- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:1708

Nanjing Sample Technology (HKG:1708) Has Some Difficulty Using Its Capital Effectively

To avoid investing in a business that's in decline, there's a few financial metrics that can provide early indications of aging. Typically, we'll see the trend of both return on capital employed (ROCE) declining and this usually coincides with a decreasing amount of capital employed. This indicates to us that the business is not only shrinking the size of its net assets, but its returns are falling as well. On that note, looking into Nanjing Sample Technology (HKG:1708), we weren't too upbeat about how things were going.

Return On Capital Employed (ROCE): What Is It?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. The formula for this calculation on Nanjing Sample Technology is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.0073 = CN¥13m ÷ (CN¥2.9b - CN¥1.1b) (Based on the trailing twelve months to December 2023).

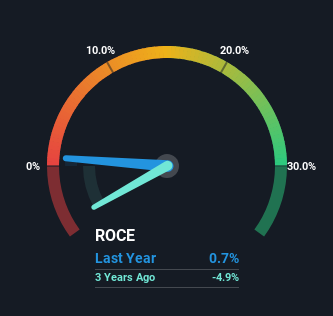

So, Nanjing Sample Technology has an ROCE of 0.7%. In absolute terms, that's a low return and it also under-performs the Electronic industry average of 7.5%.

View our latest analysis for Nanjing Sample Technology

Historical performance is a great place to start when researching a stock so above you can see the gauge for Nanjing Sample Technology's ROCE against it's prior returns. If you'd like to look at how Nanjing Sample Technology has performed in the past in other metrics, you can view this free graph of Nanjing Sample Technology's past earnings, revenue and cash flow.

The Trend Of ROCE

The trend of returns that Nanjing Sample Technology is generating are raising some concerns. The company used to generate 11% on its capital five years ago but it has since fallen noticeably. In addition to that, Nanjing Sample Technology is now employing 33% less capital than it was five years ago. The combination of lower ROCE and less capital employed can indicate that a business is likely to be facing some competitive headwinds or seeing an erosion to its moat. Typically businesses that exhibit these characteristics aren't the ones that tend to multiply over the long term, because statistically speaking, they've already gone through the growth phase of their life cycle.

The Key Takeaway

In summary, it's unfortunate that Nanjing Sample Technology is shrinking its capital base and also generating lower returns. Unsurprisingly then, the stock has dived 93% over the last five years, so investors are recognizing these changes and don't like the company's prospects. That being the case, unless the underlying trends revert to a more positive trajectory, we'd consider looking elsewhere.

On a final note, we found 4 warning signs for Nanjing Sample Technology (1 is concerning) you should be aware of.

While Nanjing Sample Technology isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

Valuation is complex, but we're here to simplify it.

Discover if Nanjing Sample Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1708

Nanjing Sample Technology

Provides visual identification and radio frequency identification (RFID) solutions to intelligent transportation, customs logistics, and other application areas in the People’s Republic of China.

Adequate balance sheet with very low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026