s strategy and future growth engine. Here is a direct quote that highlights what is driving this market view.

Continued rapid expansion of Xiaomi's AIoT and smart appliance ecosystem, reinforced by aggressive offline and new retail channel expansion, especially internationally, positions the company to benefit from surging demand for connected living. This should underpin sustained revenue growth and improve cross-selling momentum across product lines.

Want to know the secret behind Xiaomi’s high valuation target? It is built on ambitious global growth plans and bold assumptions about future profitability and margins. The underlying financial forecasts are anything but ordinary. What does the narrative really expect? Is it steady expansion or something more? Dive into the full analysis to uncover the quantitative story behind these projections.

Result: Fair Value of $62.94 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent margin pressures or a global slowdown in smartphone demand could quickly challenge even the most optimistic growth assumptions for Xiaomi.

Find out about the key risks to this Xiaomi narrative.

Another View: What Do Market Multiples Say?

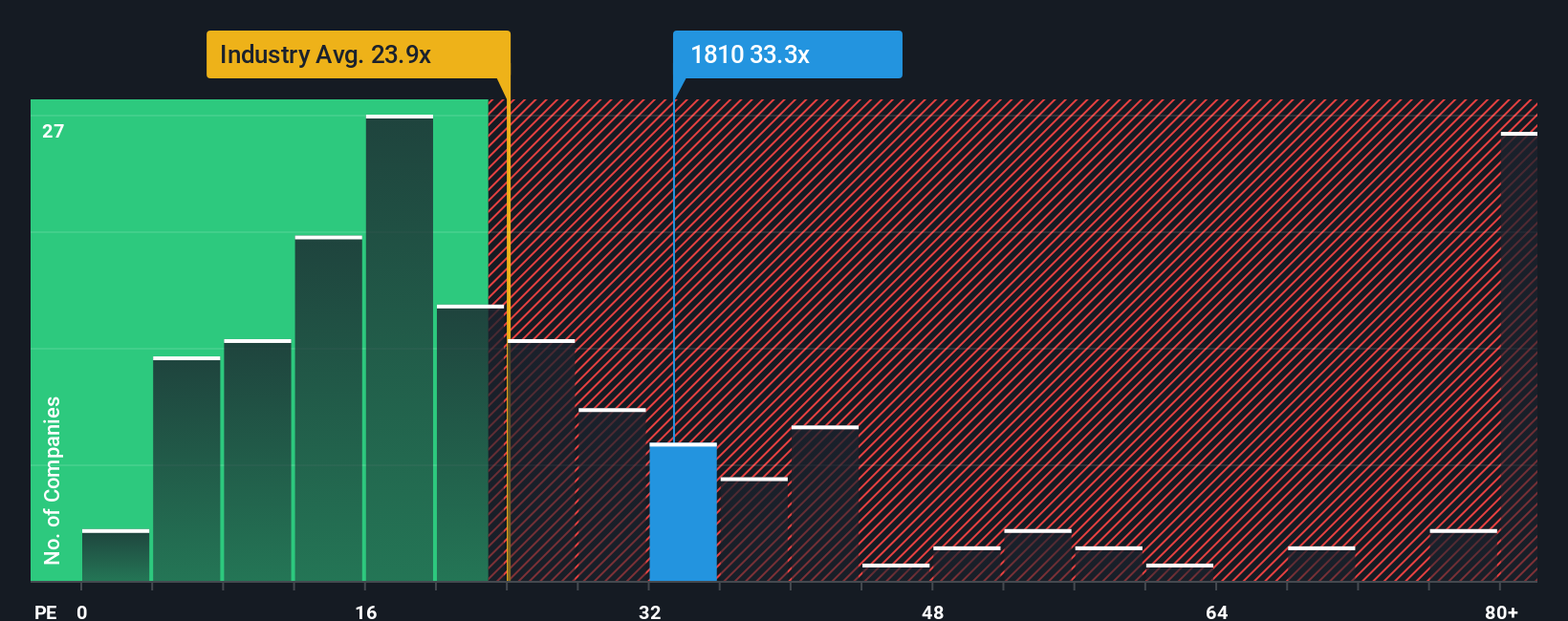

Looking through the lens of market ratios, Xiaomi's price-to-earnings ratio is currently 28x. This is higher than the Asian Tech industry average of 23x, and also above its peer group at 19.3x. More tellingly, it surpasses the fair ratio of 23.8x, which is where the market could eventually settle. This gap suggests investors are paying a premium for Xiaomi's growth potential, but it also increases the risk if growth falls short. Is this optimism justified, or is the market getting ahead of itself?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Xiaomi Narrative

If you have a different perspective or enjoy digging into the details yourself, you can shape your own Xiaomi outlook in just a few minutes. Do it your way.

A great starting point for your Xiaomi research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Ready to make your next smart move? Don’t miss out on these unique stock opportunities, handpicked to match different investment styles and interests.

- Capture high yields and stable income by starting with these 14 dividend stocks with yields > 3% to spot companies offering attractive payouts above 3%.

- Seize the upside potential in game-changing technology by targeting these 27 AI penny stocks driving innovation in artificial intelligence.

- Get ahead of the crowd and secure value by checking out these 878 undervalued stocks based on cash flows with strong future cash flow prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1810

Xiaomi

An investment holding company, engages in the development and sales of smartphones in Mainland China and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives