Global markets have recently witnessed significant shifts, with U.S. stocks rallying to record highs following a "red sweep" election outcome, which has spurred optimism around growth and tax policies. As investors navigate these evolving conditions, penny stocks—often representing smaller or newer companies—remain an intriguing investment area due to their affordability and potential for growth. Despite being seen as a relic of past market eras, penny stocks continue to offer opportunities for those seeking value in the current economic landscape.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.24 | MYR349.03M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.79 | MYR136.84M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.83 | HK$526.87M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.495 | MYR2.46B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.76 | A$139.45M | ★★★★☆☆ |

| Wellcall Holdings Berhad (KLSE:WELLCAL) | MYR1.53 | MYR761.86M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.87 | MYR288.79M | ★★★★★★ |

| Seafco (SET:SEAFCO) | THB2.12 | THB1.72B | ★★★★★★ |

| Kelington Group Berhad (KLSE:KGB) | MYR2.96 | MYR2.04B | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.87 | £384.89M | ★★★★☆☆ |

Click here to see the full list of 5,740 stocks from our Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Sinohope Technology Holdings (SEHK:1611)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sinohope Technology Holdings Limited is an investment holding company that provides technology solution services in The People’s Republic of China and internationally, with a market cap of approximately HK$969.20 million.

Operations: The company's revenue is derived from its Virtual Asset Ecosystem segment, totaling HK$1.09 billion.

Market Cap: HK$969.2M

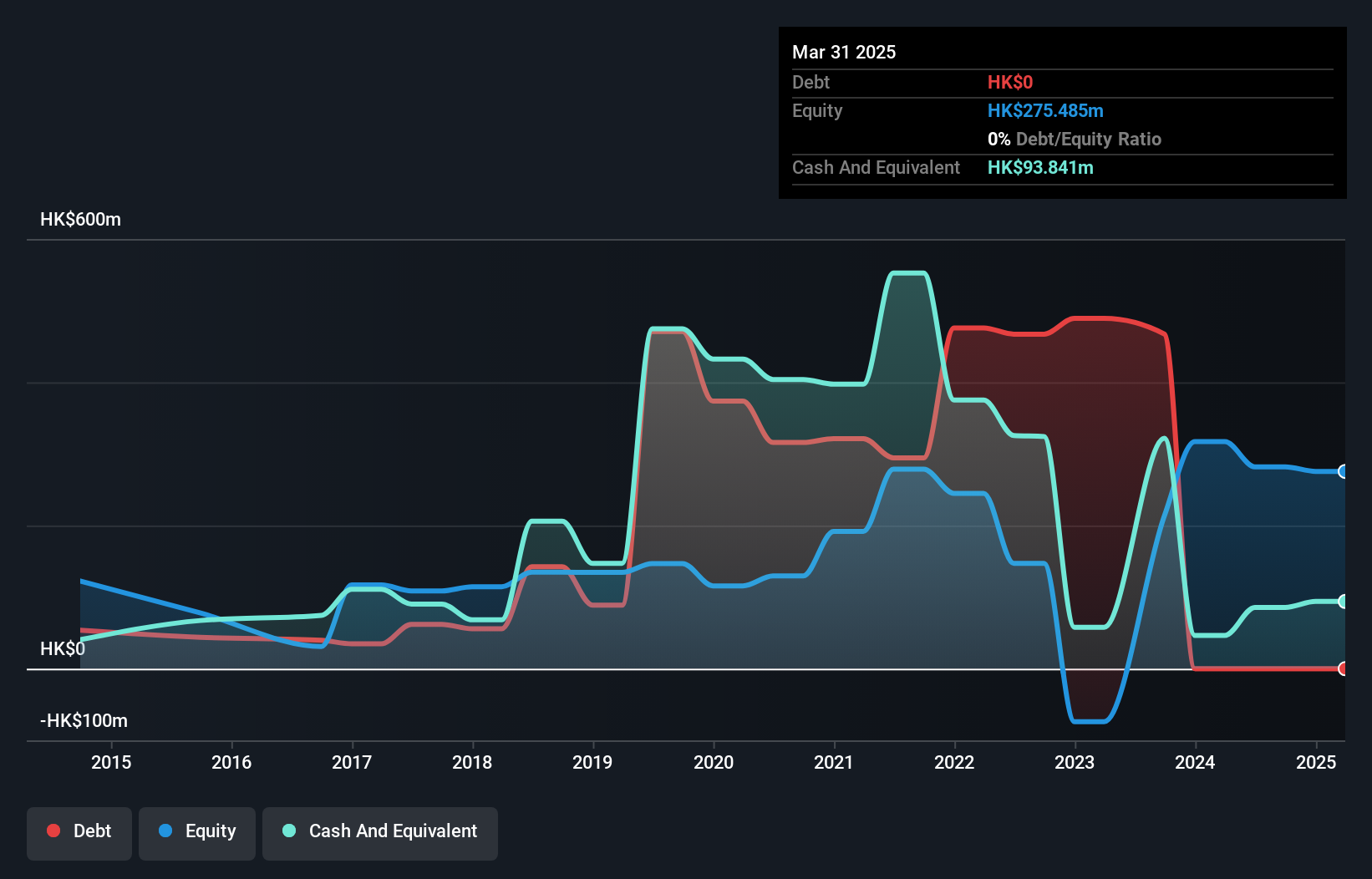

Sinohope Technology Holdings has recently transitioned to profitability, eliminating its debt and establishing a stable financial position with short-term assets of HK$330.3 million significantly exceeding liabilities. Despite a low return on equity at 13.4%, the company benefits from high non-cash earnings quality and no shareholder dilution over the past year. Recent changes in company bylaws suggest strategic shifts, while board and management tenure indicate relatively fresh leadership. The appointment of Ms. Peng Sisi as Company Secretary underscores an emphasis on governance expertise amid these developments, although the board's limited experience could pose challenges in navigating future growth trajectories effectively.

- Navigate through the intricacies of Sinohope Technology Holdings with our comprehensive balance sheet health report here.

- Examine Sinohope Technology Holdings' past performance report to understand how it has performed in prior years.

China ITS (Holdings) (SEHK:1900)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: China ITS (Holdings) Co., Ltd. is an investment holding company that offers products, specialized solutions, and services for infrastructure technology in China and internationally, with a market cap of HK$357.80 million.

Operations: The company's revenue is derived from two main segments: the Energy business, contributing CN¥572.68 million, and the Railway Business, generating CN¥223.68 million.

