- Hong Kong

- /

- Tech Hardware

- /

- SEHK:1810

How Investors Are Reacting To Xiaomi (SEHK:1810) Teaming Up With BASF Coatings For Automotive Paint Innovation

Reviewed by Sasha Jovanovic

- In October 2025, BASF Coatings announced an expanded partnership with Xiaomi to co-develop 100 innovative automotive paint colors over the next three years, aiming to transform personalization and aesthetics in smart vehicles with advanced coating technologies.

- This collaboration highlights Xiaomi's commitment to product differentiation and reinforces its growing presence in the automotive sector through design innovation.

- We'll explore how Xiaomi's push for automotive color innovation with BASF Coatings could further shape its investment narrative and market positioning.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Xiaomi Investment Narrative Recap

For any potential Xiaomi shareholder, the key belief centers on the company's ability to accelerate growth beyond its core smartphone business, particularly through innovation and entry into higher-margin sectors like smart EVs. The expanded partnership with BASF Coatings underscores Xiaomi’s efforts to differentiate its electric vehicles, but this update is unlikely to materially affect the near-term catalyst, which remains the success of Xiaomi's broader premiumization and global expansion strategies. The main risk, persistent pressure on margins from price competition and slow premiumization in global smartphone markets, remains unchanged by this news.

Among recent announcements, the June 2025 launch of the YU7 electric SUV stands out as directly relevant. This product debut, featuring new design elements such as Ambilight’s smart dimming sunroof, demonstrates how Xiaomi integrates advanced partnerships and product innovation to enhance its market positioning in automotive, a core area of expected future growth.

In contrast, investors should also be mindful of the ongoing risk from Xiaomi's continued reliance on lower-margin smartphone segments and rising industry costs...

Read the full narrative on Xiaomi (it's free!)

Xiaomi's narrative projects CN¥765.2 billion in revenue and CN¥69.6 billion in earnings by 2028. This requires 21.3% yearly revenue growth and an increase of CN¥32.4 billion in earnings from the current CN¥37.2 billion.

Uncover how Xiaomi's forecasts yield a HK$64.87 fair value, a 42% upside to its current price.

Exploring Other Perspectives

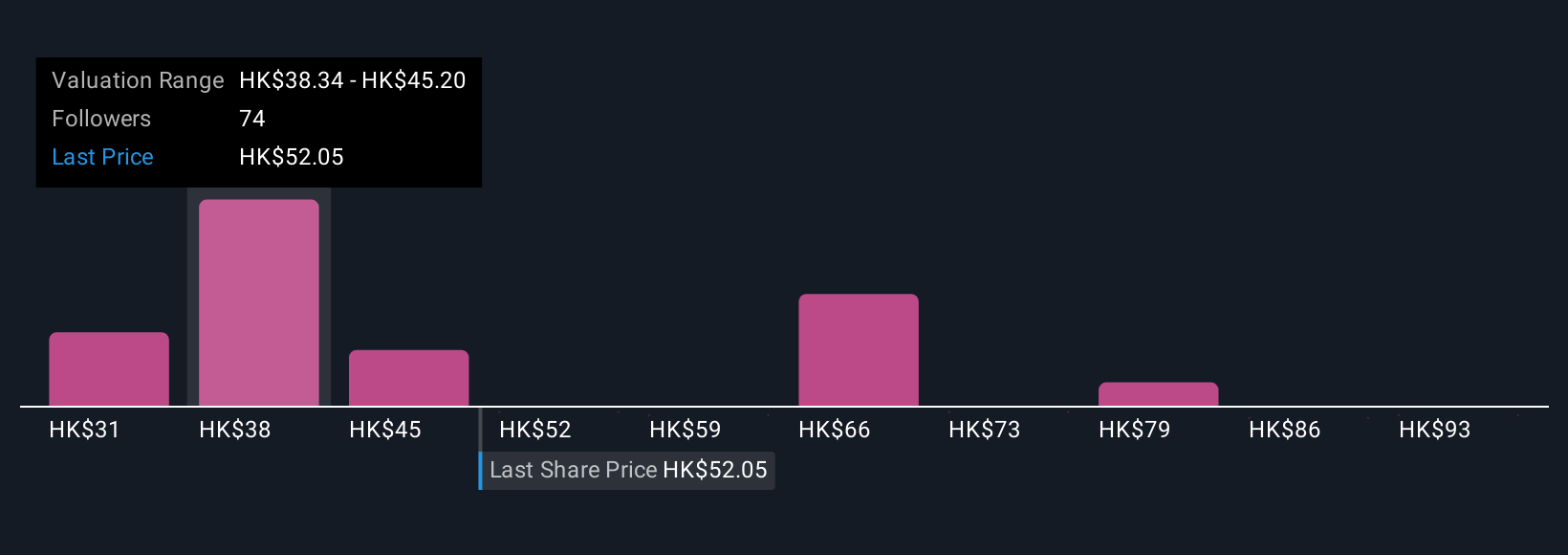

Simply Wall St Community members offered 16 fair value estimates for Xiaomi ranging from HK$31.49 to HK$80.26 per share. As opinions differ widely, remember Xiaomi's success in premiumization and international expansion continues to shape the company’s next phase, explore several distinct viewpoints before forming your own.

Explore 16 other fair value estimates on Xiaomi - why the stock might be worth as much as 75% more than the current price!

Build Your Own Xiaomi Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Xiaomi research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Xiaomi research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Xiaomi's overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1810

Xiaomi

An investment holding company, engages in the development and sales of smartphones in Mainland China and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives