We Think Kingboard Holdings Limited's (HKG:148) CEO Compensation Package Needs To Be Put Under A Microscope

Key Insights

- Kingboard Holdings to hold its Annual General Meeting on 26th of May

- CEO Wing Yiu Chang's total compensation includes salary of HK$3.17m

- Total compensation is 307% above industry average

- Over the past three years, Kingboard Holdings' EPS fell by 47% and over the past three years, the total loss to shareholders 22%

Kingboard Holdings Limited (HKG:148) has not performed well recently and CEO Wing Yiu Chang will probably need to up their game. Shareholders will be interested in what the board will have to say about turning performance around at the next AGM on 26th of May. This will be also be a chance where they can challenge the board on company direction and vote on resolutions such as executive remuneration. The data we present below explains why we think CEO compensation is not consistent with recent performance.

View our latest analysis for Kingboard Holdings

Comparing Kingboard Holdings Limited's CEO Compensation With The Industry

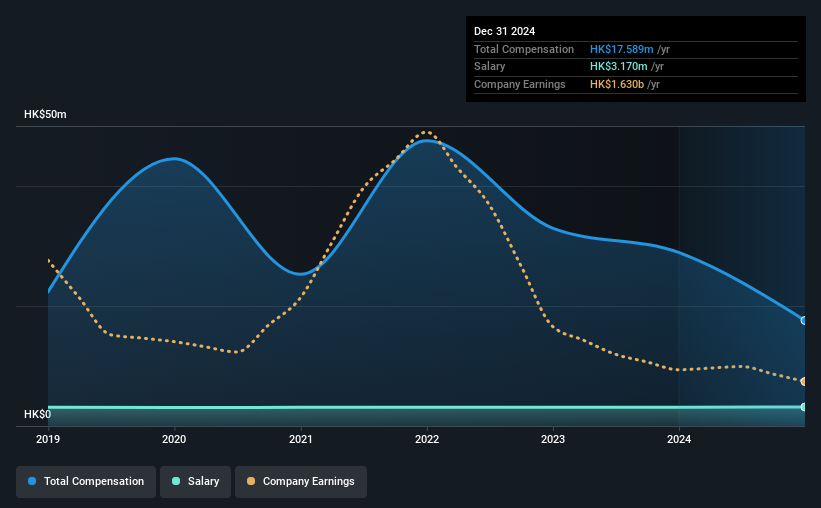

According to our data, Kingboard Holdings Limited has a market capitalization of HK$24b, and paid its CEO total annual compensation worth HK$18m over the year to December 2024. Notably, that's a decrease of 39% over the year before. While we always look at total compensation first, our analysis shows that the salary component is less, at HK$3.2m.

On examining similar-sized companies in the Hong Kong Electronic industry with market capitalizations between HK$16b and HK$50b, we discovered that the median CEO total compensation of that group was HK$4.3m. This suggests that Wing Yiu Chang is paid more than the median for the industry. Furthermore, Wing Yiu Chang directly owns HK$212m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | HK$3.2m | HK$3.1m | 18% |

| Other | HK$14m | HK$26m | 82% |

| Total Compensation | HK$18m | HK$29m | 100% |

Talking in terms of the industry, salary represented approximately 79% of total compensation out of all the companies we analyzed, while other remuneration made up 21% of the pie. Kingboard Holdings pays a modest slice of remuneration through salary, as compared to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

A Look at Kingboard Holdings Limited's Growth Numbers

Over the last three years, Kingboard Holdings Limited has shrunk its earnings per share by 47% per year. Its revenue is up 8.5% over the last year.

Overall this is not a very positive result for shareholders. The modest increase in revenue in the last year isn't enough to make us overlook the disappointing change in EPS. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Kingboard Holdings Limited Been A Good Investment?

Given the total shareholder loss of 22% over three years, many shareholders in Kingboard Holdings Limited are probably rather dissatisfied, to say the least. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

Not only have shareholders not seen a favorable return on their investment, but the business hasn't performed well either. Few shareholders would be willing to award the CEO with a pay raise. At the upcoming AGM, management will get a chance to explain how they plan to get the business back on track and address the concerns from investors.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. We identified 3 warning signs for Kingboard Holdings (1 is potentially serious!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

Valuation is complex, but we're here to simplify it.

Discover if Kingboard Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:148

Kingboard Holdings

An investment holding company, manufactures and sells laminates, printed circuit boards (PCBs), magnetic products, and chemicals in the People’s Republic of China, rest of Asia, Europe, and the United States.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

After the AI Party: A Sobering Look at Microsoft's Future

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026