- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:1710

Trio Industrial Electronics Group (HKG:1710) Has Announced That It Will Be Increasing Its Dividend To HK$0.012

Trio Industrial Electronics Group Limited's (HKG:1710) dividend will be increasing on the 5th of July to HK$0.012, with investors receiving 50% more than last year. This will take the dividend yield to an attractive 8.1%, providing a nice boost to shareholder returns.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Investors will be pleased to see that Trio Industrial Electronics Group's stock price has increased by 44% in the last 3 months, which is good for shareholders and can also explain a decrease in the dividend yield.

Check out our latest analysis for Trio Industrial Electronics Group

Trio Industrial Electronics Group Doesn't Earn Enough To Cover Its Payments

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. Based on the last payment, Trio Industrial Electronics Group was quite comfortably earning enough to cover the dividend. This indicates that a lot of the earnings are being reinvested into the business, with the aim of fueling growth.

If the company can't turn things around, EPS could fall by 31.6% over the next year. If the dividend continues along recent trends, we estimate the payout ratio could reach 152%, which could put the dividend in jeopardy if the company's earnings don't improve.

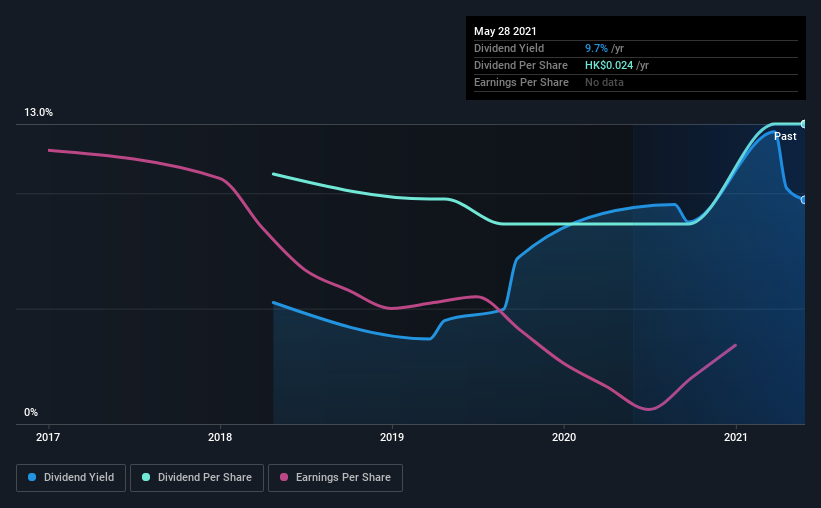

Trio Industrial Electronics Group's Dividend Has Lacked Consistency

Looking back, the dividend has been unstable but with a relatively short history, we think it may be a bit early to draw conclusions about long term dividend sustainability. The dividend has gone from HK$0.02 in 2018 to the most recent annual payment of HK$0.024. This implies that the company grew its distributions at a yearly rate of about 6.3% over that duration. It's good to see the dividend growing at a decent rate, but the dividend has been cut at least once in the past. Trio Industrial Electronics Group might have put its house in order since then, but we remain cautious.

Dividend Growth Potential Is Shaky

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. Earnings per share has been sinking by 32% over the last three years. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future.

In Summary

In summary, while it's always good to see the dividend being raised, we don't think Trio Industrial Electronics Group's payments are rock solid. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to it. We don't think Trio Industrial Electronics Group is a great stock to add to your portfolio if income is your focus.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Just as an example, we've come across 4 warning signs for Trio Industrial Electronics Group you should be aware of, and 1 of them shouldn't be ignored. We have also put together a list of global stocks with a solid dividend.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Trio Industrial Electronics Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1710

Trio Industrial Electronics Group

An investment holding company, provides customized engineering and contract manufacturing services in the People's Republic of China, South-east Asia, North America, Europe, and internationally.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives