- Singapore

- /

- Consumer Finance

- /

- SGX:S41

3 Promising Penny Stocks To Consider In December 2024

Reviewed by Simply Wall St

Global markets have experienced a mixed performance recently, with major U.S. stock indexes like the S&P 500 and Nasdaq Composite reaching record highs, while smaller-cap stocks underperformed. Amidst this backdrop, investors are turning their attention to opportunities that offer both value and growth potential. The term "penny stocks" may seem outdated, yet these often represent smaller or newer companies with the potential for significant upside when backed by strong financials. Here, we explore three penny stocks that stand out for their financial strength and growth prospects in today's market landscape.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.505 | MYR2.51B | ★★★★★★ |

| Teo Seng Capital Berhad (KLSE:TEOSENG) | MYR2.33 | MYR346.54M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

| ME Group International (LSE:MEGP) | £2.105 | £793.09M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.885 | MYR293.77M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.56 | A$65.64M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.435 | MYR1.21B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.05 | HK$44.6B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.87 | HK$539.57M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.48 | £66.37M | ★★★★☆☆ |

Click here to see the full list of 5,706 stocks from our Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Vocento (BME:VOC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Vocento, S.A. is a multimedia communications company operating in Spain with a market cap of €81.64 million.

Operations: The company's revenue is primarily derived from its regional newspapers (€196.61 million), ABC newspaper (€79.40 million), agencies and others (€26.33 million), classifieds excluding digital services (€29.65 million), food (€14.78 million), digital services (€2.91 million), and supplements and magazines (€15.06 million).

Market Cap: €81.64M

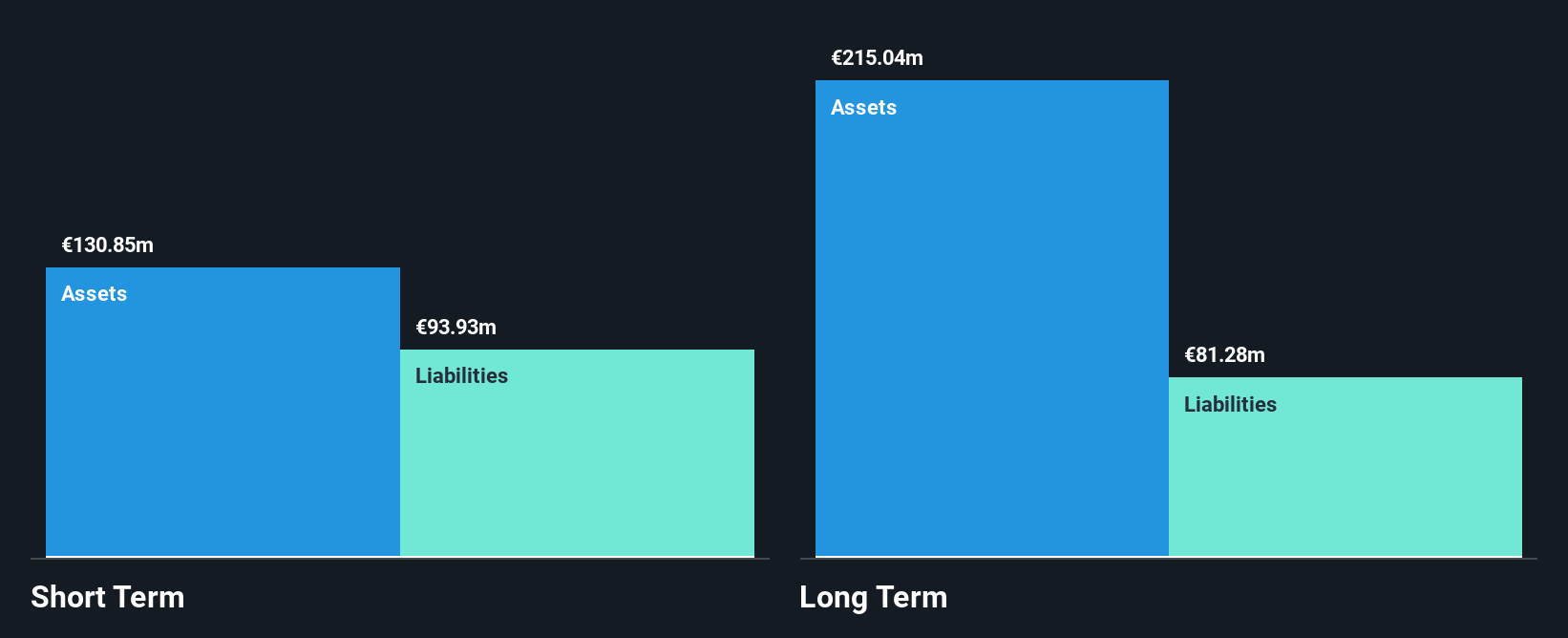

Vocento, S.A., with a market cap of €81.64 million, shows potential as a penny stock due to its diversified revenue streams from regional newspapers and other media-related ventures. Despite being unprofitable with a negative return on equity (-0.58%), the company has managed to reduce its debt-to-equity ratio over five years and maintain a satisfactory net debt level (17.5%). While earnings are forecasted to grow significantly at 105.45% annually, recent reports indicate an increased net loss of €26.97 million for the first nine months of 2024 compared to the previous year, highlighting ongoing profitability challenges amidst stable cash runway prospects exceeding three years.

- Get an in-depth perspective on Vocento's performance by reading our balance sheet health report here.

- Examine Vocento's earnings growth report to understand how analysts expect it to perform.

Sinohope Technology Holdings (SEHK:1611)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sinohope Technology Holdings Limited is an investment holding company that provides technology solution services in The People's Republic of China and internationally, with a market capitalization of approximately HK$1.03 billion.

Operations: The company generates revenue from its Virtual Asset Ecosystem segment, totaling HK$1.09 billion.

Market Cap: HK$1.03B

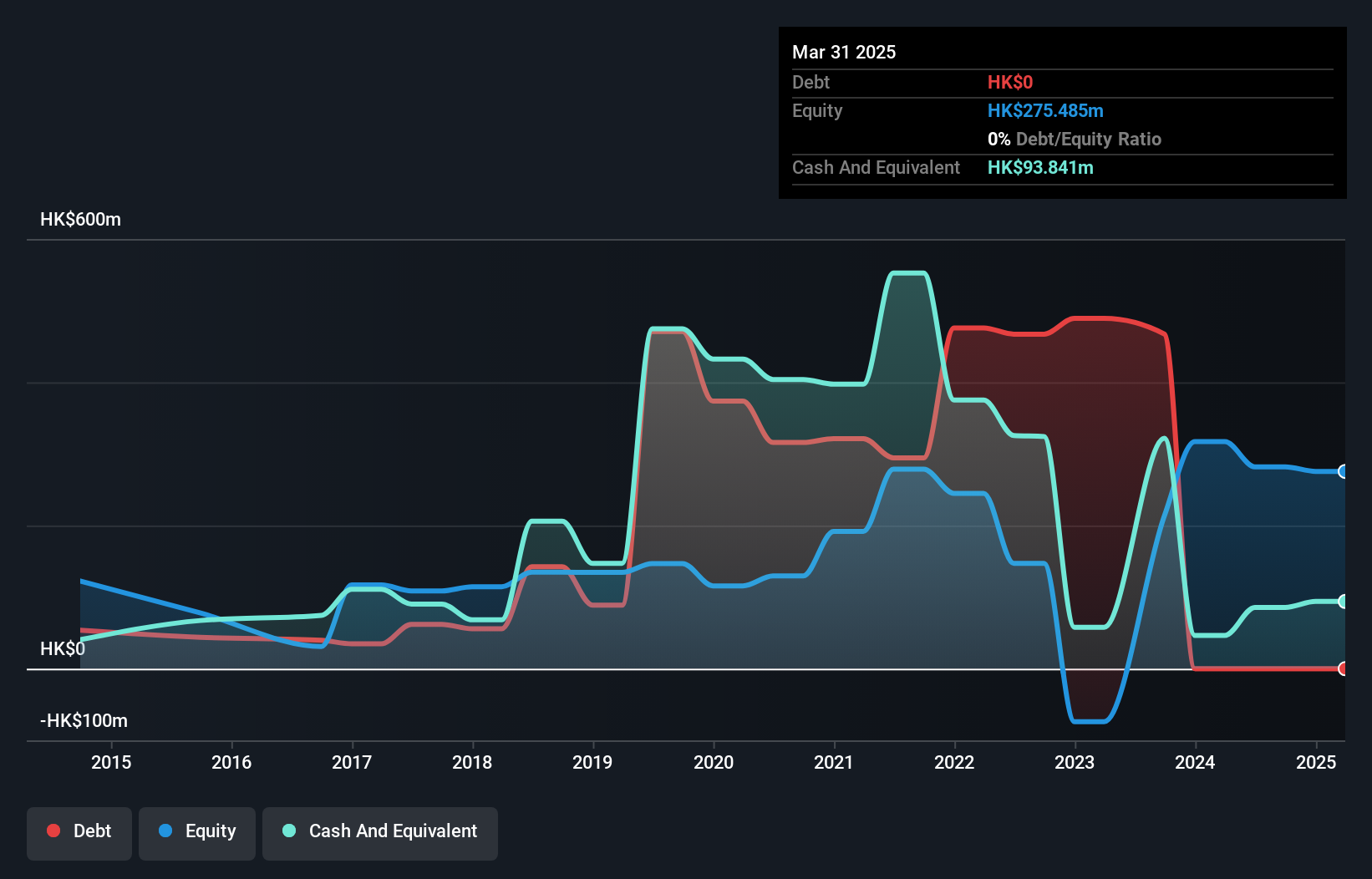

Sinohope Technology Holdings, with a market cap of HK$1.03 billion, has recently achieved profitability after years of losses. The company's revenue from its Virtual Asset Ecosystem segment stands at HK$1.09 billion, supported by strong short-term assets exceeding liabilities significantly (HK$330.3M vs HK$13.6M). Despite no long-term debt and a stable management team with an average tenure of 3.2 years, the stock remains highly volatile compared to most Hong Kong stocks over the past year. Recent amendments to its memorandum and articles suggest potential strategic shifts but do not directly impact current financial performance or stability.

- Click here and access our complete financial health analysis report to understand the dynamics of Sinohope Technology Holdings.

- Gain insights into Sinohope Technology Holdings' historical outcomes by reviewing our past performance report.

Hong Leong Finance (SGX:S41)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Hong Leong Finance Limited is a financial services company serving consumer and SME markets in Singapore, with a market cap of SGD1.10 billion.

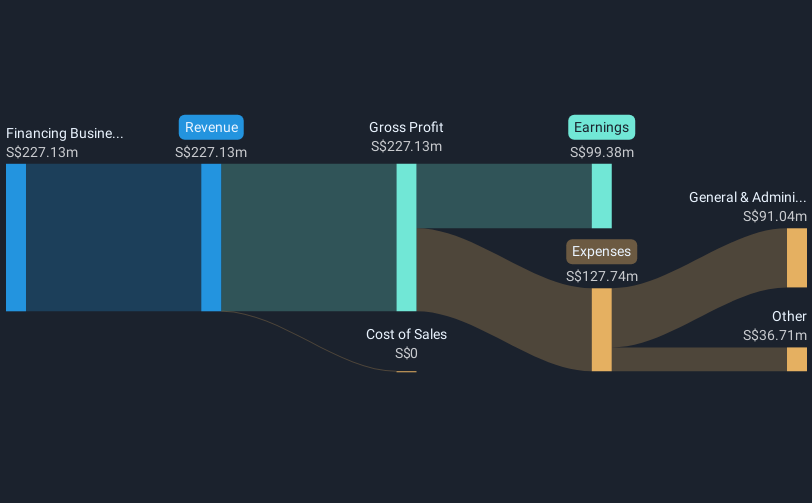

Operations: The company generates revenue primarily from its Financing Business, amounting to SGD227.13 million.

Market Cap: SGD1.1B

Hong Leong Finance, with a market cap of SGD1.10 billion, has shown mixed performance indicators typical of penny stocks. Despite stable weekly volatility and an experienced management team averaging 8.2 years in tenure, the company faces challenges with negative earnings growth over the past year and a low return on equity at 4.8%. Its financial health is supported by an appropriate level of bad loans (0.5%) and primarily low-risk funding from customer deposits (98%). While its price-to-earnings ratio is slightly below the Singapore market average, profit margins have declined compared to last year.

- Jump into the full analysis health report here for a deeper understanding of Hong Leong Finance.

- Examine Hong Leong Finance's past performance report to understand how it has performed in prior years.

Summing It All Up

- Access the full spectrum of 5,706 Penny Stocks by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hong Leong Finance might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:S41

Hong Leong Finance

Operates as a financial service company for consumer, and small and medium-sized enterprises (SMEs) markets in Singapore.

Excellent balance sheet second-rate dividend payer.