- Hong Kong

- /

- Communications

- /

- SEHK:1523

Exploring Undiscovered Gems in Hong Kong This October 2024

Reviewed by Simply Wall St

As global markets experience fluctuations, with the Hong Kong Hang Seng Index recently seeing a significant decline, investors are increasingly on the lookout for opportunities that might be overlooked amidst broader market volatility. In this context, identifying stocks with solid fundamentals and growth potential becomes crucial, especially in sectors that may benefit from current economic conditions or government policies.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 16.91% | 14.33% | 10.15% | ★★★★★★ |

| E-Commodities Holdings | 21.33% | 9.04% | 28.46% | ★★★★★★ |

| C&D Property Management Group | 1.32% | 37.15% | 41.55% | ★★★★★★ |

| Uju Holding | 21.23% | -4.96% | -15.33% | ★★★★★★ |

| ManpowerGroup Greater China | NA | 14.56% | 1.58% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Xin Point Holdings | 1.77% | 10.88% | 22.83% | ★★★★★☆ |

| S.A.S. Dragon Holdings | 60.96% | 4.62% | 10.02% | ★★★★★☆ |

| Carote | 2.36% | 85.09% | 92.12% | ★★★★★☆ |

| Chongqing Machinery & Electric | 27.77% | 8.82% | 11.12% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Sprocomm Intelligence (SEHK:1401)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sprocomm Intelligence Limited is an investment holding company involved in the research and development, design, manufacture, and sale of mobile phones across China, India, Algeria, Bangladesh, and other international markets with a market capitalization of HK$5.34 billion.

Operations: Sprocomm Intelligence generates revenue primarily from the sale of wireless communications equipment, totaling CN¥3.27 billion.

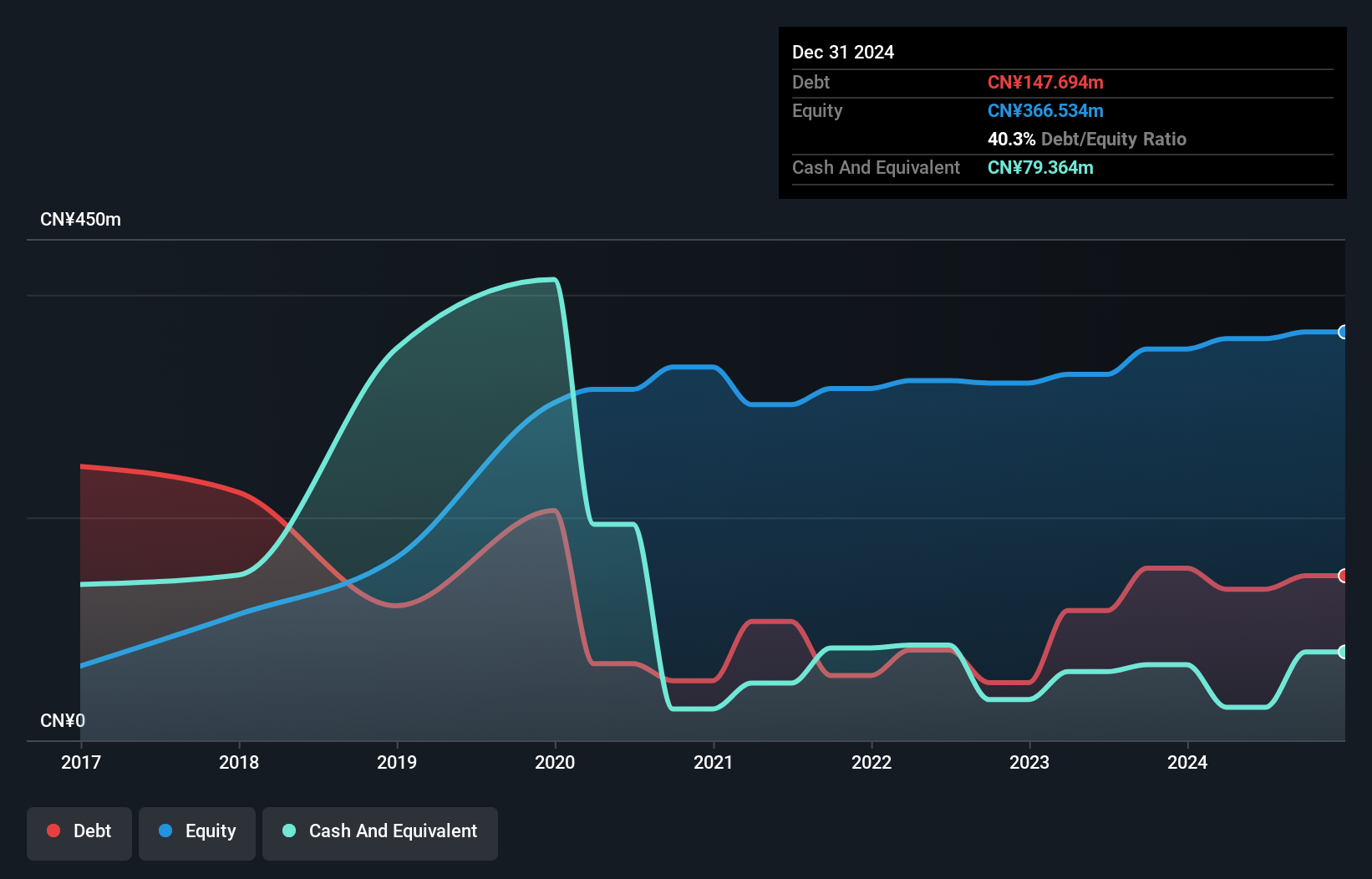

Sprocomm Intelligence, a smaller player in the tech scene, is drawing attention with its impressive earnings growth of 301% over the past year, outpacing the broader industry. The company's debt to equity ratio has improved significantly from 73.8% to 37.6% over five years, indicating better financial health. Recent earnings show sales rising to CN¥1.26 billion from CN¥806 million last year, though net income only slightly increased to CN¥9.86 million due to a one-off gain of CN¥18.1 million impacting results.

- Unlock comprehensive insights into our analysis of Sprocomm Intelligence stock in this health report.

Understand Sprocomm Intelligence's track record by examining our Past report.

Plover Bay Technologies (SEHK:1523)

Simply Wall St Value Rating: ★★★★★☆

Overview: Plover Bay Technologies Limited is an investment holding company that designs, develops, and markets software-defined wide area network routers, with a market capitalization of HK$5.34 billion.

Operations: The company's primary revenue streams include sales of SD-WAN routers, with HK$59.87 million from mobile-first connectivity and HK$15.19 million from fixed-first connectivity, alongside software licenses and warranty and support services contributing HK$31.86 million.

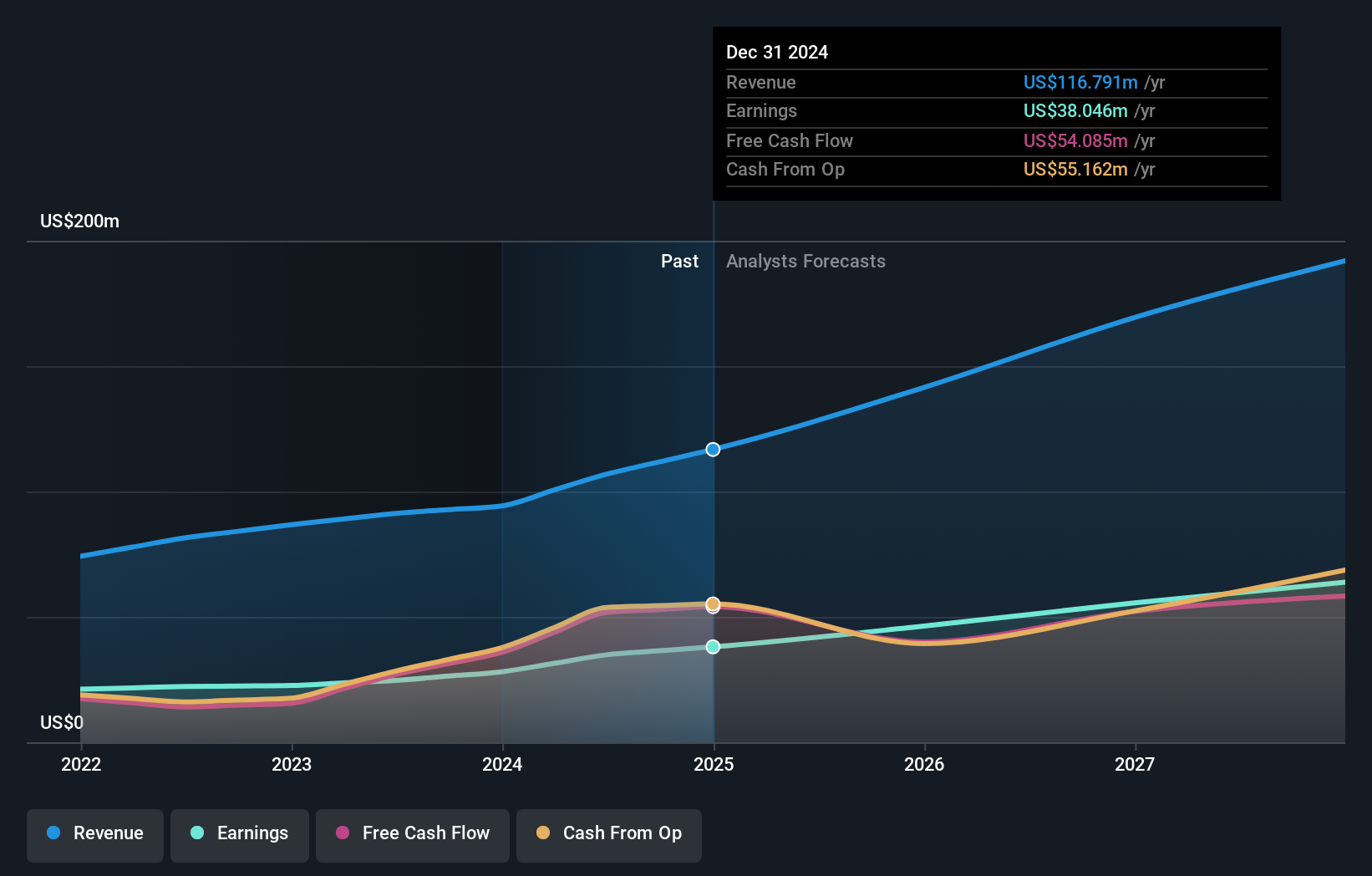

Plover Bay Technologies showcases its potential with a notable 41% earnings growth over the past year, outpacing the Communications industry. Trading at 52% below its estimated fair value, it seems undervalued. Recent financials highlight sales of US$57 million and net income of US$19 million for H1 2024. The company announced an interim dividend of HKD 0.1083 per share, reflecting confidence in cash flow strength, which rose to US$51.78 million recently.

Best Pacific International Holdings (SEHK:2111)

Simply Wall St Value Rating: ★★★★★★

Overview: Best Pacific International Holdings Limited, with a market cap of HK$2.82 billion, is engaged in the manufacturing and trading of elastic fabric, elastic webbing, and lace through its subsidiaries.

Operations: The company generates revenue primarily from the manufacturing and trading of elastic fabric, lace, and elastic webbing, with HK$3.76 billion coming from fabric and lace, and HK$915.53 million from webbing.

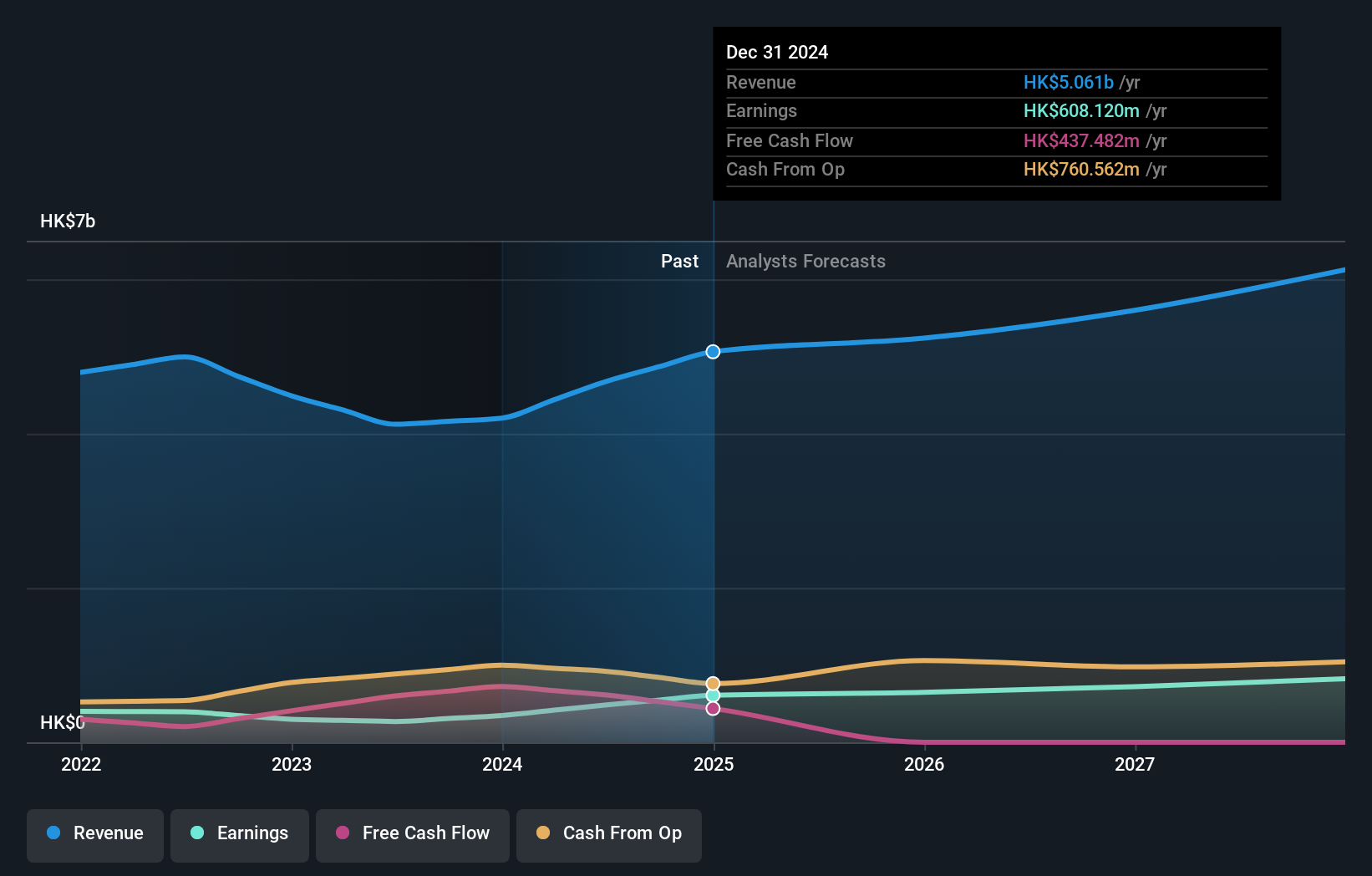

Best Pacific International Holdings is making waves with impressive earnings growth of 80.3% over the past year, outpacing the luxury industry average of 15.7%. Trading at a significant discount, it's valued at 67.6% below estimated fair value, offering potential upside for investors. The company's net debt to equity ratio stands at a satisfactory 13.8%, and its interest payments are well-covered by EBIT at 6.9 times coverage, highlighting financial stability alongside high-quality earnings and positive free cash flow trends.

Make It Happen

- Reveal the 168 hidden gems among our SEHK Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1523

Plover Bay Technologies

An investment holding company, designs, develops, and markets software defined wide area network routers.

Outstanding track record with excellent balance sheet.