Market Cap: HK$357.8M

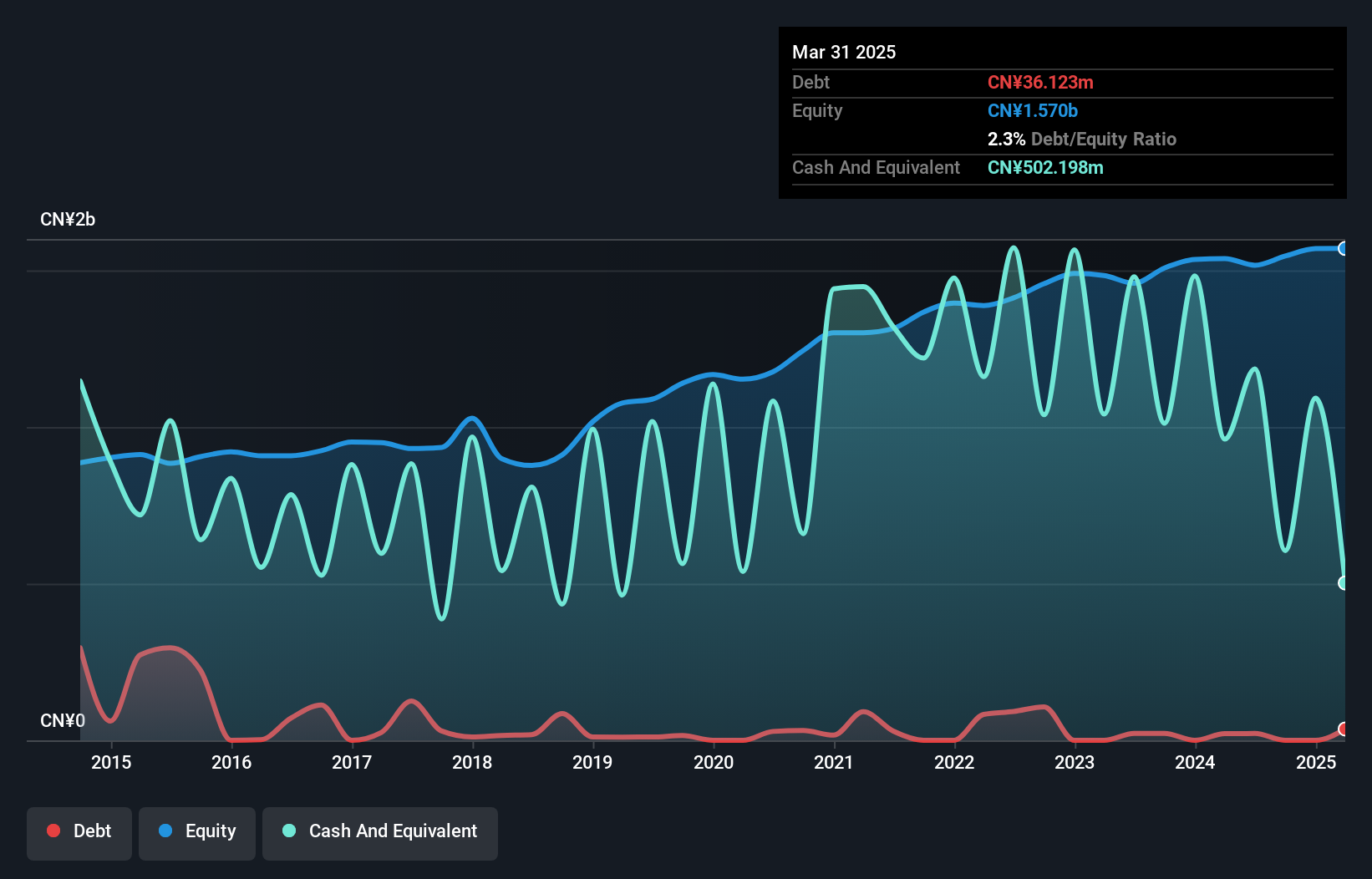

China ITS (Holdings) Co., Ltd. has demonstrated financial volatility, with recent earnings showing a decline in sales to CN¥285.09 million and a net loss of CN¥38.39 million for the first half of 2024, largely due to adverse fair value changes in financial assets and foreign exchange losses from its Myanmar operations. Despite this, the company maintains more cash than total debt and covers short-term liabilities with assets totaling CN¥1.9 billion. Its price-to-earnings ratio is favorable compared to the Hong Kong market average, but profit margins have decreased significantly from last year’s figures. The board's experience averages 8.3 years, providing stability amid challenges such as high share price volatility and low return on equity at 4%.

- Get an in-depth perspective on China ITS (Holdings)'s performance by reading our balance sheet health report here.

- Explore historical data to track China ITS (Holdings)'s performance over time in our past results report.

Tsann Kuen (China) Enterprise (SZSE:200512)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tsann Kuen (China) Enterprise Co., Ltd. and its subsidiaries develop, manufacture, and sell small home appliances for gourmet cooking, home assistance, tea, and coffee across various continents including Asia, Australia, Africa, America, and Europe with a market cap of HK$847.24 million.

Operations: The company's revenue primarily comes from its small home appliance manufacturing segment, generating CN¥1.64 billion.

Market Cap: HK$847.24M

Tsann Kuen (China) Enterprise Co., Ltd. has shown mixed financial performance with recent earnings reporting sales of CN¥1.33 billion for the first nine months of 2024, up from CN¥1.11 billion a year ago, though net income decreased to CN¥56.94 million from CN¥65.92 million. The company benefits from being debt-free, which alleviates interest payment concerns and enhances financial stability despite declining earnings over the past five years at an annual rate of 6.3%. Its price-to-earnings ratio is relatively low at 9.9x compared to the Chinese market average, suggesting potential value for investors seeking lower valuation stocks amidst unstable dividends and low return on equity at 6.7%.

- Dive into the specifics of Tsann Kuen (China) Enterprise here with our thorough balance sheet health report.

- Gain insights into Tsann Kuen (China) Enterprise's past trends and performance with our report on the company's historical track record.

Seize The Opportunity

- Unlock our comprehensive list of 5,740 Penny Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1900

China ITS (Holdings)

An investment holding company, provides products, specialized solutions, and services related to infrastructure technology in the People’s Republic of China and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives