- Hong Kong

- /

- Tech Hardware

- /

- SEHK:1263

PC Partner Group And 2 Top Dividend Stocks For Your Portfolio

Reviewed by Simply Wall St

As global markets edge toward record highs, buoyed by strong performances in major indices like the Nasdaq Composite and S&P 500, investors are navigating an environment marked by rising inflation and cautious monetary policies. In such a dynamic landscape, dividend stocks can offer a compelling proposition for those seeking steady income streams alongside potential capital appreciation.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.93% | ★★★★★★ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.37% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.58% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.01% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 3.93% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.91% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.40% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.07% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.42% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.86% | ★★★★★★ |

Click here to see the full list of 1984 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

PC Partner Group (SEHK:1263)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PC Partner Group Limited, with a market cap of HK$2.94 billion, is an investment holding company that designs, develops, manufactures, and sells computer electronics.

Operations: PC Partner Group Limited generates revenue primarily through its design, manufacturing, and trading of electronics and PC parts and accessories, amounting to HK$9.94 billion.

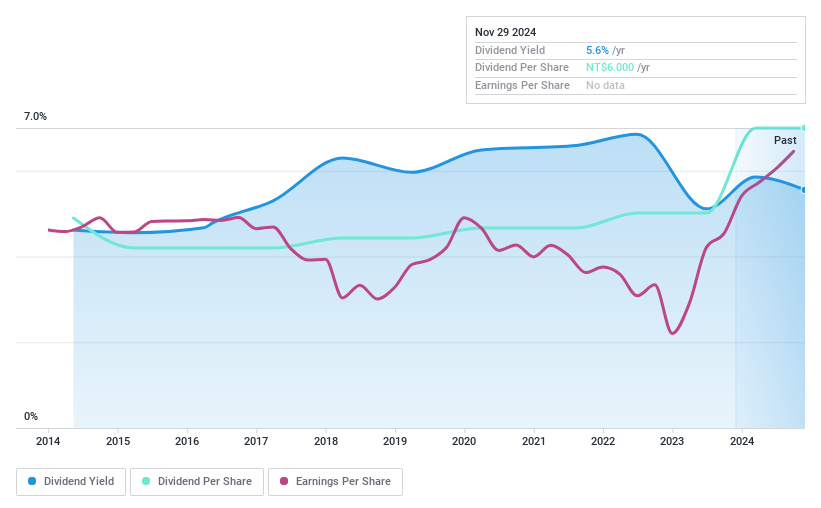

Dividend Yield: 5.3%

PC Partner Group has shown an unstable dividend track record over the past decade, with volatile payments and a yield of 5.28%, which is below the top tier in Hong Kong. Despite this, dividends are well-covered by earnings and cash flows, with payout ratios of 66.1% and 7.8% respectively. The company recently became profitable, reporting a significant increase in net profit for 2024 due to improved gross margins from strong demand for new video graphics cards.

- Unlock comprehensive insights into our analysis of PC Partner Group stock in this dividend report.

- Our valuation report unveils the possibility PC Partner Group's shares may be trading at a discount.

Formosa Optical TechnologyLtd (TPEX:5312)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Formosa Optical Technology Co., Ltd. operates in Taiwan, offering eyecare products, with a market capitalization of approximately NT$8.59 billion.

Operations: Formosa Optical Technology Co., Ltd.'s revenue primarily comes from its Bio Division, generating NT$930.46 million, and Bio Technology segment, contributing NT$2.91 billion.

Dividend Yield: 4.2%

Formosa Optical Technology Ltd. offers a reliable dividend yield of 4.2%, though it falls short of the top 25% in Taiwan. The company's dividends have been stable and growing over the past decade, with a payout ratio of 72.3% supported by earnings and an 88.8% cash payout ratio, indicating sustainability from both profits and free cash flow. Additionally, its price-to-earnings ratio of 17.2x is attractive compared to the broader Taiwan market average of 21.6x.

- Click here and access our complete dividend analysis report to understand the dynamics of Formosa Optical TechnologyLtd.

- Upon reviewing our latest valuation report, Formosa Optical TechnologyLtd's share price might be too optimistic.

Chang Wah Electromaterials (TWSE:8070)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Chang Wah Electromaterials Inc. trades electrical, telecommunication, and semiconductor materials and parts in Taiwan, Asia, and internationally with a market cap of NT$31.72 billion.

Operations: Chang Wah Electromaterials Inc.'s revenue is primarily derived from its operations, with Chang Wah Electromaterials Inc. contributing NT$7.12 billion and Chang Wah Technology Co., Ltd. and its subsidiary generating NT$11.74 billion.

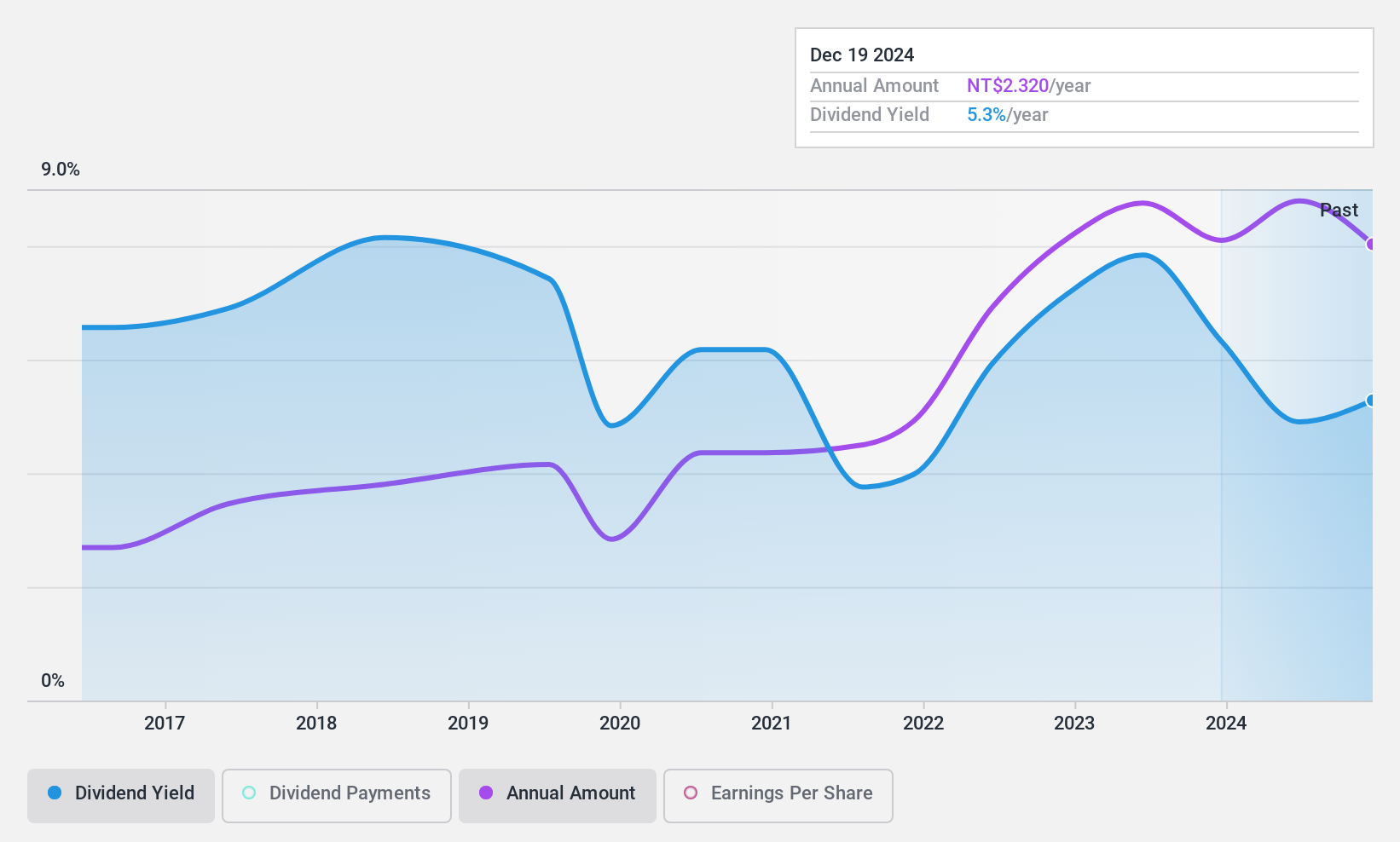

Dividend Yield: 5.2%

Chang Wah Electromaterials offers a dividend yield of 5.16%, placing it in the top 25% of Taiwan's market, yet its sustainability is questionable due to a high payout ratio of 133.5% not covered by earnings. Although dividends have increased over the past decade, they have been volatile with drops exceeding 20%. The company's cash payout ratio is more favorable at 82.5%, indicating coverage by cash flows despite overall reliability concerns.

- Click to explore a detailed breakdown of our findings in Chang Wah Electromaterials' dividend report.

- The valuation report we've compiled suggests that Chang Wah Electromaterials' current price could be inflated.

Taking Advantage

- Click here to access our complete index of 1984 Top Dividend Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1263

PC Partner Group

An investment holding company, designs, develops, manufactures, and sells computer electronics.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives