Q Technology (Group) And 2 More Stocks That May Be Trading Below Estimated Value

Reviewed by Simply Wall St

As global markets continue to navigate the complexities of rising inflation and monetary policy adjustments, U.S. stock indexes are climbing towards record highs, buoyed by investor optimism and strategic economic decisions. In this environment, identifying undervalued stocks can be a prudent strategy for investors seeking potential opportunities amidst market fluctuations. Evaluating factors such as strong fundamentals and growth prospects can help in recognizing stocks that may be trading below their estimated value, like Q Technology (Group) and others in similar positions.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Hibino (TSE:2469) | ¥2796.00 | ¥5515.05 | 49.3% |

| 3onedata (SHSE:688618) | CN¥24.76 | CN¥48.83 | 49.3% |

| Neosem (KOSDAQ:A253590) | ₩12020.00 | ₩23912.59 | 49.7% |

| Shanghai Haohai Biological Technology (SEHK:6826) | HK$26.70 | HK$52.88 | 49.5% |

| Power Wind Health Industry (TWSE:8462) | NT$112.50 | NT$222.53 | 49.4% |

| América Móvil. de (BMV:AMX B) | MX$15.05 | MX$29.71 | 49.3% |

| Sobha (NSEI:SOBHA) | ₹1191.35 | ₹2363.45 | 49.6% |

| Accent Group (ASX:AX1) | A$2.14 | A$4.23 | 49.5% |

| Superloop (ASX:SLC) | A$2.19 | A$4.35 | 49.6% |

| Integral Diagnostics (ASX:IDX) | A$2.89 | A$5.73 | 49.6% |

Below we spotlight a couple of our favorites from our exclusive screener.

Q Technology (Group) (SEHK:1478)

Overview: Q Technology (Group) Company Limited is an investment holding company that designs, develops, manufactures, and sells camera and fingerprint recognition modules in Mainland China, Hong Kong, India, and internationally with a market cap of approximately HK$9.35 billion.

Operations: The company generates revenue primarily from camera modules, which account for CN¥13.79 billion, and fingerprint recognition modules, contributing CN¥781.23 million.

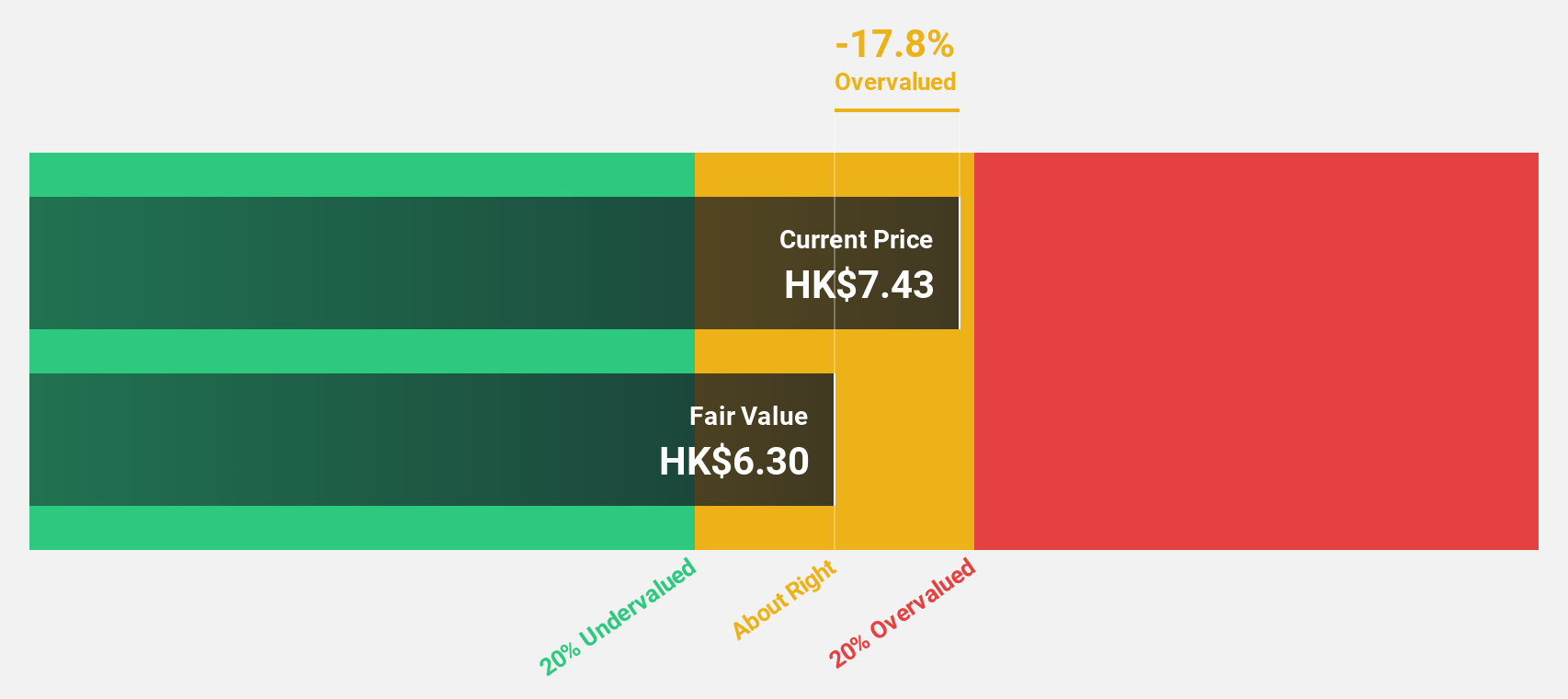

Estimated Discount To Fair Value: 26.3%

Q Technology (Group) appears undervalued with its stock trading at HK$8.1, below the estimated fair value of HK$10.98. Recent sales data shows robust demand for camera and fingerprint recognition modules, supporting a forecasted earnings growth of 40.43% annually, outpacing the Hong Kong market average of 11.7%. Despite a low projected return on equity, significant profit growth driven by increased high-end product sales and improved capacity utilization enhances its cash flow potential.

- Our comprehensive growth report raises the possibility that Q Technology (Group) is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of Q Technology (Group).

Innovent Biologics (SEHK:1801)

Overview: Innovent Biologics, Inc. is a biopharmaceutical company that develops and commercializes monoclonal antibodies and other drug assets for oncology, ophthalmology, autoimmune, and cardiovascular and metabolic diseases in China, with a market cap of approximately HK$64.38 billion.

Operations: The company generates revenue primarily from its biotechnology segment, amounting to approximately CN¥7.46 billion.

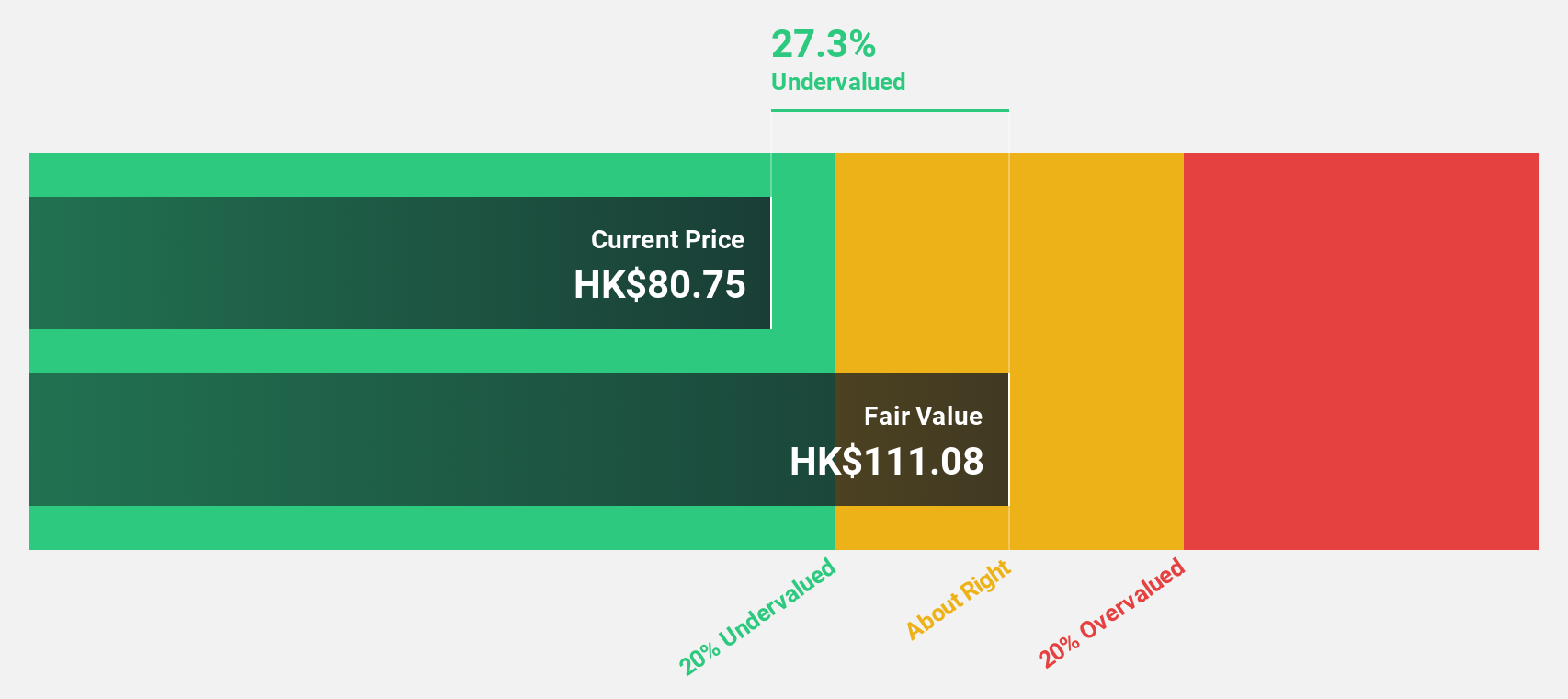

Estimated Discount To Fair Value: 48.7%

Innovent Biologics trades at HK$41.7, significantly below its estimated fair value of HK$81.24, suggesting potential undervaluation based on cash flows. The company reported over RMB 8.2 billion in product revenue for 2024, driven by strong oncology sales and new product momentum like limertinib and DOVBLERON®. Although expected to become profitable within three years with above-average market growth, Innovent's forecasted return on equity remains modest at 15.7%.

- According our earnings growth report, there's an indication that Innovent Biologics might be ready to expand.

- Unlock comprehensive insights into our analysis of Innovent Biologics stock in this financial health report.

Lenovo Group (SEHK:992)

Overview: Lenovo Group Limited is an investment holding company that develops, manufactures, and markets technology products and services, with a market capitalization of approximately HK$146.13 billion.

Operations: The company's revenue is primarily derived from the Intelligent Devices Group at $47.76 billion, followed by the Infrastructure Solutions Group at $11.47 billion and the Solutions and Services Group at $7.89 billion.

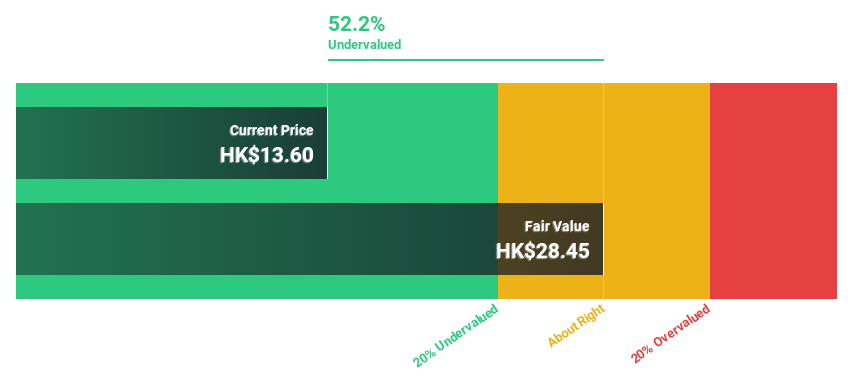

Estimated Discount To Fair Value: 43.9%

Lenovo Group is trading at HK$13.6, below its estimated fair value of HK$24.25, highlighting potential undervaluation based on cash flows. Recent innovations in AI and robotics enhance its market position, while earnings are forecast to grow 15.1% annually—faster than the Hong Kong market's 11.7%. Despite slower revenue growth projections compared to peers, Lenovo's strategic advancements and high projected return on equity (20.2%) bolster its investment appeal amidst industry challenges.

- Insights from our recent growth report point to a promising forecast for Lenovo Group's business outlook.

- Click to explore a detailed breakdown of our findings in Lenovo Group's balance sheet health report.

Summing It All Up

- Embark on your investment journey to our 907 Undervalued Stocks Based On Cash Flows selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Innovent Biologics, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1801

Innovent Biologics

A biopharmaceutical company, develops, manufactures and commercializes monoclonal antibodies and other drug assets in the fields of oncology, ophthalmology, autoimmune, and cardiovascular and metabolic diseases in China.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives